Senate Passes Budget Bill, Excludes Crypto Tax Provision Amid Controversy

Senate Passes Major Bill, Crypto Tax Proposals Left Out

Last-Minute Changes Exclude Crypto Tax Clarifications

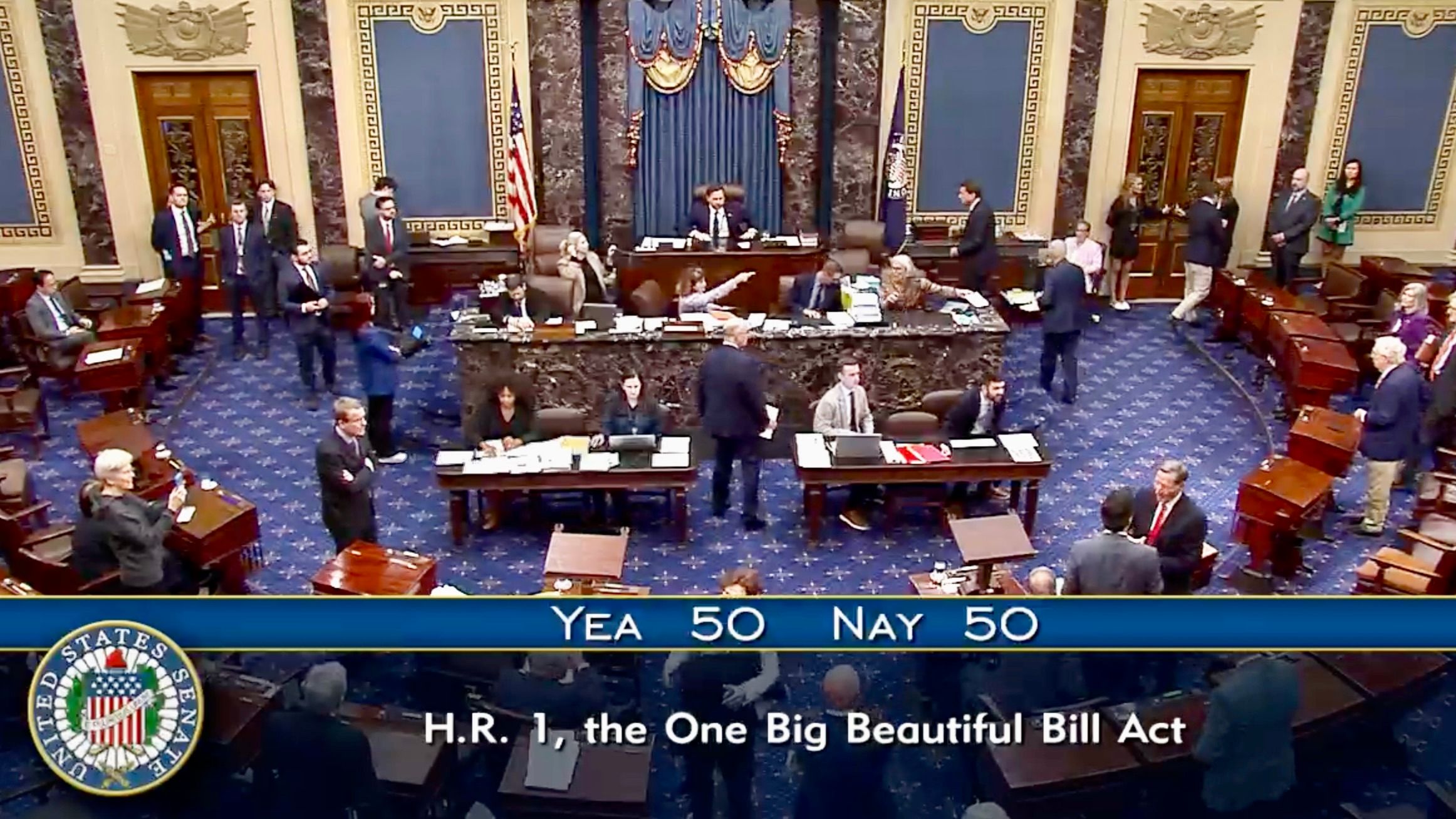

The U.S. Senate has approved a significant piece of legislation aimed at advancing much of former President Donald Trump’s policy initiatives. However, the final version of the bill, often referred to as the “One Big Beautiful Bill,” did not incorporate any proposals to simplify or clarify the taxation of cryptocurrency transactions.

Senator Lummis Advocates for Crypto Tax Reforms

Senator Cynthia Lummis had been a strong proponent of reforms to the U.S. tax framework concerning cryptocurrency, including suggestions to eliminate capital gains taxes on minor transactions. Despite her efforts, her amendment was not included in the bill, which passed with a narrow 50-50 vote, requiring Vice President J.D. Vance to cast the deciding vote.

Throughout the night, senators debated numerous amendments, most of which were rejected, culminating in a Republican victory. Despite last-minute lobbying from the digital assets sector, Lummis’ proposals did not gain traction.

Future of Crypto Tax Legislation Uncertain

Lummis has expressed her commitment to pursuing standalone legislation aimed at rationalizing the U.S. tax system and addressing issues of double taxation related to cryptocurrencies. Her office has yet to provide a statement regarding the recent developments.

Implications of the Bill on U.S. Spending

The legislative package, which seeks to dramatically alter U.S. government spending, is projected to increase the budget deficit by over $3 trillion. The bill will now move to the House of Representatives, where it is expected to face intense scrutiny following its earlier narrow passage.

Senate Majority Leader John Thune celebrated the bill’s passage, emphasizing its potential to provide tax relief for American workers, enhance military funding, secure borders, and stimulate the energy sector. He humorously remarked on the need for rest after the lengthy session.

Calls for Swift Action from Treasury Secretary

Treasury Secretary Scott Bessent urged House Republicans to act promptly to fulfill President Trump’s economic promises, asserting that swift action is necessary to maintain the U.S. as a leading hub for capital and innovation.

Criticism from Senator Warren

In response to the bill’s passage, Senator Elizabeth Warren, a vocal opponent of the legislation, addressed leaders of major U.S. tech companies. She criticized their financial support for Trump and congressional Republicans, suggesting that they are poised to receive substantial tax breaks at the expense of American families.

This article provides an overview of the recent Senate bill’s passage, highlighting the exclusion of crypto tax reforms and the broader implications for U.S. fiscal policy.