$1 Billion Bitcoin Transfer Sparks Major Liquidations: Key Insights Revealed

Major bitcoin Transfer Sparks Market Speculation

Overview of the Transfer

A significant bitcoin transaction, amounting to nearly $1 billion, has recently captured the attention of the cryptocurrency community. This transfer, which involved approximately 7,743 BTC valued at around $916.25 million, originated from Coinbase and was directed to an undisclosed wallet. The timing of this event coincided with bitcoin trading at $118,329.11, raising questions about potential institutional buying or the long-term storage strategies of major holders.

Increased Whale Activity

Recent data from Whale Alert indicates a notable uptick in large-scale transactions within the bitcoin ecosystem over the past fortnight. This surge suggests a resurgence of activity among significant holders, often referred to as “whales.” Analysts are closely monitoring these developments, as they may indicate shifting market dynamics.

The Emergence of a Dormant Whale

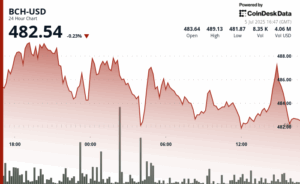

Adding to the intrigue, a bitcoin whale that had been inactive for 14 years has recently re-entered the market, executing transfers worth billions in a matter of hours. Tracking service Lookonchain reported that this whale moved a staggering total of $8.7 billion across various wallets, coinciding with a period of heightened concern regarding a potential price correction in bitcoin, which dipped below $117,000 earlier this week.

Market Implications

The same long-dormant whale also transferred 9,000 BTC, valued at approximately $1.06 billion, to Galaxy Digital. This activity has contributed to increased volatility in the market and has sparked speculation about possible selling pressure in the near future.

Conclusion: What Lies Ahead?

The recent spike in whale transactions and the substantial bitcoin transfer have led to heightened speculation and uncertainty within the cryptocurrency market. The long-term effects of these developments on bitcoin‘s price and overall market behavior remain to be seen, as investors and analysts continue to assess the implications of these significant movements.

This article originally appeared on Benzinga.com, highlighting the ongoing developments in the cryptocurrency landscape.