Ego Death Capital Raises $100M for Bitcoin-Focused Venture Fund

Ego Death Capital Secures $100 Million for bitcoin-Focused Venture Fund

Venture Firm Expands Investment in bitcoin Startups

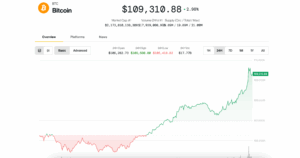

Ego Death Capital, a venture capital firm dedicated to the bitcoin ecosystem, has successfully raised $100 million for its second fund. This marks a significant increase from its initial fund, reflecting a strong commitment to supporting early-stage companies that are innovating on the bitcoin blockchain—a specialized area within the larger cryptocurrency investment sector.

- Venture Firm Expands Investment in bitcoin Startups

- Fund II: Focused on Series A Investments

- bitcoin as a Foundation for Real-World Applications

- Investment Philosophy: Infrastructure Over Speculation

- Addressing Funding Gaps for bitcoin Startups

- Initial Investments from Fund II

- Background of Ego Death Capital

- Stay Informed with The Funding Newsletter

- Disclaimer

Fund II: Focused on Series A Investments

The closing of this fund comes approximately 18 months after Ego Death Capital first revealed its fundraising intentions in January 2024. The new fund will primarily concentrate on leading Series A investment rounds, with initial funding amounts ranging from $3 million to $8 million. The firm aims to support businesses that are developing on bitcoin and its various application layers, such as the Lightning Network, Fedimint, and Discreet Log Contracts.

bitcoin as a Foundation for Real-World Applications

For an increasing number of cryptocurrency venture capitalists, bitcoin is evolving beyond merely a store of value. Recent reports indicate that investors are now more inclined to support startups that leverage bitcoin’s emerging layers—from the Lightning Network to rollups—viewing the protocol as a reliable and tested foundation for practical applications.

Investment Philosophy: Infrastructure Over Speculation

Lyn Alden, a general partner at Ego Death Capital, emphasized the firm’s investment philosophy, stating, “We focus on businesses that view bitcoin as a foundational infrastructure rather than a speculative asset.” This perspective highlights the firm’s commitment to backing companies that prioritize long-term growth over short-term trading strategies.

Addressing Funding Gaps for bitcoin Startups

Ego Death Capital aims to fill a critical gap in Series A funding for bitcoin-centric startups, where entrepreneurs often face challenges in securing lead investors who possess both technical knowledge and a long-term vision. The firm is dedicated to supporting companies that have functional products and initial market traction, steering clear of speculative ventures that chase fleeting profits.

Initial Investments from Fund II

So far, Fund II has made investments in three notable companies: Relai, a Swiss-based bitcoin brokerage; LN Markets, a derivatives trading platform utilizing the Lightning Network; and Roxom, which is developing a global trading system built on bitcoin.

Background of Ego Death Capital

Founded in 2022, Ego Death Capital launched its first fund with a total of $25.2 million, supplemented by a $7.5 million special purpose vehicle. The firm continues to position itself as a key player in the bitcoin-focused venture capital landscape.

Stay Informed with The Funding Newsletter

For those interested in the latest developments in cryptocurrency funding, consider subscribing to my free bimonthly newsletter, The Funding. Stay updated on trends and news in the crypto investment space.

Disclaimer

The Block operates as an independent media entity delivering news, research, and data. As of November 2023, Foresight Ventures holds a majority stake in The Block and invests in various companies within the cryptocurrency sector. Notably, crypto exchange Bitget serves as an anchor limited partner for Foresight Ventures. The Block maintains its independence to provide objective and timely insights into the crypto industry. For more details, please refer to our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is intended solely for informational purposes and should not be construed as legal, tax, investment, financial, or other forms of advice.