JPMorgan Unveils Blockchain App for Carbon Market Innovation

JPMorgan Chase Innovates Carbon Markets with blockchain Technology

Overview of JPMorgan’s Initiative

JPMorgan Chase has announced plans to enhance voluntary carbon markets by introducing blockchain tokens at the registry level. This initiative aims to facilitate the issuance, transfer, and retirement of carbon credits, enabling market participants to manage their carbon credit transactions more efficiently.

- Overview of JPMorgan’s Initiative

- Collaboration with Carbon Registries

- Enhancing Market Transparency and Standardization

- Development of a Digital Token Application

- Insights from JPMorgan Leadership

- Challenges and Opportunities in Tokenization

- Importance of Standardization in Data

- Future Directions for Carbon Registries

- Commitment to a Modern Carbon Market

Collaboration with Carbon Registries

The bank is currently in discussions to test its blockchain solutions with several carbon registries, including S&P Global Commodity Insights, EcoRegistry, and the International Carbon Registry. This collaboration, part of JPMorgan’s blockchain division, Kinexys, is designed to explore the feasibility of tokenizing carbon credits.

Enhancing Market Transparency and Standardization

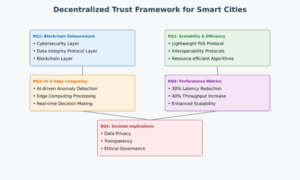

By integrating carbon registries into a blockchain framework, JPMorgan envisions a unified, tokenized ecosystem that would streamline interactions between carbon credit buyers and sellers. This approach is expected to tackle existing challenges related to transparency, standardization, and fragmentation within the carbon market.

Development of a Digital Token Application

JPMorgan is developing an application that will enable carbon registries to digitally represent ownership and data attributes of carbon credits. This application will allow for the direct issuance and tracking of credits on the Kinexys Digital Assets blockchain platform. Since its inception, this blockchain unit has processed transactions exceeding $1.5 trillion.

Insights from JPMorgan Leadership

Alastair Northway, Head of Natural Resource Advisory at JPMorgan Payments, highlighted the potential for innovation within the voluntary carbon market. He emphasized that tokenization could foster a globally interoperable system, enhancing the integrity of the underlying infrastructure and promoting greater price transparency and liquidity.

Challenges and Opportunities in Tokenization

While JPMorgan acknowledges that implementing native tokenization projects can be complex in established markets, it believes that the relatively nascent voluntary carbon market presents a unique opportunity for quicker adoption. A significant portion of the market is concentrated among a few registries, which could facilitate this transition.

Importance of Standardization in Data

The bank noted that creating a tokenization standard with embedded project and credit attributes could significantly improve data transparency and standardization. However, it clarified that its application does not serve as an authority on credit quality. Instead, its role is to enforce standardized data structures and enhance transparency, allowing users to independently evaluate information related to specific projects and credits.

Future Directions for Carbon Registries

The carbon registries involved will aim to make their data more accessible to external stakeholders. In addition to assessing the viability of tokenization, they will evaluate Kinexys’ capabilities in managing accounts, projects, and credit lifecycles, focusing on technical connectivity and compatibility with various data models.

Commitment to a Modern Carbon Market

Oli Torfason, COO of the International Carbon Registry, expressed that this collaboration marks a significant advancement toward a modernized and integrated carbon market structure. He emphasized the shared commitment to fostering transparency, innovation, and the necessary infrastructure for a robust climate economy.