Bitcoin Dips Below $100K as Oil Crisis Looms: Iran Threatens Strait

Bitcoin Drops as Global Tensions Rise: Market Impact Analyzed

Bitcoin’s Current Status and Market Outlook

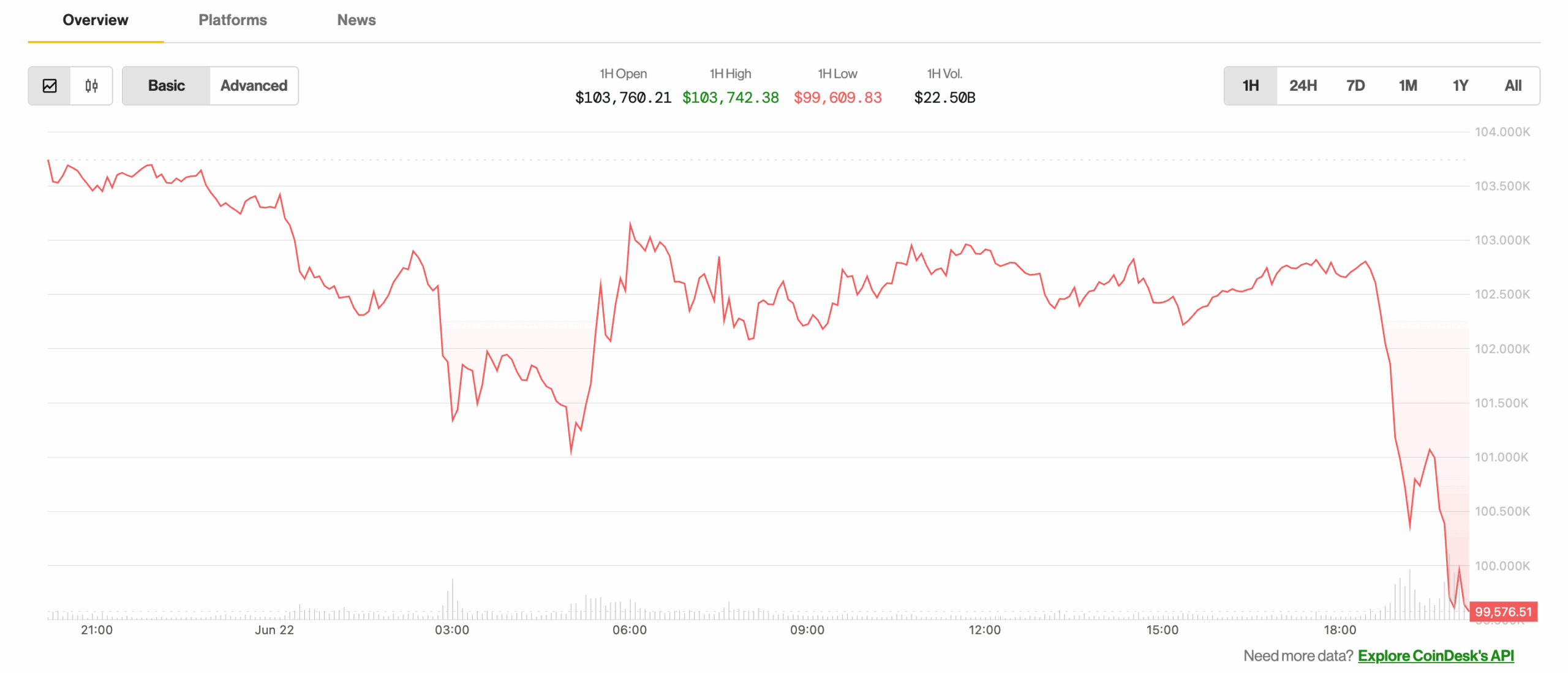

Bitcoin has recently plummeted below the $100,000 mark, a level not seen since May. This decline is indicative of growing apprehension among investors on Wall Street. The drop comes amid alarming developments suggesting that Iran may take measures to obstruct navigation through the Strait of Hormuz.

Understanding the Significance of the Strait of Hormuz

The Strait of Hormuz, situated between Oman and Iran, serves as a critical passageway linking the Persian Gulf with the Gulf of Oman and the Arabian Sea. Notably, this strait is vital for global energy supply, as it accommodates approximately 20% of the world’s oil trade.

Concerns Over Oil Prices Amid Regional Tensions

There are concerns among analysts regarding Iran’s political maneuvers that may lead to the closure of the Strait. Such actions could trigger a dramatic increase in oil prices, especially following reported U.S. military strikes in the region.

The Kobeissi Letter highlighted that over 50 large oil tankers have been urgently departing from the Strait of Hormuz due to the escalating situation, anticipated to result in a significant reduction in oil supply. Experts, including those from JPMorgan, expressed that this scenario poses the worst-case outcome in the ongoing Israel-Iran conflict.

Projected Oil Price Surge and Economic Ramifications

JPMorgan analysts have projected that under such circumstances, oil prices could soar to between $120 and $130 per barrel. This surge could have dire implications for the U.S. economy, potentially raising the inflation rate to 5%, the highest level recorded since March 2023. It was during this time that the Federal Reserve had raised interest rates to counter heightened inflation.

Cryptocurrency Market Response to Broader Economic Changes

The drop in Bitcoin prices has reverberated throughout the cryptocurrency market, negatively impacting other major digital currencies. Notably, XRP, the payment-centric cryptocurrency, encountered a 6% decline, reaching $1.935, its lowest price since April 10. Similarly, Ethereum’s ether token has fallen to levels reminiscent of early May, according to data from industry sources.

As geopolitical tensions continue to evolve, the broader implications for both traditional and digital markets remain a topic of keen interest among investors and analysts alike.