Surging Stablecoin Market Sparks Optimism for Upcoming Crypto Rally

Bitcoin Rally Supported by Surge in Stablecoin Supply

Stablecoins Reach New Heights Amid Bitcoin Surge

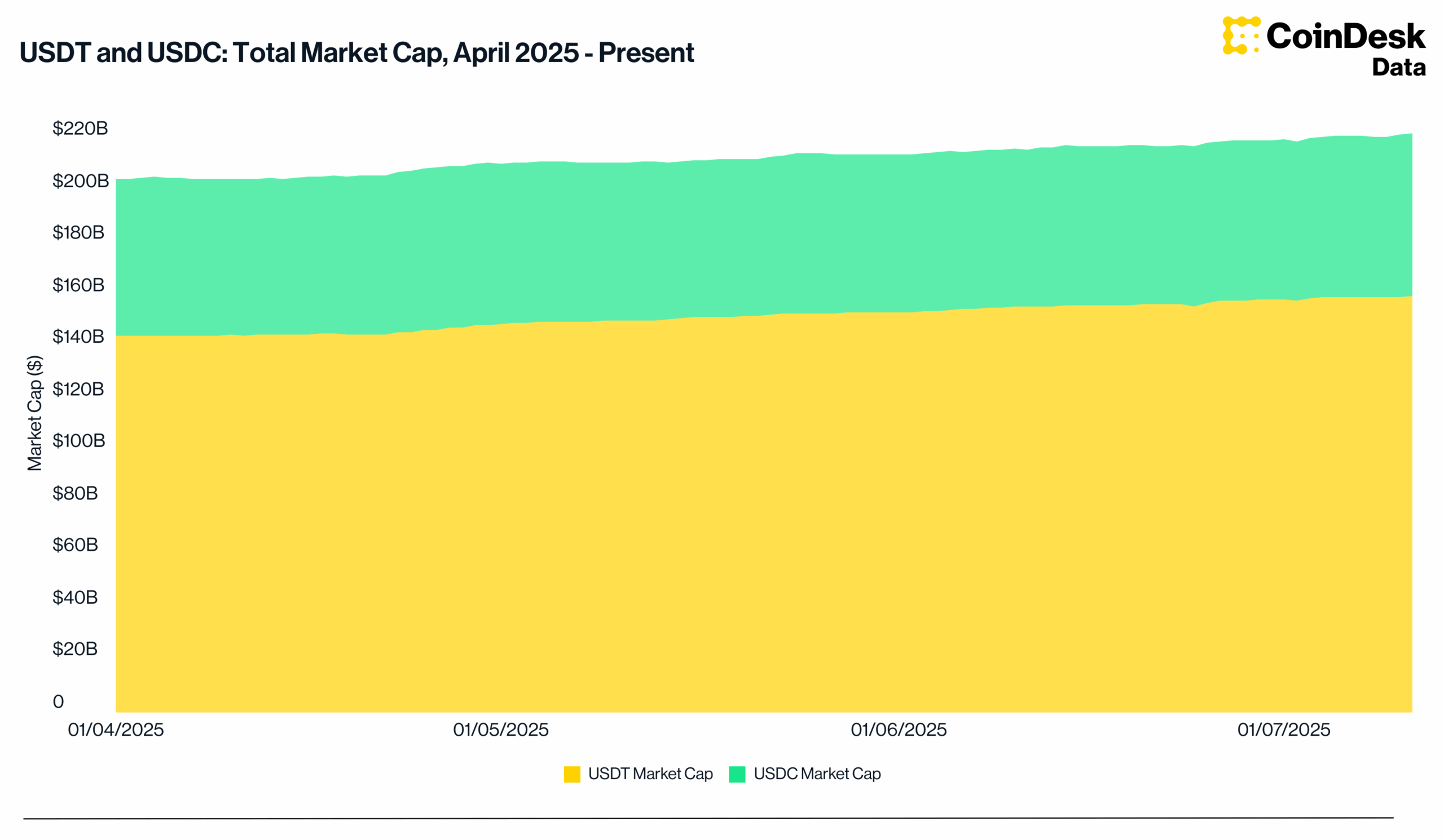

As Bitcoin continues to break previous records, the increase in stablecoin supply suggests that this upward trend may be more substantial than it appears. Tether’s USDT and Circle’s USDC, the two leading dollar-pegged stablecoins, have both achieved unprecedented supply levels this week, according to data from TradingView. Since early July, USDC’s market capitalization has risen by $1.3 billion, bringing it to $62.8 billion, while USDT has seen an increase of $1.4 billion, approaching a total of nearly $160 billion.

Historical Context of Stablecoin Growth

Looking back to April, when the market experienced a temporary downturn, the growth in stablecoins becomes even more striking. USDT expanded by $15.2 billion, marking an increase of approximately 10.5%, while USDC added $2.7 billion, or 4.6%.

Stablecoins are digital currencies designed to maintain a stable value by being linked to external assets, primarily the U.S. dollar. Their popularity has surged not only for transactional purposes but also as a vital source of liquidity and trading pairs on cryptocurrency exchanges.

Implications of Stablecoin Growth for the Crypto Market

Analysts often interpret the growth of stablecoins as an indicator of new capital entering the cryptocurrency market. Historical data shows that periods of rapid expansion in stablecoin supply have frequently aligned with significant rallies in Bitcoin prices. Caleb Franzen, founder of Cubic Analytics, highlighted this correlation in a chart shared on social media.

In summary, the current surge in stablecoin supply may signal a robust influx of investment into the broader cryptocurrency ecosystem, reinforcing the ongoing Bitcoin rally.

Read more: Bitcoin’s ‘Low Volatility’ Rally From $70K to $118K: A Tale of Transition From Wild West to Wall Street-Like Dynamics