Unlock E-Commerce Growth: Why Groupon and CarGurus Are Key Players

Ecommerce Industry Outlook for 2025: Growth and Trends

Positive Growth in Ecommerce Sales

As we look ahead to 2025, the ecommerce sector is poised for significant growth, continuing to capture a larger share of the overall retail market. Recent data from the Commerce Department indicates that ecommerce sales in the first quarter of 2025 increased by 6.1% compared to the same period in 2024, while total retail sales rose by 4.5%. Ecommerce now represents approximately 16.2% of all retail sales in the United States.

- Positive Growth in Ecommerce Sales

- Innovations Shaping the Ecommerce Landscape

- The Blurring Lines Between Physical and Digital Retail

- Subscription Models Gaining Popularity

- Importance of Direct Consumer Access

- Macroeconomic Factors Influencing Ecommerce

- Rise of Social Commerce Among Gen-Z

- Zacks Industry Rank Highlights Strength

- Strong Shareholder Returns in Ecommerce

- Current Valuation Trends

- Recommended Stocks for Investment

- Groupon, Inc. (GRPN)

- CarGurus, Inc. (CARG)

- Conclusion

Typically, growth rates tend to stabilize following the robust holiday shopping season. With valuations becoming more attractive, this period often presents a favorable opportunity for investors. Notable stock recommendations include Groupon, Inc. (GRPN) and CarGurus, Inc. (CARG).

The convenience of online shopping remains a primary driver of ecommerce growth, particularly among Gen-Z consumers. This demographic, having grown up in a digital environment, is accustomed to seamless online experiences and is heavily influenced by trends on social media platforms.

Innovations Shaping the Ecommerce Landscape

The Blurring Lines Between Physical and Digital Retail

The distinction between online and offline shopping continues to diminish as consumers increasingly integrate both experiences. This trend manifests in various ways, such as researching products online before purchasing in-store or opting for online orders with in-store pickup. Enhanced convenience is a key factor, leading to greater reliance on technologies like robots and drones for delivery, which can streamline logistics and reduce costs. Consequently, both traditional retailers and online-first brands are investing in digital platforms to enhance their market presence.

Subscription Models Gaining Popularity

Another emerging trend is the adoption of subscription services for frequently purchased items. This model simplifies the ordering process for consumers and aids retailers in inventory management. Many retailers offer discounts to incentivize subscription choices, making this option increasingly appealing. This trend is expected to grow as both low and high-value products are increasingly marketed as subscription services.

Importance of Direct Consumer Access

Direct access to consumers is crucial for retailers, as it allows for the collection of valuable customer data. Major companies, like Amazon, leverage this data to enhance their services, leading to heightened consumer expectations. As businesses increasingly utilize data analytics, they can tailor their offerings to meet customer demands effectively. The integration of artificial intelligence and generative AI is becoming essential for maintaining competitiveness in this evolving landscape.

Macroeconomic Factors Influencing Ecommerce

The broader economic environment is also evolving, with indications that a severe recession is unlikely. The job market appears stable, and tax policies are expected to remain favorable, which may help sustain consumer spending. However, geopolitical tensions and trade tariffs could pose challenges. While consumers are currently cautious, the government is likely to monitor economic pressures on disposable income closely. Overall, the ecommerce sector is expected to benefit from the digital transformation that has accelerated in recent years.

Rise of Social Commerce Among Gen-Z

Social commerce is gaining traction, particularly among Gen-Z consumers, who prefer discovering and purchasing products directly through social media platforms. This trend often involves influencers promoting products, creating a more interactive shopping experience. Platforms like TikTok, which have seen immense popularity among younger audiences, are at the forefront of this movement, alongside established platforms like Facebook and Instagram.

Zacks Industry Rank Highlights Strength

The Zacks Internet – Commerce sector is a significant segment within the broader Retail and Wholesale category, currently holding a Zacks Industry Rank of #51, placing it in the top 21% of nearly 250 industries. Research indicates that industries in the top half of Zacks rankings tend to outperform those in the bottom half by a substantial margin.

The ecommerce sector’s strong ranking reflects its performance relative to other industries. Recent aggregate earnings estimates show fluctuations, with a 1.4% increase for 2025, peaking earlier in the year before stabilizing. The 2026 estimates have experienced volatility, influenced by uncertainties surrounding interest rates and potential economic downturns.

Strong Shareholder Returns in Ecommerce

Over the past year, the Zacks Electronic – Commerce Industry has performed closely to the broader Retail and Wholesale sector and the S&P 500, often at a premium. The industry has seen a collective gain of 18% over the past year, outperforming the 16.5% increase in the broader retail sector and the 11.9% rise in the S&P 500.

Current Valuation Trends

Historically, the ecommerce industry has traded at a premium compared to both the retail sector and the S&P 500. Currently, the price-to-forward earnings ratio stands at 24.6X, which is an 8.6% premium to the S&P 500 and a slight discount to the retail sector. This valuation reflects a modest premium compared to its own historical median.

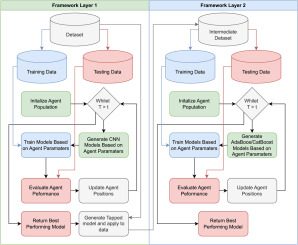

Recommended Stocks for Investment

Given the robust growth potential within the ecommerce sector, several stocks are worth considering. Utilizing a proprietary ranking system, we highlight two stocks that appear particularly attractive at this time.

Groupon, Inc. (GRPN)

Groupon operates as an online marketplace that connects consumers with local businesses across various sectors, including goods, travel, and dining. While the company faces challenges due to high debt levels and potential macroeconomic shifts, it has shown a strong track record of exceeding expectations. Recently, Groupon achieved profitability, and analysts have revised their earnings estimates upward, indicating positive momentum.

CarGurus, Inc. (CARG)

CarGurus specializes in the online marketplace for new and used vehicles, primarily in the U.S. The company focuses on enhancing dealer profitability through data-driven solutions and a user-friendly experience. With no debt and strong liquidity, CarGurus is well-positioned for growth. Recent earnings estimates have also seen upward revisions, suggesting a positive outlook for the company.

Conclusion

The ecommerce industry is on a promising trajectory as it adapts to evolving consumer preferences and technological advancements. With strong growth prospects and innovative trends shaping the landscape, investors have a variety of opportunities to explore in this dynamic sector.