Solana Staking ETF Secures $12M in Strong Wall Street Launch

Rex-Osprey Solana + Staking ETF Launches with Strong Initial Inflows

Overview of the ETF’s Debut

The Rex-Osprey Solana + Staking ETF made a significant entrance into the market, attracting $12 million in investments on its first day, as confirmed by representatives from REX Shares and Osprey Funds. This ETF marks a pivotal moment for cryptocurrency investment in the United States, particularly with its unique staking feature.

A New Era for Crypto Investments

According to Nathan McCauley, co-founder and CEO of Anchorage Digital, the introduction of this ETF signifies a transformative phase for cryptocurrency in the U.S. The fund not only provides exposure to Solana but also allows investors to earn yields by staking a substantial portion of its assets—an unprecedented move in the U.S. financial landscape.

Anticipated SEC Approvals

The U.S. Securities and Exchange Commission (SEC) is expected to greenlight additional cryptocurrency-focused ETFs in the near future, further expanding the investment options available to institutional and retail investors alike.

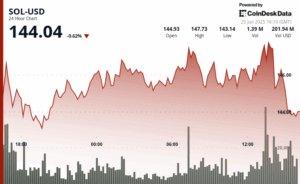

Performance Metrics and Market Reactions

On its debut, the Rex-Osprey Solana + Staking ETF recorded a trading volume of $33.6 million, as reported by Nasdaq. However, Bitwise Senior Investment Strategist Juan Leon noted that the trading volume was 82% lower than anticipated based on the market capitalizations of Solana and bitcoin, indicating that institutional investors may still be in the early stages of understanding Solana’s potential.

Current Market Status of Solana

As of the latest updates, Solana’s price was approximately $153, reflecting a 4.6% increase over the previous day. Despite this uptick, the asset has seen a 48% decline since reaching $293 earlier this year, shortly after the launch of a meme coin associated with former President Donald Trump.

Significance of the ETF Launch

McCauley emphasized that the launch of this crypto staking ETF is a significant victory for consumers, paving the way for broader access to the cryptocurrency ecosystem. Anchorage Digital, recognized as the only federally chartered digital asset bank in the U.S., is responsible for safeguarding the ETF’s digital assets and facilitating the staking process.

Anchorage’s Role in the ETF

Anchorage has been at the forefront of institutional crypto services, having allowed institutions to stake ethereum since 2022, coinciding with ethereum‘s shift to a proof-of-stake model. Recently, BlackRock selected Anchorage as a custodian for its bitcoin and ethereum ETFs, further solidifying its position in the market.

Custodial Services and ETF Structure

Anchorage’s services resemble those of a traditional bank but are tailored for cryptocurrency holdings. Unlike other crypto ETFs that have been approved by the SEC, the Rex-Osprey Solana + Staking ETF is structured under the Investment Company Act, necessitating the involvement of a qualified custodian like Anchorage to manage the fund’s assets.

Initial Trading Success

Bloomberg ETF Analyst James Seyffart remarked on the ETF’s promising start, noting that it achieved $8 million in trading volume within the first 20 minutes of trading. This initial performance indicates a healthy interest in the fund, despite the overall cautious sentiment among institutional investors.

Edited by James Rubin