Cardano ADA Price Surge: Key Factors Driving Today’s Market Rally

Cardano Price Surge: Key Market Drivers and Investor Sentiment

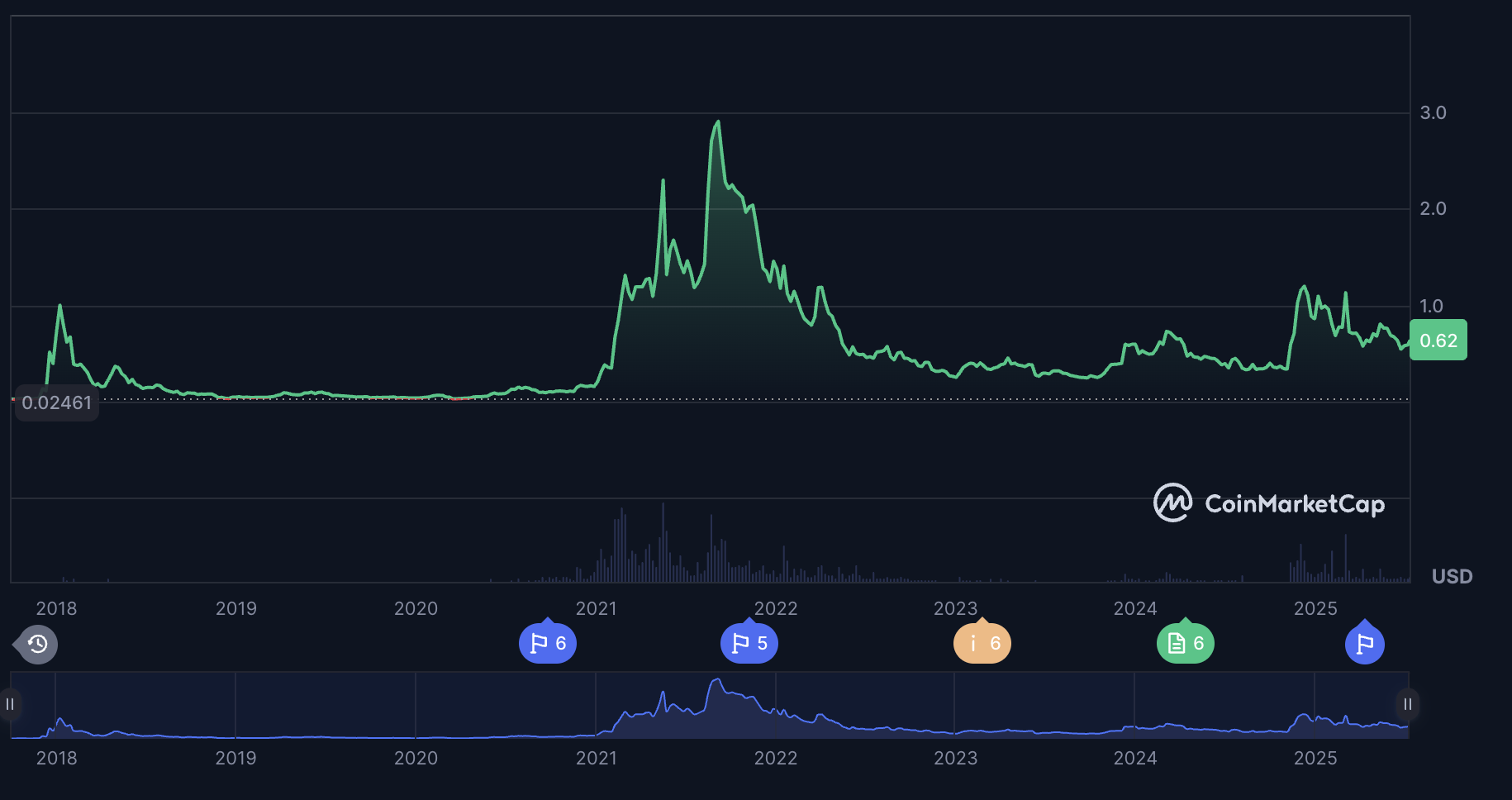

Overview of Recent Price Movements

Cardano (ADA) has experienced a notable increase of 2.09% over the past 24 hours, coinciding with Bitcoin’s recent peak and a wave of positive technical indicators, alongside significant accumulation by large investors.

1. Bitcoin’s Influence on the Market

The recent spike in Bitcoin’s value, reaching an all-time high of $112,152 on July 9-10, has had a ripple effect across the cryptocurrency landscape. This surge has not only propelled ADA’s price upward but has also seen Ethereum and Solana posting gains of 7% and 4-6%, respectively. The overall cryptocurrency market capitalization rose by 1.65% within the same timeframe, with a 29% increase in derivatives open interest, as reported by CoinMarketCap.

2. Technical Indicators Suggest Bullish Trends

Recent technical analyses reveal a significant bullish signal for ADA, marked by the first-ever weekly golden cross, where the 50-week moving average has crossed above the 200-week moving average. This is historically seen as a positive indicator. Additionally, the Relative Strength Index (RSI) stands at 55.5, indicating a neutral stance but showing signs of recovery from previously oversold conditions. A bullish crossover in the Moving Average Convergence Divergence (MACD) further supports a short-term optimistic outlook.

Key price levels to monitor include immediate resistance at $0.72, identified through Fibonacci retracement levels, and support at $0.60. The current rally in ADA is largely attributed to Bitcoin’s market dominance, increased whale activity, and favorable technical conditions. Observers are keenly watching for a sustained close above $0.72 to confirm ongoing upward momentum.

What’s Next for Cardano?

The potential for ADA to decouple from Bitcoin remains a topic of interest, especially in light of ongoing discussions regarding ETF approvals. While Cardano displays a mix of bullish technical signals and rising institutional interest, it also faces challenges with resistance levels in a fluctuating market.

1. Technical Developments

Cardano has achieved a significant milestone with its first weekly golden cross on July 9, 2025, a classic indicator of bullish potential. However, ADA continues to trade below critical resistance at $0.66, necessitating sustained closes above $0.64 to validate any upward momentum. The upcoming Plomin Hard Fork, scheduled for Q1 2025, is expected to enhance decentralization, with data indicating that 70.92% of ADA is held in long-term “holder” addresses.

2. Business Initiatives and Collaborations

On July 8, the Cardano Foundation introduced Reeve, an enterprise-level tool designed for transparent financial reporting, particularly aimed at ESG sectors and government entities. This initiative follows a controversial proposal by Charles Hoskinson on June 14 to convert $100 million of ADA treasury reserves into Bitcoin and stablecoins to enhance DeFi liquidity, igniting discussions within the community about ADA’s utility.

3. Market Metrics and Whale Activity

Recent data indicates a surge in whale activity, with addresses holding between 1-10 million ADA accumulating a total of 120 million tokens, valued at approximately $3.3 billion, since June 25. Despite this accumulation, ADA’s price has remained relatively stagnant, fluctuating between $0.59 and $0.63, trailing behind Bitcoin’s 7% weekly growth with only a 4.7% increase. Speculation surrounding a potential Cardano ETF continues, with Bloomberg analysts estimating a 75% likelihood of approval, although no formal applications have been submitted yet.

While ongoing network upgrades and increased whale accumulation suggest a growing confidence among institutional investors, ADA must break through the $0.66 resistance level to fully leverage its technical advantages. The question remains: will Cardano’s enterprise-focused tools like Reeve garner enough real-world adoption to validate the bullish bets made by large investors?

Stay updated with the latest developments in Cardano.

Disclaimer: This content is for informational purposes only and should not be considered financial advice. Always conduct your own research.