iShares BTC ETF Bitcoin Holdings Soar Past 700K in Historic Surge

BlackRock’s iShares bitcoin Trust Surpasses 700,000 BTC in Record Time

iShares bitcoin Trust Achieves Significant Milestone

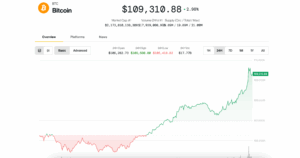

BlackRock’s iShares bitcoin Trust (IBIT) has reached a remarkable milestone, now holding over 700,000 bitcoins, as reported by Glassnode. This achievement comes within just 18 months of its launch, accumulating an impressive $76 billion in assets under management. This rapid growth has outpaced other notable ETFs, including the iShares Core S&P 500 ETF (IVV) and the iShares Russell 2000 ETF (IWM), both of which track major segments of the U.S. equity market.

Comparison with Other bitcoin Holdings

In comparison to other institutional players in the cryptocurrency space, IBIT’s holdings significantly surpass those of MicroStrategy (MSTR), which has accumulated 600,000 BTC since it began purchasing in 2020. Additionally, Fidelity’s bitcoin ETF (FBTC) holds 203,000 BTC, while Grayscale’s bitcoin Trust (GBTC) has 184,000 BTC in its portfolio.

The Rise of bitcoin ETFs

The introduction of U.S. spot bitcoin exchange-traded funds (ETFs) in January 2024 has marked a historic moment in the financial landscape, becoming the most successful ETF launches to date. Since their inception, these ETFs have attracted a staggering $50 billion in net inflows, demonstrating strong investor interest in cryptocurrency assets.

BlackRock’s ETF Success

IBIT has quickly become one of BlackRock’s top revenue-generating ETFs, ranking third among its extensive portfolio of 1,197 funds. Eric Balchunas, a senior analyst at Bloomberg specializing in ETFs, highlighted the significance of this achievement, showcasing the growing demand for cryptocurrency investment vehicles.

Industry Reactions

Nate Geraci, president of The ETF Store, expressed his astonishment at the rapid growth of the iShares bitcoin ETF, noting the impressive accumulation of 700,000 BTC in such a short period. His comments reflect the broader excitement and interest surrounding the evolving landscape of cryptocurrency investments.

In summary, BlackRock’s iShares bitcoin Trust has not only set a new benchmark in the ETF market but has also underscored the increasing acceptance and integration of digital assets within traditional finance.