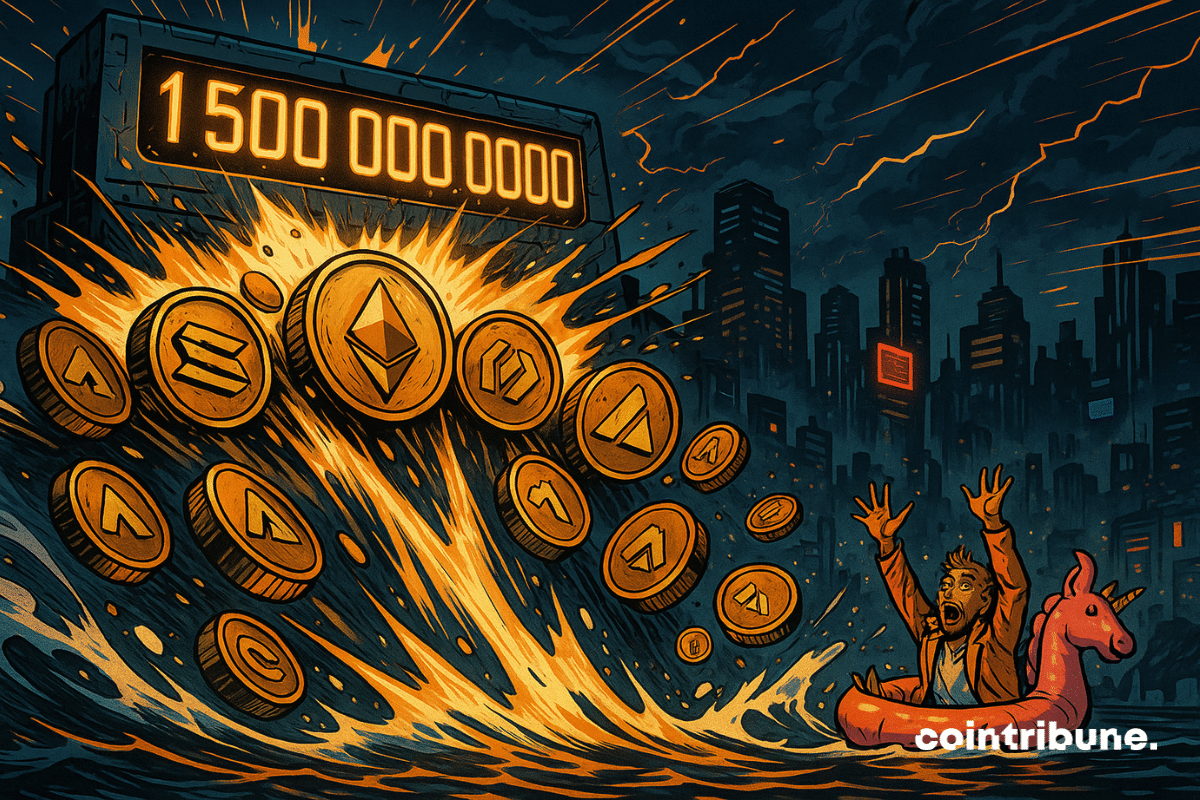

Altcoins Soar as Stablecoin Inflows Hit Record Highs: What to Know

altcoin Market Surges Past $1.5 Trillion: A Potential Shift in Crypto Dynamics

Overview of the altcoin Surge

The altcoin market has recently surpassed the significant milestone of $1.5 trillion in capitalization. While Bitcoin struggles to break through its resistance levels, a noticeable shift in investment flows towards alternative cryptocurrencies suggests the onset of an altseason. This transition often precedes periods of heightened speculation and is occurring alongside a major technical breakout, prompting analysts to closely monitor the situation.

Key Highlights

- The altcoin market has crossed the crucial $1.5 trillion capitalization mark, a significant technical milestone.

- This level has not been reached since January, indicating a potential large-scale altseason.

- Exchanges like Binance and HTX have reported over $1.7 billion in stablecoin inflows, signaling a return of liquidity.

- Some analysts predict that the total capitalization of altcoins could soar to $5 trillion in this cycle.

Technical Breakthrough for Altcoins

As of Friday, the total market capitalization of cryptocurrencies, excluding Bitcoin, hit $1.5 trillion, buoyed by positive signals from the Altseason Index. This marks the first time in five months that the TOTAL2 index has breached this critical threshold.

This level represents a long-term resistance point, previously tested in January. If TOTAL2 manages to close the month above $1.51 trillion, it would set a new record for the highest monthly close for the altcoin index. Such an outcome would bolster the theory of a significant technical shift favoring altcoins, potentially targeting the previous peak of $1.72 trillion.

Inflow Dynamics Indicate Renewed Interest

The recent surge is driven by a notable inflow of capital, particularly through stablecoins, indicating a shift in both institutional and retail investment strategies. Key data points include:

- A staggering $1.7 billion in stablecoins have been moved to exchanges this week, marking an unprecedented volume in recent months.

- Binance has seen net stablecoin inflows of $895 million, while HTX recorded $819 million.

- An additional $2 billion in stablecoins has been deposited on major derivatives platforms, predominantly in USDT.

- Meanwhile, Bitcoin deposits from large investors have decreased by $2.25 billion, easing selling pressure on Bitcoin and potentially freeing up capital for altcoins.

This reallocation of funds suggests a renewed appetite for riskier assets, supported by a favorable technical landscape and a market environment rich in accumulation signals.

Early Cycle Indicators: Consolidation and Growth Potential

While the focus remains on TOTAL2, another important metric is TOTAL3, which measures the total market capitalization excluding Bitcoin and Ethereum. Currently valued at around $1 trillion, it is still far from its previous highs, but many analysts believe we are on the cusp of a significant cycle.

Crypto analyst Mags notes that altcoin cycles typically unfold in multiple phases. “The most explosive gains occur in the final phase, characterized by a vertical surge often concentrated in just a few months,” he explains.

This pattern has been observed in past cycles and often catches late investors off guard.

The Altseason Index further supports this early cycle diagnosis. Over a 30-day period, the index has crossed the 75 mark, indicating the beginning of capital rotation towards altcoins. However, over a 60-day span, the index remains relatively low, suggesting that only a few altcoins have sustainably outperformed Bitcoin. This disparity indicates that the market has not yet fully realized its potential, with accumulation signs still present but the main wave of growth yet to be triggered.

Conclusion: Implications for Future Growth

Given the current context, several implications arise. If the trend continues, altcoins may enter a phase of exponential growth in the coming months, with significant performance concentrated over a brief period. However, this scenario demands careful execution and precise timing, as the market remains volatile, and periods of euphoria can lead to sharp corrections.

Disclaimer: The views and opinions expressed in this article are solely those of the author and should not be interpreted as investment advice. Always conduct your own research before making any investment decisions.