Unlocking Value: Innovative Crypto Treasury Strategies for Businesses

The Evolution of Corporate Crypto Treasury Strategies

The Rise of Crypto Treasury Management

An increasing number of businesses are now securing funds specifically to adopt crypto treasury management—investing in assets like Bitcoin and various cryptocurrencies. MicroStrategy was the first to implement this strategy on a large scale, setting a precedent that has inspired numerous companies globally.

- The Rise of Crypto Treasury Management

- MicroStrategy’s Strategic Investment in Bitcoin

- The Ripple Effect of MicroStrategy’s Success

- ethereum Gains Traction in Corporate Treasuries

- Notable ethereum Treasury Companies

- Diversifying Beyond Bitcoin: The Expanding Crypto Treasury Landscape

- The Challenges of Crypto Treasury Strategies

- Conclusion: The Future of Corporate Crypto Treasury Strategies

MicroStrategy’s Strategic Investment in Bitcoin

MicroStrategy initiated its Bitcoin purchases in August 2020. As of July 18, 2025, the company has amassed approximately 601,550 Bitcoins, valued at over $70 billion based on current market rates. The average purchase price was around $71,268 per Bitcoin, leading to a total investment of $42.87 billion.

With Bitcoin trading close to $120,000, MicroStrategy’s investment has appreciated by roughly 68%. The company’s stock has outperformed Bitcoin, rising 46% since January 2025, while Bitcoin has seen a 26% increase in the same timeframe. Since the inception of its Bitcoin strategy in 2020, MicroStrategy’s stock has skyrocketed by over 3,000%.

The Ripple Effect of MicroStrategy’s Success

MicroStrategy’s impressive performance has caught the attention of other firms. One notable follower is Japan’s Metaplanet, which claims that holding Bitcoin through its stock provides tax benefits under Japanese regulations. Since April 2024, Metaplanet has acquired over 16,000 Bitcoins, resulting in a stock price increase of more than 4,000%.

According to Benchmark Equity Research, “One of the strategic advantages… is the more favorable tax treatment of shareholders who seek exposure to Bitcoin through its stock versus the punitive tax treatment of those who own Bitcoin directly.”

However, not all companies have enjoyed similar success. GameStop entered the crypto market in May 2025 after board approval in March. Despite raising $2.25 billion, presumably for Bitcoin investments, its stock has experienced significant volatility. Companies that acted early and maintained focus have yielded the best returns.

ethereum Gains Traction in Corporate Treasuries

While Bitcoin has led the charge, ethereum is increasingly being recognized in corporate treasury strategies. In June 2025, SharpLink Gaming (SBET) secured $425 million in a deal facilitated by Consensys, appointing ethereum co-founder Joseph Lubin as chairman. The company announced plans to allocate nearly all of the funds to purchase Ether, ethereum‘s native cryptocurrency. Following this announcement, SBET shares surged from $3 to nearly $79, and by July 18, they were trading at $29—still representing a nearly 900% increase from pre-announcement levels.

Another example is BitMine Immersion Technologies, which saw crypto advocate Tom Lee join its board, while Peter Thiel acquired a 9.1% stake. BitMine disclosed that approximately 40-50% of its treasury is now held in Ether. The stock price jumped from $3 to $135, closing at $42.35 by July 18—a staggering 1,300% increase from before the announcement.

