Cardano Bulls Shocked by 1,512% Liquidation Imbalance: What’s Next?

Cardano Faces Price Volatility as Bulls Suffer Major Losses

Cardano’s Recent Market Struggles

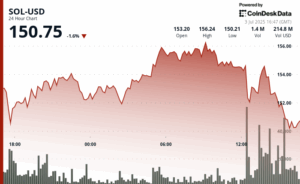

Cardano (ADA), currently ranked 10th among cryptocurrencies, is experiencing significant price fluctuations. This volatility has resulted in an astonishing liquidation imbalance of 1,512% for bullish traders who anticipated a rise in the asset’s value, potentially pushing it towards the $1 mark.

Major Losses for Cardano Bulls

Data from CoinGlass reveals that long-position traders incurred losses exceeding $13 million within the past 24 hours as the price dipped, reversing its upward trajectory toward the $1 target. This unexpected price movement caught many Cardano bulls off guard, leading to substantial financial setbacks.

As of the latest updates, Cardano’s trading price stood at $0.8208, reflecting a decline of 3.64% over the previous day. The asset had previously peaked at $0.8601 during the day but quickly fell to $0.8008 before recovering slightly.

Despite the downturn, the volatility has significantly impacted long-position traders, while short-position traders also faced losses, totaling approximately $764,060 during the same period. This brings the overall liquidation figure to around $13.08 million.

Technical Indicators Signal Overbought Conditions

A key technical indicator for Cardano suggests that the asset has entered an overbought territory, with its Relative Strength Index (RSI) reaching 78.01. This situation has prompted some investors to take profits, contributing to the recent price pullback.

Nevertheless, there remains a sense of optimism within the Cardano community, as the recent price drop has not resulted in a substantial loss of ground.

Potential for Recovery Through DeFi Wallet Integration

In the broader cryptocurrency landscape, Cardano’s recent integration with Blockchain.com’s DeFi Wallet could provide a boost to its price outlook. This strategic move allows ADA to be accessible to 37 million users on the platform, enabling seamless trading without the need for transferring the asset to an external wallet.

For Cardano to maintain its trajectory toward the $1 mark, trading volume—which has plummeted by 48.02% to $1.72 billion—must see an uptick. Both retail and institutional investors within the ecosystem will play a crucial role in driving volume higher for a potential price rebound.

Over the past week, Cardano has shown impressive resilience, achieving a price increase of 13.35%. With adequate support from its ecosystem, the asset may find its way back to an upward trend.