Bitcoin Soars to New High as Trump Signals Eased Crypto Regulations

Bitcoin Reaches Historic Highs Amid Regulatory Hopes

Bitcoin Surges Past $120,000

Bitcoin has achieved a remarkable milestone, crossing the $120,000 mark for the first time on Monday. This surge reflects growing investor confidence as they anticipate favorable regulatory developments for the cryptocurrency sector this week.

Record Highs and Market Reactions

The cryptocurrency reached an all-time high of $123,153.22 before experiencing a slight pullback, trading at approximately $122,000, which represents a 2.4% increase. Later today, the U.S. House of Representatives is set to discuss several legislative proposals aimed at establishing a comprehensive regulatory framework for the digital asset industry.

Political Support for Cryptocurrency

U.S. President Donald Trump, who has dubbed himself the “crypto president,” has voiced his support for reforming regulations to benefit the cryptocurrency sector. Market analyst Tony Sycamore from IG noted that Bitcoin is currently benefiting from several positive factors, including robust institutional demand and expectations of further price increases, alongside Trump’s backing.

Continued Momentum in the Market

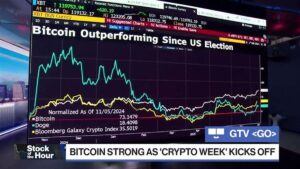

Sycamore remarked on the strong upward trend observed over the past week, suggesting that Bitcoin could soon approach the $125,000 threshold. The recent price surge has also catalyzed a broader rally in the cryptocurrency market, with Bitcoin up 30% year-to-date, despite the backdrop of Trump’s tumultuous tariff policies.

Other Cryptocurrencies Join the Rally

Ether, the second-largest cryptocurrency, has also seen significant gains, reaching a five-month high of $3,059.60. Other notable cryptocurrencies, such as XRP and Solana, have each increased by approximately 3%. The total market capitalization of the cryptocurrency sector has now risen to around $3.81 trillion, according to CoinMarketCap.

Growing Institutional Interest

Gracie Lin, CEO of crypto exchange OKX in Singapore, highlighted the increasing recognition of Bitcoin as a long-term reserve asset, not just among retail investors but also among institutions and some central banks. She pointed out a notable uptick in interest from Asian investors, including family offices and wealth managers, indicating a structural shift in how Bitcoin is perceived within the global financial landscape.

Legislative Developments on the Horizon

Earlier this month, Washington designated the week of July 14 as “crypto week,” during which Congress members are expected to vote on several key bills, including the Genius Act, the Clarity Act, and the Anti-CBDC Surveillance State Act. The Genius Act is particularly significant as it aims to establish federal regulations for stablecoins.

Positive Trends in Crypto Stocks

In premarket trading in the U.S., shares of cryptocurrency exchange Coinbase rose by 1.7%, while Bitcoin holder Strategy saw a 3.3% increase. Additionally, crypto mining company Mara Holdings experienced a 4.6% jump. In Hong Kong, spot Bitcoin ETFs launched by China AMC, Harvest, and Bosera have all reached record highs.

– Reporting by Global News’ Ari Rabinovitch