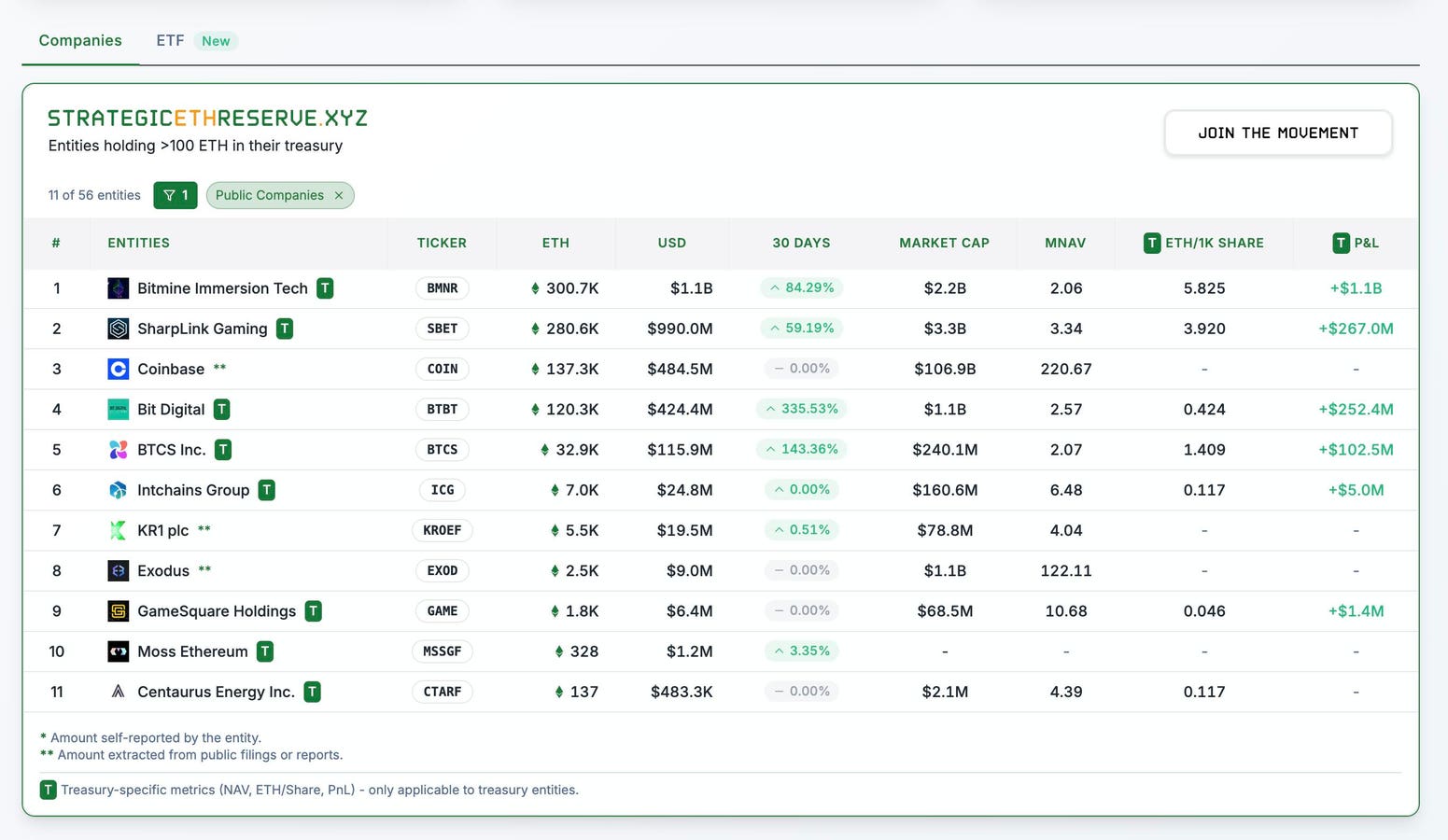

Notable ethereum Treasury Companies

A visual representation of companies adopting ethereum treasury strategies can be found in various resources.

Diversifying Beyond Bitcoin: The Expanding Crypto Treasury Landscape

The trend is not limited to Bitcoin and ethereum. SRM Entertainment, now known as Tron Inc., has fully committed to TRX. Other companies are exploring BNB, Hyperliquid, and even Litecoin as part of their reserve strategies.

In a dramatic turn of events, YHC Corporation became a media sensation when Robert Leshner, founder of Compound, announced plans to acquire it and transform it into a crypto treasury firm. However, he later withdrew due to legal disputes over control, causing significant fluctuations in the stock price and underscoring the speculative nature of this sector.

As more companies venture into the crypto space, skepticism is on the rise. An anonymous fund manager remarked, “We’re seeing companies with no real crypto ties suddenly pivot to these strategies just to pump their stock. It feels like a bubble.”

The Challenges of Crypto Treasury Strategies

Despite the potential for high returns, the risks associated with crypto treasury strategies are significant. Critics argue that many of these strategies rely on a precarious cycle: raising capital, purchasing crypto, boosting share prices, and then raising more funds.

Prominent short-seller Jim Chanos has been vocal in his criticism, cautioning that MicroStrategy’s stock is trading at a premium compared to the value of its Bitcoin holdings, and its complex financing structure adds layers of risk. He stated, “MicroStrategy’s model is simple: borrow cheap, buy Bitcoin, watch it rise, sell more stock at a premium, and repeat. But if Bitcoin falls or debt costs rise, the whole cycle could break.” He likens the current trend to the SPAC bubble of 2021, where hype led to the overvaluation of companies that ultimately collapsed.

Conclusion: The Future of Corporate Crypto Treasury Strategies

Crypto treasury strategies are reshaping how businesses manage their financial resources. While early adopters have reaped substantial rewards, the risks associated with volatility, debt, and market euphoria are becoming increasingly apparent. Whether this trend signifies a genuine financial transformation or merely another speculative bubble remains uncertain. However, it is clear that crypto treasury strategies are significantly altering the corporate financial landscape.