DEX Trading Volumes Surge: Are Centralized Exchanges Losing Dominance?

Surge in DEX Trading Volumes Signals Shift in Crypto Landscape

Crypto Market Overview: June Gains Amidst Geopolitical Tensions

In June, the overall cryptocurrency market saw a slight increase of 2.62%, despite ongoing volatility driven by heightened geopolitical issues in the Middle East. Investor concerns regarding potential disruptions in energy supplies and escalating regional conflicts continued to exert pressure on asset valuations.

- Crypto Market Overview: June Gains Amidst Geopolitical Tensions

- DEX Trading Takes Center Stage

- Year-on-Year Growth in DEX Activity

- PancakeSwap Leads the Charge

- Hyperliquid’s Impressive Volume Growth

- User Engagement on Solana

- The Rise of Hybrid CeDeFi Platforms

- Benefits of CeDeFi Offerings

- Regulatory Flexibility Fuels DEX Innovation

DEX Trading Takes Center Stage

During the same month, the trading volume on decentralized exchanges (DEXs) reached an unprecedented level, accounting for 27.9% of total spot trading. This marks a significant milestone in the ongoing evolution of the crypto trading landscape.

Year-on-Year Growth in DEX Activity

Over the past year, trading volumes on DEX platforms have more than doubled, contrasting sharply with stagnant activity on centralized exchanges (CEXs), as highlighted in a recent report from Binance Research shared with CryptoPotato.

PancakeSwap Leads the Charge

PancakeSwap emerged as a frontrunner in the DEX market, increasing its share from 16% in April to an impressive 42% by June. This growth was fueled by a rise in Alpha trading volumes and the successful Infinity upgrade, which enhanced transaction speed, reduced costs, and improved liquidity. Additionally, World Liberty Financial’s uptick in on-chain transactions contributed to greater liquidity and yield opportunities.

Hyperliquid’s Impressive Volume Growth

Hyperliquid also experienced a surge in spot trading volume, climbing from $6 billion in January to nearly $10 billion in June, amidst stiff competition from decentralized perpetual trading platforms.

User Engagement on Solana

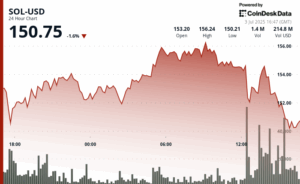

On the Solana blockchain, PumpSwap maintained robust user engagement, while other platforms like Raydium, Orca, and Meteora struggled to replicate their trading highs from January, which were largely driven by the hype surrounding meme coins.

The Rise of Hybrid CeDeFi Platforms

A significant factor in the growth of DEXs is the increasing trend of centralized exchanges directing their activities toward decentralized platforms. Many major exchanges have introduced hybrid models that combine CEX liquidity with on-chain settlement.

Benefits of CeDeFi Offerings

According to Binance Research, these CeDeFi solutions provide advantages such as low-slippage trading, protection against miner extractable value (MEV), and rapid transaction speeds. This innovation allows DEXs to scale effectively while bridging the divide between centralized and decentralized markets.

Regulatory Flexibility Fuels DEX Innovation

The adaptable regulatory landscape for decentralized finance (DeFi) has empowered DEXs to innovate and expand their offerings, resulting in increased on-chain trading volumes. In contrast, CEX spot trading remains heavily influenced by retail speculation, macroeconomic factors, and market volatility, making them more susceptible to external fluctuations observed throughout the year.

The article highlights a pivotal moment in the crypto trading ecosystem, suggesting that DEXs are gaining traction and challenging the dominance of traditional centralized exchanges.