Bitcoin Surges as Markets React to Temporary Iran Conflict Impact

Geopolitical Tensions Impact Markets: Iran, Crypto, and Commodities

Diplomatic Developments Amidst Military Actions

Iran’s foreign minister engaged in discussions with Russian officials in Moscow, signaling a revival of diplomatic channels following recent military strikes. This meeting comes as tensions escalate in the region, particularly after U.S. and Israeli airstrikes targeted Iranian nuclear facilities.

- Diplomatic Developments Amidst Military Actions

- Market Reactions to Geopolitical Events

- Commodities Show Mixed Responses

- Investor Sentiment and Market Stability

- Iran’s Counteractions and Global Implications

- Future Outlook and Diplomatic Efforts

- Market Resilience Amidst Escalation

- Crypto Market Dynamics

- Analyst Insights on Market Behavior

- Conclusion: Navigating Uncertainty in Emerging Markets

Market Reactions to Geopolitical Events

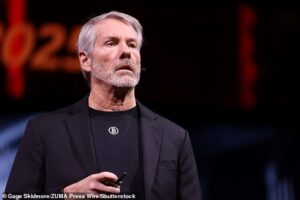

Pav Hundal from Swyftx noted that the heightened trading volumes reflect significant uncertainty among investors, characterizing the initial market downturn as part of the inherent volatility of cryptocurrencies.

Commodities Show Mixed Responses

Both oil and gold experienced a retreat from their peak values, suggesting that traders anticipate a limited escalation in the ongoing conflict. bitcoin managed to recover late Sunday, trading above $101,000 after suffering losses earlier in the weekend, as investors reacted to the airstrikes.

Investor Sentiment and Market Stability

The modest fluctuations in gold and a restrained response in oil and equity futures indicate that traders are expecting the situation to remain contained rather than lead to a prolonged geopolitical crisis. The U.S. military operation, executed in collaboration with Israel, involved over 125 aircraft targeting key Iranian sites.

Iran’s Counteractions and Global Implications

In retaliation, Iran launched missile and drone strikes on Israeli cities and threatened U.S. military installations in the Gulf region. The Iranian foreign minister’s emergency visit to Moscow coincided with President Trump’s indication of a potential halt in further U.S. military actions.

Future Outlook and Diplomatic Efforts

A decision regarding subsequent actions is anticipated within the next two weeks. Meanwhile, European leaders have called for restraint and expressed a willingness to engage in renewed diplomatic efforts.

Market Resilience Amidst Escalation

Despite the rising tensions, markets quickly regained stability. Gold prices briefly reached $3,398 before settling at $3,374, while oil prices increased slightly by 0.5%. Analysts from The Kobeissi Letter remarked that the market is bracing for a short-lived conflict, as oil prices remain significantly lower than historical levels associated with disruptions in the Strait of Hormuz.

Crypto Market Dynamics

The cryptocurrency market mirrored this sentiment, with bitcoin initially declining during the height of the geopolitical developments but later rebounding as risk appetite among traders increased.

Analyst Insights on Market Behavior

Pav Hundal highlighted the surge in trading activity following the U.S. strikes on Iranian targets, stating that if tensions ease in the Middle East, investor confidence could rebound, leading to a gradual increase in prices. He emphasized the unpredictable nature of the situation, which contributes to the uncertainty that traders often find challenging.

Conclusion: Navigating Uncertainty in Emerging Markets

The ongoing developments in the Middle East serve as a reminder of the volatility inherent in emerging markets like cryptocurrency. As traders navigate this uncertainty, the potential for rapid shifts in market sentiment remains a critical factor to watch.