BitMine Secures $250M for Strategic Ethereum Treasury Investment

BitMine Immersion Technologies Expands ethereum Strategy with New Consulting Agreement

BitMine Partners with ethereum Tower LLC

In a significant development, BitMine Immersion Technologies (BMNR) has announced a strategic partnership with ethereum Tower LLC. This collaboration, established on July 8, 2025, involves a consulting agreement aimed at optimizing BitMine’s digital asset treasury. The focus will be on increasing the company’s ethereum (ETH) holdings through various decentralized finance initiatives. While ethereum Tower will oversee operational management, BitMine will maintain control over its assets, ensuring a strategic approach to maximizing its ETH reserves.

Major Funding Milestone Achieved

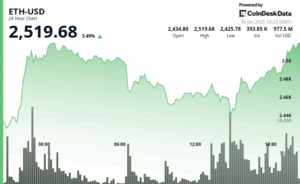

On July 9, 2025, BitMine also revealed the successful completion of a $250 million private placement. This funding is intended to bolster its ethereum treasury strategy, marking a pivotal moment in the company’s growth trajectory. The initiative is designed not only to fortify the ethereum ecosystem but also to enhance returns for shareholders by positioning ETH as the primary asset in its treasury.

Overview of BitMine Immersion Technologies

BitMine Immersion Technologies is dedicated to the Bitcoin and ethereum sectors, focusing on the long-term accumulation of cryptocurrencies. The company’s operations encompass Bitcoin mining, synthetic Bitcoin mining, and the provision of hashrate as a financial product, alongside advisory services related to Bitcoin. With operations strategically located in regions with low energy costs, such as Trinidad and Texas, BitMine is well-positioned to capitalize on market opportunities.

Key Metrics

- Average Trading Volume: 4,944,417 shares

- Technical Sentiment Signal: Buy

- Current Market Capitalization: $662.4 million

For comprehensive insights into BMNR stock, visit TipRanks’ Stock Analysis page for further details.

Disclaimer

This article is for informational purposes only and does not constitute financial advice.