BTCT Shares Jump 14% Following $1M Ethereum Reserve Announcement

BTC Digital Ltd. Invests $1 Million in ethereum to Strengthen DeFi Position

Strategic Move into the ethereum Ecosystem

BTC Digital Ltd. (BTCT) has made headlines by allocating $1 million to establish a strategic reserve in ethereum (ETH). This initiative is just the beginning of a larger plan aimed at deepening the company’s involvement in the ethereum ecosystem, particularly in decentralized finance (DeFi) and tokenization. By taking this step, BTCT is positioning itself to enhance its role in the evolving landscape of digital assets.

CEO Highlights ethereum‘s Growing Importance

Mr. Siguang Peng, the CEO of BTCT, emphasized the explosive growth of the stablecoin market and ethereum‘s critical function in facilitating USD transactions and value transfers. With this initial investment in ETH, BTCT is preparing to embrace greater opportunities in DeFi, the creation of stablecoins, and the tokenization of assets. ethereum‘s significant share in the stablecoin market—over 50% of major stablecoins like USDT and USDC operate on its network—illustrates its vital role in global liquidity and payment systems.

Trends in ETH Utilization and Market Dynamics

The rising trend of using ETH for staking and as collateral in DeFi and tokenization is anticipated to reduce ETH’s available supply, thereby bolstering the network’s security and overall value. This trend is being mirrored by various blockchain and mining firms that are utilizing ETH as reserves and smart contracts to yield returns, provide collateral, or facilitate cross-chain solutions. BTCT’s actions align with this broader industry movement towards maximizing ethereum‘s potential.

Transitioning Business Models for Future Growth

BTCT’s approach is not limited to a single ETH acquisition; the company is gradually shifting its business focus from crypto mining to becoming a key player in on-chain financial systems. Plans are in place for BTCT to incrementally increase its ETH holdings, adapting to market fluctuations and advancements within the ethereum network. Upcoming upgrades, including Pectra and Layer-2 enhancements, are expected to improve ethereum‘s speed, cost-efficiency, and regulatory compliance, further reinforcing its role in stablecoin transactions and decentralized operations.

Investor Confidence and Market Response

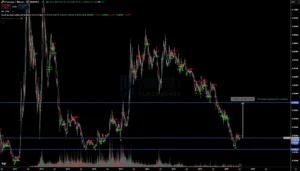

The leadership at BTCT is optimistic that ethereum could become the digital equivalent of gold in the future economy. By investing early in stablecoin transactions, payment systems, and asset tokenization, BTCT aims to secure a leading position in these sectors. This strategic investment has garnered positive reactions from investors, with BTCT’s stock experiencing a 14% increase following the announcement. The market perceives this as a strong indicator of confidence and potential growth, suggesting that BTCT is on track to emerge as a frontrunner in the rapidly changing cryptocurrency landscape.