Crypto Price Analysis (7-16): BTC, ETH, SOL, ARB, FIL, JUP Trends Revealed

Crypto Market Recovers as bitcoin Tests Support Levels

The cryptocurrency market has bounced back following a decline earlier this week, with bitcoin (BTC) approaching critical support zones. The total market capitalization has increased by 1.34%, reaching $3.71 trillion. After a nearly 2% drop on Tuesday, bitcoin found itself at $117,682, having dipped to an intraday low of $115,701. Currently, BTC is slightly up, trading around $117,868.

- ethereum and Other Altcoins Show Strong Recovery

- Dow Jones Declines Amid Rising Inflation Concerns

- Key Crypto Legislation Faces Delays

- Ripple Aims for MiCA License in the EU

- Kraken Introduces Regulated Crypto Derivatives Trading

- bitcoin (BTC) Price Trends and Analysis

- ethereum (ETH) Price Trends and Analysis

- Solana (SOL) Price Trends and Analysis

- Arbitrum (ARB) Price Trends and Analysis

- Filecoin (FIL) Price Trends and Analysis

- Jupiter (JUP) Price Trends and Analysis

ethereum and Other Altcoins Show Strong Recovery

ethereum (ETH) has rebounded impressively after its recent dip, climbing nearly 6% to surpass the $3,000 mark, now trading at approximately $3,137. Ripple (XRP) has also seen a rise of 1.54%, currently priced at $2.92. Solana (SOL) is up nearly 2%, trading around $163. Dogecoin (DOGE) has increased by over 3%, while Cardano (ADA) has risen by 2.50%, trading at about $0.743. Other cryptocurrencies, including Stellar (XLM), Chainlink (LINK), Hedera (HBAR), Toncoin (TON), Litecoin (LTC), and Polkadot (DOT), have also experienced notable gains.

Dow Jones Declines Amid Rising Inflation Concerns

U.S. stock markets had a mixed performance, coinciding with an uptick in a significant inflation indicator. The Dow Jones Industrial Average fell by over 300 points (0.72%), while the S&P 500 decreased by 0.13%. Conversely, the tech-heavy Nasdaq Composite gained 100 points, or 0.53%, largely due to Nvidia’s strong performance. Investors are closely monitoring the latest developments regarding U.S. tariffs, as June’s consumer price index (CPI) indicated the first signs of inflation linked to these tariffs, rising 2.7% year-over-year and 0.3% month-over-month.

Despite the recent tariff announcements, market reactions have been muted, with skepticism surrounding President Trump’s commitment to implementing these tariffs.

Key Crypto Legislation Faces Delays

Significant cryptocurrency legislation backed by President Trump has stalled in the U.S. House of Representatives after failing to pass a crucial procedural hurdle. Trump urged Republican lawmakers to expedite the voting process on the GENIUS Act, which aims to establish a regulatory framework for payment stablecoins as part of a broader initiative to pass crypto legislation before the August recess. He took to Truth Social to encourage Republicans to support the bill.

In response, Democratic lawmakers have sought to counter the “Crypto Week” narrative by launching their own initiative, dubbed Crypto Corruption Awareness Week. Representatives Maxine Waters, Stephen Lynch, and others are advocating for provisions that would prevent sitting Presidents from engaging in or profiting from cryptocurrency ventures.

Despite these challenges, Trump asserted that he has persuaded most Republican lawmakers who were initially opposed to the bill to support it when the House reconvenes.

“I am in the Oval Office with 11 of the 12 Congressmen/women necessary to pass the GENIUS Act, and, after a short discussion, they have all agreed to vote tomorrow morning in favor of the Rule.”

Republicans are keen to bundle the GENIUS Act with two other crypto bills set for a vote later this week: the Anti-CBDC Surveillance Act and the CLARITY Act. House Speaker Mike Johnson expressed gratitude for Trump’s involvement, stating,

“I’m thankful for President Trump getting involved tonight to ensure that we can pass the GENIUS Act tomorrow, and agreeing again to help us advance additional crypto legislation in the coming days.”

