Will Bitcoin Hit $2600 or Drop to $2200? Expert Predictions Inside!

ethereum Price Analysis: Navigating Volatility and Future Predictions

The ethereum market has shown resilience, maintaining its value above the $2,400 threshold amidst rising volatility in the cryptocurrency landscape. This stability has sparked various speculations among market analysts regarding the future trajectory of the ETH token.

Short-Term Outlook: Key Support Levels

Ali Martinez, a prominent figure in the crypto community with over 139,000 followers on X, has expressed concerns regarding ethereum‘s short-term price targets. In his recent commentary, he emphasized the critical support level at $2,200. A failure to sustain this support could lead to a significant downturn, potentially driving prices down to a multi-month low of $1,160.

Mixed Sentiments in ethereum Derivatives

Recent analysis of ethereum derivatives reveals a 2.74% increase in open interest, now totaling $31.97 billion. Additionally, options open interest has surged to $6.45 billion, with a remarkable 91.36% rise in options volume, reaching $797.32 million. The Long/Short ratio over the past day stands at 0.9952, indicating heightened trading activity in the market.

The funding rate weighted by open interest for ETH has shown fluctuations since early April, yet the overall trend remains positive, suggesting a growing number of long positions. Historically, ethereum‘s price has oscillated between $2,100 and $3,000, reflecting aggressive long positions, while occasional dips are attributed to macroeconomic corrections or increased short interest.

Liquidation Trends and Market Sentiment

The liquidation data for ETH indicates spikes during price declines, with short liquidations rising during bullish trends. Volatility has led to forced exits from leveraged positions, contributing to an uncertain market sentiment, particularly during sell-offs in February and June.

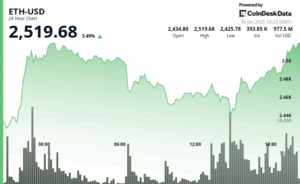

Current Trading Range and Market Indicators

Despite ongoing market fluctuations, ethereum is currently trading within a consolidated range of $2,384 to $2,525, marking significant buying and selling points. With a current price of $2,476.19 and a 24-hour trading volume of $17.38 billion, ethereum boasts a market capitalization of $300.98 billion, holding a 9.0227% market dominance.

The Relative Strength Index (RSI) remains above the neutral mark at 56.86, suggesting a mixed sentiment in the market. The average trendline is acting as a robust support level, indicating potential for price movement.

Future Price Predictions: Bullish or Bearish?

If ethereum maintains its value above the support trendline at $2,450, it may soon retest the upper range of $2,525. A surge in bullish sentiment could propel the price toward the resistance level of $2,600 in the near future.

Conversely, should bearish momentum take hold, the price may decline to the critical support level of $2,384.75. If the bulls cannot regain strength at this juncture, a further drop to the lower support level of $2,300 could occur.

Given the current market dynamics, there is a possibility that ethereum could experience a decline to $2,200 in the coming month, reflecting the ongoing uncertainty in the market.

This analysis provides a comprehensive overview of ethereum‘s current market position and potential future movements, catering to investors seeking insights into the cryptocurrency’s price prospects.