Bitcoin Eyes $110K as Solana ETF Race Intensifies with Nine Filings

bitcoin Approaches $20 Billion Options Expiry Amid Market Developments

Overview of the Current Crypto Landscape

The cryptocurrency market is at a crucial juncture as bitcoin nears a significant $20 billion options expiry, with bullish traders eyeing a target of $110,000 while the asset hovers around $107,300. Concurrently, the race for Solana ETFs heats up, as Invesco Galaxy becomes the latest firm to file for a spot ETF, reflecting a growing institutional interest in digital assets beyond bitcoin and ethereum.

Key Highlights

- bitcoin is on the verge of a $20 billion options expiry, with bullish expectations pushing for a price of $110,000.

- Invesco Galaxy’s recent filing for a Solana ETF marks the ninth application, indicating increasing institutional engagement with alternative cryptocurrencies.

- The U.S. is advancing in crypto regulation, permitting the use of cryptocurrencies as collateral for home loans, while Europe is resolving regulatory challenges concerning USDe stablecoin operations.

- ethereum‘s price remains below $2,500, amid a decline in interest in leveraged trading as the SEC reviews potential changes to ethereum ETFs.

bitcoin‘s Options Expiry and Market Sentiment

As traders prepare for the $20 billion monthly options expiry set for Friday, the outcome could significantly influence bitcoin‘s trajectory toward the $110,000 target. Currently trading at approximately $107,300, bitcoin is just 4% shy of its all-time high. The options market shows a favorable position for bulls, with $11.2 billion in call options compared to $8.8 billion in put options, suggesting a bullish sentiment.

Market analysts believe that maintaining support above $106,000 could trigger a rally in July. The recent dovish stance from the Federal Reserve, as indicated by Chair Jerome Powell, may encourage investors to shift from safer assets to riskier options like bitcoin.

ethereum‘s Market Position

ethereum is currently facing challenges, with its price dropping 4% over the past week despite $322 million in ETF inflows. Trading at $2,426, ethereum remains significantly below its peak. Data from futures markets indicates a waning interest in leveraged bullish positions, with the perpetual futures funding rate plummeting to -2% annually.

The SEC is actively reviewing potential modifications to ethereum ETFs, including the introduction of “in-kind” creation and redemption processes. Despite recent price declines, ethereum advocates highlight its robust architecture and security features as compelling reasons for institutional adoption.

Solana ETF Filings and Institutional Interest

Invesco Galaxy’s filing for a Solana ETF adds to the competitive landscape of alternative cryptocurrency ETFs, marking a significant step for Solana’s institutional recognition. If approved, the ETF would trade on the Cboe BZX exchange under the ticker “QSOL,” aiming to track Solana’s spot price.

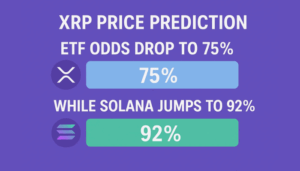

The surge in Solana ETF applications underscores a broader market interest in altcoins beyond bitcoin and ethereum. Analysts suggest that the likelihood of various altcoin ETFs receiving approval in 2025 is high, reflecting institutional investors’ desire for diverse exposure to leading blockchain platforms.

Conclusion

As the cryptocurrency market evolves, the impending options expiry for bitcoin and the growing interest in Solana ETFs highlight a dynamic landscape. With regulatory advancements in the U.S. and Europe, the future of digital assets appears increasingly promising, paving the way for broader adoption and investment opportunities in the crypto space.