Ripple Aims for MiCA License in the EU

Ripple has announced its intention to apply for a MiCA license to broaden its cryptocurrency and stablecoin services within the European Union (EU). A company representative indicated that Ripple is committed to becoming MiCA-compliant, recognizing the substantial opportunities available in Europe. This announcement follows Ripple’s registration of Ripple Payments Europe SA in Luxembourg in late April. Reports suggest that Ripple has also applied for an electronic money institution license in Luxembourg, although the company has yet to confirm these details.

Kraken Introduces Regulated Crypto Derivatives Trading

Kraken has launched a new derivatives trading feature integrated with its Kraken Pro platform, allowing users to access cryptocurrency futures listed on the Chicago Mercantile Exchange. In a press release, Kraken stated,

“With this launch, Kraken clients in the U.S. can now trade futures alongside one of the world’s most liquid cryptocurrency spot markets. It’s a meaningful step in giving traders broad market access and increased capital efficiency within a regulated and high-performance environment.”

This feature enables Kraken Derivatives U.S. customers to benefit from instant funding and facilitates the seamless transfer of assets used as collateral. Additionally, Kraken plans to expand its offerings to include commodities, fixed income, foreign exchange, and equity futures.

“Kraken Derivatives U.S. further enriches our unified trading experience, where digital and traditional assets can be accessed side by side without compromising on features, performance, or liquidity.”

bitcoin (BTC) Price Trends and Analysis

bitcoin has shown a slight recovery during the current trading session after testing a significant support level earlier this week. The cryptocurrency ended the previous weekend positively, climbing nearly 2% to close at $118,624. Bullish sentiment surged on Monday as BTC soared past $123,000, reaching an all-time high of $123,091 before losing momentum and settling at $119,714. Selling pressure emerged on Tuesday as traders began to secure profits, causing the price to drop to an intraday low of $115,701 before closing at $117,682, marking a nearly 2% decline.

Despite this setback, analysts remain optimistic that BTC will not enter a downward trend soon, with on-chain data suggesting a continuation of its bullish momentum. Matt Mena, a crypto research strategist at 21Shares, noted,

“The structural imbalance between surging demand and a rapidly vanishing supply base makes a prolonged correction increasingly unlikely. There are far more positives than negatives right now.”

Mena highlighted that BTC supply on exchanges and over-the-counter (OTC) desks remains at an all-time low, while the asset’s price continues to rise.

“On the supply side, the fundamentals remain even more skewed.”

However, he cautioned that macroeconomic risks could threaten the upward trend, and a reversal cannot be entirely dismissed.

“It is certainly possible that bitcoin consolidates, or even sees a pullback. If Trump’s proposed tariffs end up being more severe than markets currently anticipate, or if Powell signals that rate cuts are further off than expected, we could see risk assets broadly reprice lower, including bitcoin.”

Mena anticipates that the upward trend will resume once summer liquidity returns.

“Once summer ends and liquidity returns, we expect upside momentum to resume. What’s truly remarkable is that bitcoin is setting new all-time highs during the most illiquid, seasonally weak part of the year.”

BTC crossed the $110,000 mark on Thursday (July 3) but lost momentum after reaching this level, falling 1.41% to $108,097 on Friday. The price recovered over the weekend, rising 0.19% on Saturday and nearly 1% on Sunday to settle at $109,231. Despite the positive weekend, BTC was back in the red on Monday, dropping almost 1% to $108,273. It recovered on Tuesday, rising 0.62% and settling at $108,942. Buyers regained control on Wednesday as the price rose over 2% to cross $111,000 and settle at $111,255. Bullish sentiment intensified on Thursday as BTC registered a 3.51% increase, moving to $115,160.

ethereum (ETH) Price Trends and Analysis

ethereum experienced a sharp decline on Tuesday as the cryptocurrency market dipped into bearish territory. However, the second-largest cryptocurrency rebounded, climbing from a low of $2,932 to reclaim the $3,000 level, closing Tuesday at $3,410, up over 4%. Currently, ETH is trading around $3,163, with buyers maintaining control. The rally has allowed ETH to outperform BTC as it approaches the $3,200 mark.

