Solana Sandwich Attacks Plummet: Insights from Anza’s Max Resnick

Addressing the Sandwich Attack Challenge in Solana’s Ecosystem

Insights from Max Resnick on Solana’s Economic Landscape

In a recent discussion on the Lightspeed platform, Max Resnick, the lead economist at Anza, shared his perspective on a pressing issue within Solana’s economic framework: the ongoing challenge of sandwich attacks.

Understanding Sandwich Attacks in Solana

Resnick’s insights were unexpected. He noted that the frequency of sandwich attacks has significantly decreased. For context, sandwich attacks occur when a malicious trader strategically places orders before and after a legitimate trade, thereby profiting at the expense of the unsuspecting trader.

Historically, sandwich attacks have posed a significant threat to Solana and its development community. In early 2024, Jito, a key player in Solana’s infrastructure, temporarily halted its mempool operations due to concerns over these attacks. Shortly thereafter, the Solana Foundation took action by removing suspected sandwich attackers from its stake delegation program. Additionally, Jito’s decentralized autonomous organization (DAO) voted to exclude harmful validators from its staking pool.

Despite these measures, sandwich attacks persisted. However, Resnick attributes the decline in these attacks not to punitive actions against offenders, but rather to enhancements made to Solana’s underlying code.

The Role of Code Improvements in Mitigating Attacks

According to Resnick, sandwich attacks are fundamentally a numbers game for the perpetrators. In 2024, the process of submitting transactions on Solana was notably challenging, leading to a broad distribution of transactions across validators. This situation provided malicious actors with numerous opportunities to frontrun legitimate trades. As Solana’s transaction targeting capabilities have evolved, the average number of validators exposed to each transaction has decreased, thereby limiting the chances for sandwich attackers to exploit the system.

Resnick emphasized that now, a 10% stake involved in sandwiching can only access 10% of the transactions, which aligns with the intended design of the network.

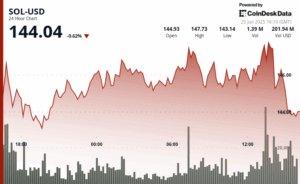

Data Supporting the Decline of Sandwich Attacks

Recent data supports Resnick’s claims. A report from Ghost, a tracker focused on sandwich attacks, indicates that profits from these attacks on Solana were lower in March and April of this year compared to the same months in the previous year, even though the network’s revenue remained relatively stable during both periods.

Furthermore, the report highlighted that Marinade, a prominent staking provider on Solana, has become a key target for sandwich attackers. In response, Marinade has implemented penalties for those engaging in sandwich attacks within its staking auction marketplace.

Conclusion

The evolving landscape of Solana’s economic environment reflects significant strides in mitigating sandwich attacks through code improvements rather than solely relying on punitive measures. As the network continues to adapt, the focus remains on enhancing security and user experience, ensuring a more robust ecosystem for all participants.