New Crypto Law: What It Means for Stablecoins and the Future of Finance

Major Crypto Legislation Passes, Boosting Bitcoin and Other Tokens to New Heights

Introduction to Recent Crypto Legislation

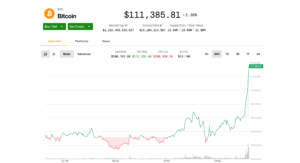

This week, following extensive political negotiations, three cryptocurrency bills backed by former President Donald Trump gained significant traction in Congress, culminating in one being enacted into law on Friday. The anticipation surrounding these legislative developments has led to a surge in the values of key cryptocurrencies—bitcoin, ether, and ripple—each reaching unprecedented levels. Bitcoin, in particular, has emerged as the top-performing asset globally this year, with a nearly 30% increase, surpassing both gold and the tech-heavy Nasdaq Composite index.

The GENIUS Act: A Game Changer for Stablecoins

The most impactful of the newly passed bills is the GENIUS Act, which facilitates the issuance of stablecoins by private companies. These stablecoins are designed to maintain a stable value, typically pegged to the U.S. dollar. Previously, many companies ventured into stablecoin issuance without clear legal guidelines, but the GENIUS Act introduces specific compliance requirements, including adherence to anti-money laundering regulations and the monitoring of suspicious activities.

Consumer advocates, however, have criticized these measures as insufficient. Corey Frayer, the director of Investor Protection for the Consumer Federation of America, emphasized the risks of consumers exchanging federally insured dollars for stablecoins lacking similar protections.

While many businesses are exploring stablecoins primarily for backend operations—such as reducing transaction fees or simplifying cross-border payments—mainstream financial institutions are also showing interest. Reports indicate that several major U.S. banks and the payment platform Zelle are in discussions to create a joint stablecoin.

Despite the potential benefits of stablecoins in streamlining operations and offering unique customer incentives, concerns persist. The Trump family’s involvement in stablecoin ventures, particularly through World Liberty Financial, raises questions about conflicts of interest. The company, which is majority-owned by the Trump Organization, has already secured significant investments, including a $2 billion backing from Abu Dhabi for its association with Binance.

Risks Associated with Stablecoins

The introduction of stablecoins under the GENIUS Act presents several risks. Firstly, the act allows stablecoin issuers to operate with minimal regulatory oversight, effectively positioning them as self-regulating entities. Frayer warns that this could lead to a repeat of the financial crises seen in the past, as the absence of stringent banking regulations could create instability.

Consumer Reports has echoed these concerns, stating that as stablecoins become more integrated into the financial system, they could expose consumers to greater risks, potentially leading to insolvencies and necessitating government bailouts.

In contrast, the Blockchain Association has praised the GENIUS Act for providing a framework that balances consumer protection with innovation, asserting that it enhances the U.S. dollar’s role in the digital economy.

The CLARITY Act: Defining Regulatory Boundaries

The second piece of legislation, the CLARITY Act, is currently under Senate review after passing the House. This bill aims to categorize various tokens to clarify which regulatory body—either the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC)—will oversee them. Many tokens are expected to fall under the CFTC’s jurisdiction.

However, critics argue that this could disproportionately benefit Trump’s business interests by allowing them to evade stringent securities regulations in favor of more lenient commodity rules. This would also exempt World Liberty from regulatory scrutiny regarding its digital token, WLFI.

Despite these concerns, the CLARITY Act has garnered bipartisan support, with advocates arguing that it could stimulate development and investment in the crypto space by providing clearer regulatory guidance.

The Anti-CBDC Surveillance State Act: Addressing Privacy Concerns

The third bill, the Anti-CBDC Surveillance State Act, has also passed the House and is awaiting Senate approval. This legislation responds to Republican fears regarding the potential introduction of a digital currency managed by the Federal Reserve and the privacy implications that could arise.

The bill seeks to prohibit the issuance of such digital tokens for monetary policy purposes, although Federal Reserve officials have indicated that they are not close to implementing a central bank digital currency (CBDC). Other nations and the European Union have already begun exploring CBDCs, citing benefits like faster transactions and improved access to financial tools.

The banking sector has expressed opposition to the creation of a CBDC, supporting the Anti-CBDC Surveillance State Act. The American Bankers Association has stated that a CBDC would disrupt the relationship between citizens and the Federal Reserve, complicating the credit extension process and potentially exacerbating economic crises.

Conclusion

As the crypto landscape evolves with the passage of these significant bills, the implications for consumers, businesses, and the financial system at large remain to be seen. While the potential for innovation and efficiency exists, the associated risks and regulatory challenges will require careful navigation to ensure a stable and secure financial future.