ETH has successfully crossed the resistance level around $3,100 and may test the next resistance at $3,220. A breakthrough above this level could propel ETH towards $3,500. Conversely, if buying momentum wanes, the price could drop back to $3,000, and a breach of this level could see ETH fall to $2,800.

ETH reached an intraday high of $2,636 on Thursday (July 3) but lost momentum on Friday, dropping over 3% to $2,509. The price recovered over the weekend, rising 0.35% on Saturday and over 2% on Sunday to settle at $2,572. Despite the positive weekend, ETH was back in the red on Monday, dropping 1.12% to $2,543. It rebounded on Tuesday, rising nearly 3% to cross $2,600 and settle at $2,616. Buyers maintained control on Wednesday as the price rose almost 6% and settled at $2,770. Bullish sentiment intensified on Thursday as ETH rose 6.51% to cross $2,900 and settle at $2,951.

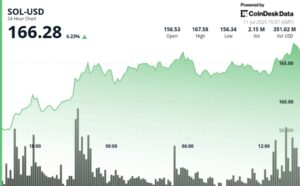

Solana (SOL) Price Trends and Analysis

Solana faced significant selling pressure on Tuesday, dropping to an intraday low of $157. However, it managed to recover, reclaiming the $160 mark and closing at $165, ultimately registering a 1.08% increase. Currently, SOL is trading around $165, with bulls eyeing the $200 level. Analysts believe a breakout towards $200 is feasible if the price surpasses the $170 resistance. However, if sellers regain control, SOL could revisit the $150 level and potentially drop further.

Solana experienced volatility and selling pressure on Thursday (July 3), ultimately registering a marginal decline. Selling pressure intensified on Friday as the price fell over 3%, slipping below $150 and settling at $147. SOL saw a slight decrease on Saturday before rising nearly 3% on Sunday to reclaim $150 and settle at $151. Despite the positive sentiment, SOL was back in the red on Monday, dropping 1.97% to $148. The price recovered on Tuesday, rising nearly 2% to reclaim $150 and settle at $151. Buyers regained control on Wednesday as SOL rose 3.54%, crossing the 50-day SMA and settling at $157.

Arbitrum (ARB) Price Trends and Analysis

Arbitrum began the previous weekend on a bearish note, dropping nearly 6% on Friday and settling at $0.324. However, it rebounded over the weekend, rising 1.20% on Saturday and almost 2% on Sunday to close at $0.334. The price fell back on Monday, dropping nearly 2% to settle at $0.329. Despite this, ARB returned to positive territory on Tuesday, rising almost 3% to settle at $0.338. Buyers maintained control on Wednesday as the price surged over 5%, crossing the 50-day SMA and closing at $0.355. Bullish sentiment intensified on Thursday as ARB rallied, rising over 11% to settle at $0.396.

Filecoin (FIL) Price Trends and Analysis

Filecoin experienced a sharp decline on Friday (July 4), starting the weekend in the red with a nearly 6% drop, settling at $2.25. Sellers maintained control on Saturday, causing FIL to drop 0.29%. However, it rebounded on Sunday, rising 1.38% to settle at $2.28. FIL faced a marginal decline on Monday but recovered on Tuesday, rising 1.59% to settle at $2.31. Bullish sentiment grew on Wednesday as the price rose 5.53%, moving to $2.43. Buyers continued to dominate on Thursday, with FIL rising over 6%, crossing the 50-day SMA and settling at $2.58.

Jupiter (JUP) Price Trends and Analysis

Jupiter started the previous weekend with a decline, falling over 5% on Friday (July 4) to settle at $0.434. It managed to recover on Saturday, registering a slight increase to $0.436. Buyers retained control on Sunday, as JUP rose over 2% to close at $0.445. Despite this positive momentum, JUP fell back on Monday, dropping 2.06% to settle at $0.436. Sellers maintained control on Tuesday, causing the price to decline nearly 1% to $0.432. JUP rebounded on Wednesday, rising over 5% to settle at $0.454. Bullish sentiment intensified on Thursday as the price rallied, rising nearly 7% to cross the 50-day SMA and settle at $0.485.

Disclaimer: This article is intended for informational purposes only and should not be construed as legal, tax, investment, financial, or other advice.