Truth Social’s Bitcoin and Ether ETF Filing Receives SEC Acknowledgment

SEC Greenlights Trump Media’s Bitcoin and ethereum ETF Application

The U.S. Securities and Exchange Commission (SEC) has officially accepted the application from Trump Media for a Bitcoin and ethereum exchange-traded fund (ETF), initiating the timeline for the agency to either approve or deny the proposal.

ETF Structure and Management

The proposed ETF aims to provide investors with exposure to Bitcoin (BTC) and Ether (ETH) through shares traded on NYSE Arca. The fund plans to allocate 75% of its assets to Bitcoin and 25% to Ether, as outlined in the official filing. Foris DAX Trust Company, operating under the name Crypto.com, will serve as the custodian, while Yorkville America Digital will sponsor the fund.

This filing arrives during a surge of other crypto ETF applications, with reports indicating that the SEC is considering a streamlined listing process for crypto ETFs that could automate much of the approval procedure.

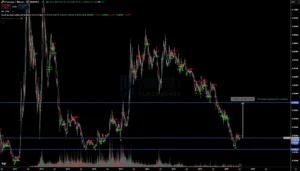

Daily Valuation Methodology

Truth Social’s ETF intends to assess its net asset value daily, using the CME CF Bitcoin reference rate for the Bitcoin component, which aggregates trading data from various major cryptocurrency exchanges. The Ether portion will be valued based on the Ether CME CF reference rate, unless the sponsor decides otherwise.

The custodian will maintain separate accounts for the fund’s Bitcoin and Ether, ensuring that private keys are securely stored in cold storage.

Delays in Fidelity’s Solana ETF

In other news, the SEC has postponed its decision regarding Fidelity’s proposed spot Solana (SOL) ETF, reopening a public comment period that allows responses for 21 days and rebuttals for 35 days. The Cboe BZX Exchange initially sought approval for this ETF in a filing dated March 25.

Bloomberg ETF analyst James Seyffart noted on social media that this delay was anticipated. He emphasized the ongoing wait for any significant progress from the SEC concerning a comprehensive framework for digital asset exchange-traded products (ETPs).

Signs of Progress in SEC’s Crypto ETP Review

Seyffart also mentioned in another post that the SEC’s request for issuers of SOL spot ETFs to amend and resubmit their applications by the end of the month is a positive indication of the agency’s movement regarding new crypto ETPs. He cautioned, however, that these interactions should not be misconstrued as approvals but rather as constructive dialogue between the SEC and issuers or exchanges.

In summary, the developments surrounding the Trump Media ETF and the ongoing discussions about Fidelity’s Solana ETF reflect a dynamic landscape in the cryptocurrency investment space, with potential implications for future regulatory frameworks.