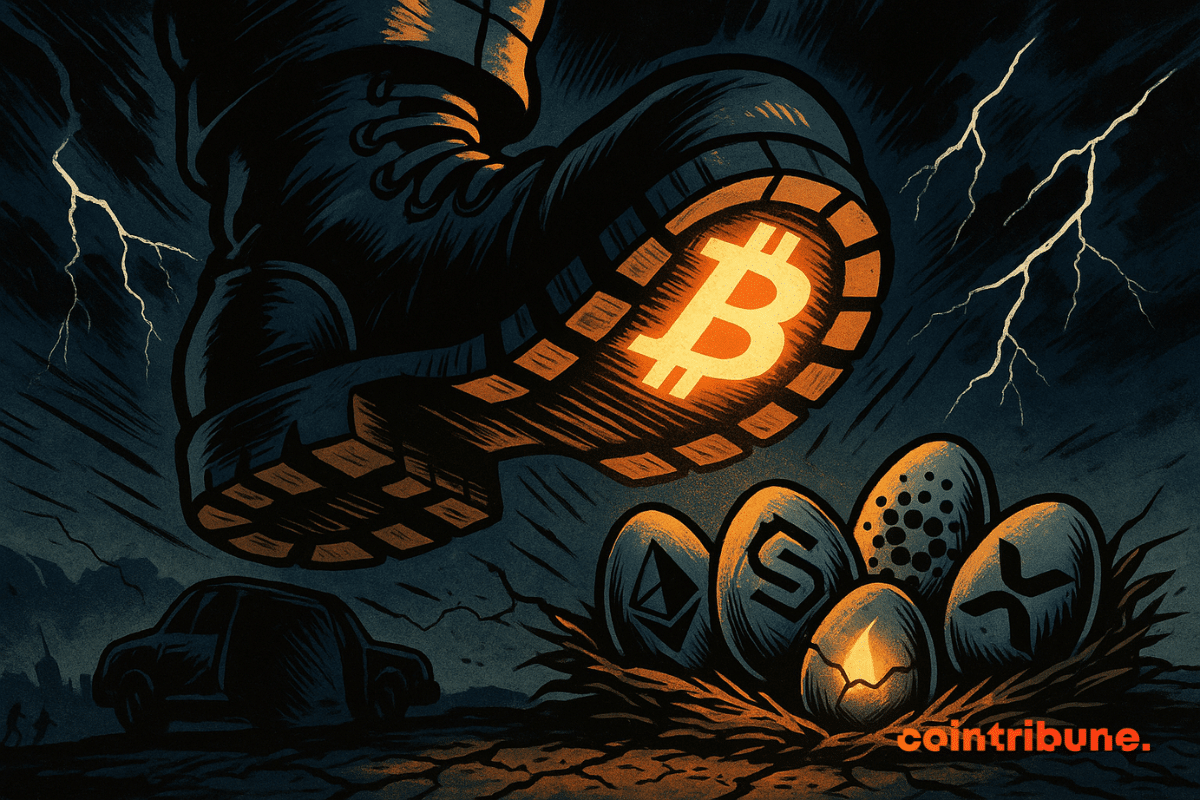

Bitcoin’s Dominance: Why Altcoins May Remain in the Shadows

The Current State of Altcoins: Is Altseason Just Around the Corner?

A Long-Awaited Altseason or a Bitcoin-Driven Market?

The much-anticipated altseason, a period when alternative cryptocurrencies typically thrive, has yet to manifest this summer. Instead, Bitcoin remains at the forefront, capturing headlines and market attention. Traders who were hopeful for a rise in altcoins are finding their patience tested as Bitcoin continues its unprecedented journey, leading many to question whether this behavior indicates a market shift or simply a familiar pause in an ongoing cycle.

Key Points on the Current Crypto Landscape

- Bitcoin sustains its position on a robust support level, hindering altcoins from making significant gains.

- Institutional investors are increasingly backing Bitcoin, steering clear of alternative cryptocurrencies perceived as high-risk.

- In the past year, approximately $36 billion has been withdrawn from altcoins.

- Although some indicators hint at a possible resurgence for altcoins, none have yet confirmed a definitive altseason.

Bitcoin’s Dominance in the Crypto Market

Since the start of the year, Bitcoin dominance has positioned itself above 60% and has recently approached 65%. This technical stronghold is validated by the Bull Market Support Band (BMSB), a critical moving average that appears to uphold Bitcoin’s dominance. Market analysts have noted that as long as Bitcoin maintains this stability, the potential for volatility remains low.

In this competitive landscape, Bitcoin continues to excel, while altcoins are left struggling. Key technical indicators, such as the RSI and MACD, display signs of stagnation, indicating that the market is largely immobilized. In this context, Bitcoin stands as the primary asset attracting investor confidence.

The Continued Wait for Altcoins to Shine

Many had hoped that the much-desired altseason would materialize soon, yet their patience has been stretched thin. The core issue lies not in interest but in investment flow. A detailed analysis from CryptoQuant reveals that a staggering $36 billion has exited from alternative coins over the past year. This downturn started as early as December 2024, leading to what analysts describe as a collapse in momentum.

As the spotlight on Bitcoin intensifies, the introduction of spot Bitcoin ETFs has redirected investments away from altcoins. Institutional investors are leaning toward Bitcoin, viewing other tokens as excessively volatile and lacking adequate regulatory support.

The continued financial pressure is exacerbated by the Federal Reserve holding its key rates between 4.25% and 4.50%. Until liquidity returns to the market, altcoins will likely remain marginalized along with a section of the crypto economy yearning for a revival.

Could We Have Already Missed the Altseason?

Despite the prevailing skepticism, some voices are suggesting that altseason may have already begun unbeknownst to the wider market. One such claim comes from Milk Road, which notes that certain indicators may actually signal a hidden resurgence.

Recent interest in cryptographic stocks showcases a renewed spark in the community. Moreover, there are modest signals amidst Ethereum trading volumes, and several alternative projects are ramping up their marketing efforts to recapture investor attention. To turn the tide, experts like Ki Young Ju from CryptoQuant assert that altcoins need to break free from Bitcoin dependency and pursue independent strategies that can attract capital.

Current Observations and Future Outlook

Several trends merit attention as the crypto landscape evolves:

- The Altseason index remains subdued yet shows signs of stabilization.

- Recent movements suggest a shift in market dynamics, marked by breaks in the Dollar Index trend, signaling a return of risk appetite among investors.

- Bitcoin’s price currently hovers below $105,000, creating a potential opening for alternative cryptocurrencies.

- The substantial withdrawal of $36 billion serves as a stark indicator of the ongoing challenges facing altcoins.

Given these complexities, it remains challenging to assert that an altseason is presently underway. However, prematurely dismissing its potential return would also be unwise.

In closing, the uncertainty surrounding the future of altcoins leaves many wondering if they will eventually see a reckoning. While doubts persist, the realm of cryptocurrency is intrinsically unpredictable, characterized by unexpected bursts of activity and occasional calm. Maintaining hope and resilience in this fluctuating market landscape is essential.