Solana (SOL) Drops 8% as First U.S. Staking ETF Launch Approaches

Solana Experiences Significant Decline Ahead of ETF Launch

Market Overview

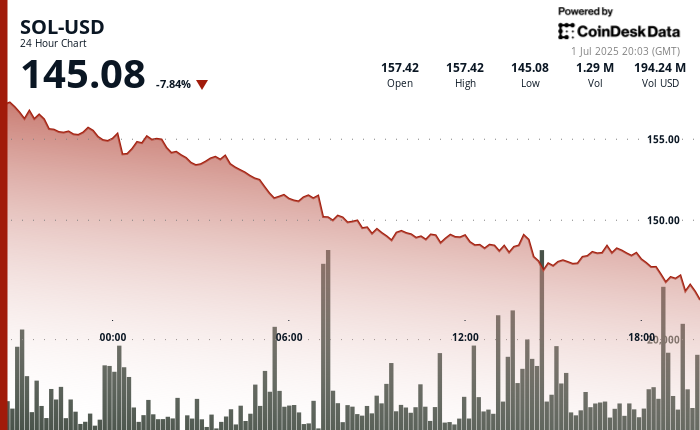

Solana (SOL) has faced a notable downturn, dropping 7.84% in the last 24 hours to a trading price of $145.08 as of 20:03 UTC on July 1, 2025. This decline contrasts sharply with the broader cryptocurrency market, represented by the CoinDesk 20 index, which only fell by 0.24% during the same timeframe.

Upcoming Milestone: REX-Osprey SOL + Staking ETF

The timing of SOL’s price drop is particularly striking as it comes just a day before the anticipated launch of the REX-Osprey SOL + Staking ETF. This exchange-traded fund, set to debut on July 2, 2025, will be the first of its kind in the U.S. to offer direct exposure to Solana’s native token while also allowing investors to benefit from staking rewards. Unlike conventional crypto ETFs that merely track price movements, this fund provides a unique opportunity for passive income through Solana’s proof-of-stake mechanism.

ETF Structure and Regulatory Framework

The ETF will allocate approximately 80% of its assets to SOL, with around half of those tokens actively staked. It is structured under the Investment Company Act of 1940, which is generally seen as more favorable from a regulatory perspective compared to the 1933 Act. This structure may enhance investor protections and facilitate quicker approvals, potentially attracting more institutional investors.

Implications for Solana’s Market Position

Analysts view this ETF launch as a pivotal moment for Solana’s reputation among U.S. financial institutions. By incorporating yield generation directly into the ETF, it offers a more holistic exposure to the asset compared to traditional spot-tracking funds. Market observers believe this could act as a catalyst for long-term adoption, especially as other firms like Grayscale, VanEck, and Bitwise are also pursuing similar ETF applications for SOL.

Market Sentiment and Technical Analysis

Despite the impending ETF launch, SOL has experienced widespread selling pressure, indicating a cautious market sentiment leading up to the event.

Technical Analysis Highlights

- SOL’s price fell by $12.34 in the past 24 hours, moving from $157.42 to $145.08, marking a 7.84% decrease.

- Resistance was notably strong at $157.42 during the initial hour of analysis, followed by persistent selling throughout the trading session.

- The highest trading volume occurred at 06:00 UTC, surpassing 1.57 million units, with price rejection observed near $151.50.

- Support was identified at $146.55 during the 14:00 UTC hour, coinciding with increased trading volume, suggesting accumulation interest at that price point.

- In the final hour of analysis, SOL further declined from $146.31 to $145.08, reaching its lowest point of the day.

- The price action has formed a clear descending channel, marked by lower highs and lower lows throughout the trading period.

Conclusion

As Solana prepares for the launch of its innovative ETF, the current market dynamics reflect a mix of anticipation and caution. The upcoming days will be crucial for both SOL and the broader cryptocurrency market as investors closely monitor the implications of this new financial product.

Disclaimer: Portions of this article were generated with the assistance of AI tools and have been reviewed by our editorial team to ensure accuracy and compliance with our standards. For further details, please refer to CoinDesk’s full AI Policy.