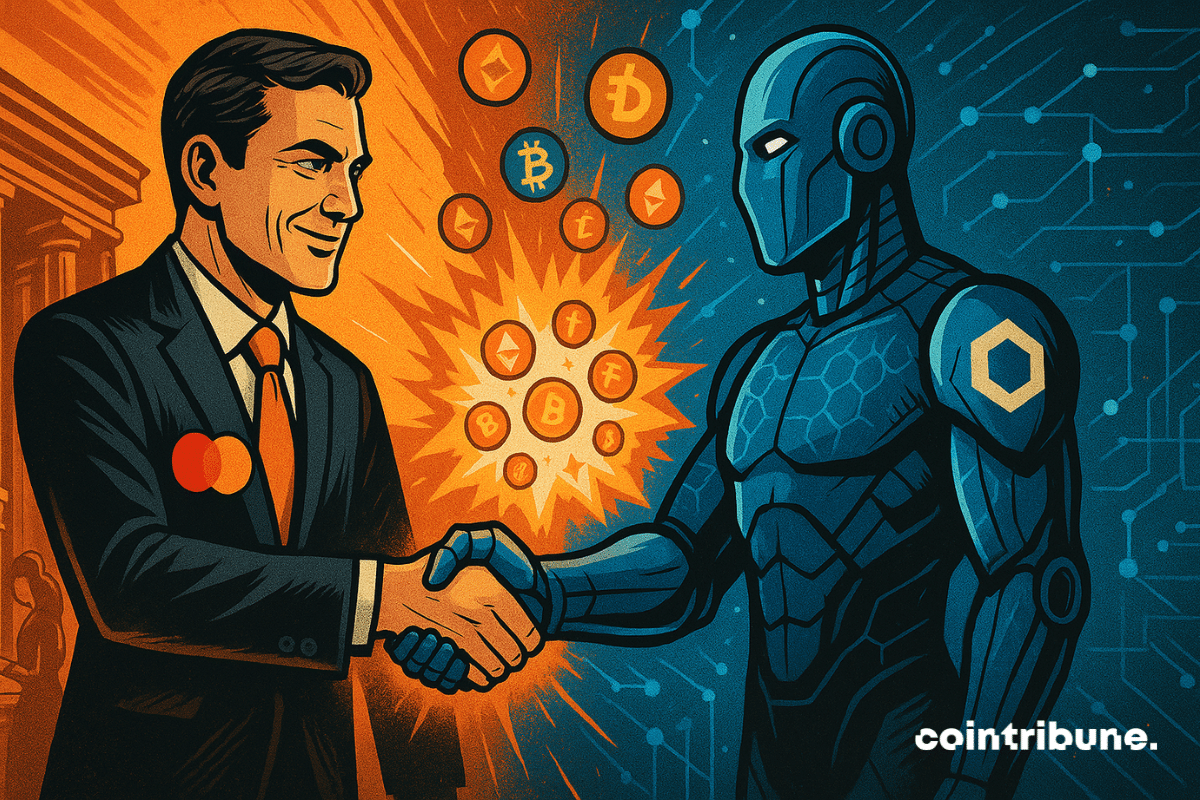

Mastercard Enters DeFi Space with Chainlink Partnership: A Game Changer!

Mastercard and Chainlink Forge Partnership for On-Chain Fiat-to-Crypto Solutions

Introduction to a New Era of Payments

In a significant development in the financial landscape, Mastercard has joined forces with Chainlink to introduce an innovative solution for converting fiat currency to cryptocurrency directly on-chain. Announced on Tuesday, this partnership aims to enhance accessibility to digital assets for Mastercard cardholders, marking a pivotal shift towards integrating traditional finance with blockchain technology.

Key Highlights of the Partnership

- Direct Crypto Purchases: Mastercard cardholders will now have the ability to buy cryptocurrencies directly on-chain, simplifying the process.

- Enhanced Accessibility: This initiative is designed to provide a seamless and secure method for users to engage with digital assets without the need for exchanges.

- Broad User Reach: With over 3 billion users, Mastercard aims to bridge the gap between traditional finance and the decentralized economy.

- Accelerating Adoption: This partnership could significantly boost the mainstream acceptance of cryptocurrencies.

A Comprehensive Infrastructure for Crypto Transactions

Mastercard’s collaboration with Chainlink is rooted in a clear objective: to eliminate barriers that hinder average users from entering the blockchain ecosystem. According to a press release, cardholders will be able to purchase crypto assets through a secure fiat-to-crypto conversion process.

This new approach differs from previous models that relied on off-chain conversions. Instead, it focuses on direct integration within the blockchain environment, ensuring a smooth and compliant buying experience.

Technological Ecosystem Partners

To realize this ambitious project, Mastercard and Chainlink have established a robust technological framework involving several key partners:

- Chainlink: Provides a decentralized oracle network that connects off-chain and on-chain systems.

- Zerohash: Manages compliance, custody, and fiat-crypto conversion in line with regulatory standards.

- Swapper Finance: Supplies the user interface, incorporating XSwap, a decentralized exchange (DEX) from the Chainlink ecosystem.

- Shift4 Payments: Handles card payment processing.

- Uniswap: Offers on-chain liquidity for conversions.

This integrated architecture aims to deliver a unified and user-friendly experience.

Bridging Traditional Finance and DeFi

Mastercard’s goal is to connect users to the crypto ecosystem seamlessly. Raj Dhamodharan, Executive Vice President of Blockchain and Digital Assets at Mastercard, emphasizes the need for a safe and innovative approach to on-chain commerce that encourages broader crypto adoption.

This solution is designed to facilitate smooth fiat-to-crypto conversions without leaving the blockchain environment, thereby transforming Mastercard cards into gateways to decentralized finance (DeFi).

A Shift in Strategy for Mastercard

This partnership represents a departure from Mastercard’s previous strategies, which primarily focused on co-branded cards for spending existing cryptocurrencies. The new initiative aims to make the purchase of cryptocurrencies an inherent part of the blockchain experience, utilizing decentralized protocols like Uniswap.

The collaboration with Chainlink is not merely a marketing effort; it establishes a new standard for accessing cryptocurrencies that is more direct, secure, and potentially universal.

Future Implications and Considerations

This announcement raises several questions about the potential impact on centralized cryptocurrency exchanges and regulatory responses to this direct link between fiat and crypto. Additionally, it remains to be seen whether this integration will successfully attract users who are currently hesitant to engage with DeFi.

As Mastercard continues to explore ways to make on-chain transactions a standard aspect of banking, the industry will be closely monitoring developments, especially following the launch of a crypto card in Europe and the UK in collaboration with Kraken.

Conclusion

This partnership between Mastercard and Chainlink signifies a transformative step towards integrating traditional finance with the blockchain ecosystem. As the landscape evolves, stakeholders will need to consider the implications for users, regulators, and the broader financial system.

Disclaimer: The opinions expressed in this article are solely those of the author and should not be interpreted as investment advice. Always conduct your own research before making any investment decisions.