Ethereum Surges Past $2,800: Will Bulls Sustain the Rally?

ethereum Price Analysis: Bulls Target $4,000 Amid Market Fluctuations

ethereum‘s Recent Price Movements

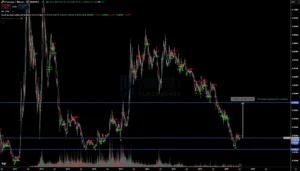

Market analyst Daan Crypto, known for his insights on X, has shed light on the current state of ethereum, indicating that the altcoin is navigating a precarious price landscape. Recently, ethereum (ETH) surged past the significant resistance level of $2,800, briefly reaching the $3,000 mark. This upward movement resulted in a notable market gain of 16.77%, showcasing impressive performance for the second-largest cryptocurrency.

Key Resistance Levels and Future Outlook

In a post dated July 12, Daan Crypto pointed out that the $2,800 threshold has historically served as a formidable resistance level for ethereum over the last two years. The recent bullish momentum has allowed the cryptocurrency to break through this barrier, suggesting potential for further price increases.

However, the retreat from the $3,000 level indicates that profit-taking by traders may be pressuring the price, potentially leading it back below $2,800. Daan Crypto warns that while a brief dip followed by a rebound may not significantly impact bullish sentiment, prolonged trading below $2,800 could push ETH down to levels between $2,100 and $2,160.

Importance of Maintaining Price Above $2,800

The analyst emphasizes that it is crucial for ETH bulls to keep the price above $2,800 to maintain the current bullish trend, which could pave the way for a return to the previous market peak of $4,000. From a trading perspective, this price point serves as a clear indicator that bullish control remains intact as long as ethereum stays above this level.

Technical Indicators and Market Sentiment

The Moving Average Convergence Divergence (MACD) indicator on ethereum‘s daily chart supports the possibility of a sustained upward trend. The recent crossover of the MACD line above the signal line is generally viewed as a bullish sign.

Conversely, the Relative Strength Index (RSI) currently sits at 71.12, indicating that ethereum may be entering an overbought territory. This situation raises concerns about the potential for market overheating, which could lead to widespread profit-taking.

Current Market Overview

As of the latest update, ethereum is trading at $2,966, reflecting a slight decline of 0.11% over the past day. Despite this minor pullback, the asset has achieved an impressive 16.53% increase over the last month, suggesting that most investors are still in profit.

Data from blockchain analytics firm Sentora reveals that the ethereum network has generated total fees of $6.04 million, marking a modest decrease of 0.60% from the previous week. This decline in fees indicates a slight reduction in transaction activity on the network.

Additionally, crypto exchanges have reported outflows totaling $493 million, indicating that investors are choosing to store their assets in private wallets. This trend typically reflects increased confidence in the market, as users are less likely to sell and more inclined to hold their assets in anticipation of further price growth.

Disclaimer: This article is for informational purposes only. Past performance does not guarantee future results.