Discover 3 Surprising Crypto Tokens Set to Shock Traders in 2023!

altcoin Rally: Three Tokens Poised for Gains Amid XRP Surge

altcoin Season: Key Tokens to Watch

Altcoins are experiencing a surge following XRP’s recent all-time high, which peaked above $3.66 before settling at $3.42. This momentum has sparked interest in altcoins within the top 50 cryptocurrencies by market capitalization, with traders anticipating significant returns as we approach July 2025.

Among the altcoins to keep an eye on are Pi Network (PI), Hyperliquid (HYPE), and Official Trump (TRUMP). These tokens are positioned to potentially deliver surprising returns in the upcoming week.

Understanding altcoin Season Dynamics

The term “altcoin season” describes a phase where a majority—75%—of the top 50 cryptocurrencies outperform Bitcoin (BTC) for an extended period of over 90 days. The altcoin season index serves as a tool to gauge whether we are in such a season, guiding investors on whether to allocate funds, take profits from Bitcoin, or hold onto altcoins.

Currently, the index suggests that an altcoin season is on the horizon, with a monthly reading of 80 out of 100, indicating that July is shaping up to be an “altcoin month.”

altcoin season index” />

With XRP’s recent peak, altcoins in the top 50 are witnessing notable gains, reinforcing the idea that an altcoin season is developing.

Bitcoin Dominance Declines: Is altcoin Season Near?

Bitcoin dominance, which measures Bitcoin’s share of the total cryptocurrency market cap, has decreased by nearly 4% over the past three weeks. As of Friday, BTC dominance stands at 61.61%, down from 66% at the end of June.

This decline in Bitcoin’s dominance has led market participants to anticipate potential gains in altcoins. Factors such as capital rotation and profit-taking are driving this shift. With Bitcoin recently surpassing $123,000, many large holders and dormant wallets are beginning to sell for profits, which could create downward pressure on Bitcoin prices and open the door for altcoin growth.

Recent data shows a significant increase in exchange inflows, with large holders moving quickly to capitalize on market conditions. Miners have also contributed to this trend, offloading over 16,000 BTC in one day—one of the largest outflows seen in recent months. Meanwhile, altcoins are experiencing relatively low exchange inflows, suggesting traders are not rushing to sell, which points to a likely altcoin season in July 2025.

Price Analysis: Pi Network, Hyperliquid, and Official Trump

Currently, Pi Network is trading above $0.44. Analysts suggest that PI could see a potential increase of nearly 17%, targeting resistance at $0.5281. A daily close above this level could set the stage for further gains, with a target of $0.6667.

The positive momentum is supported by green histogram bars on the MACD indicator, indicating a bullish trend for Pi Network.

In the event of a market correction, PI may find support around $0.40.

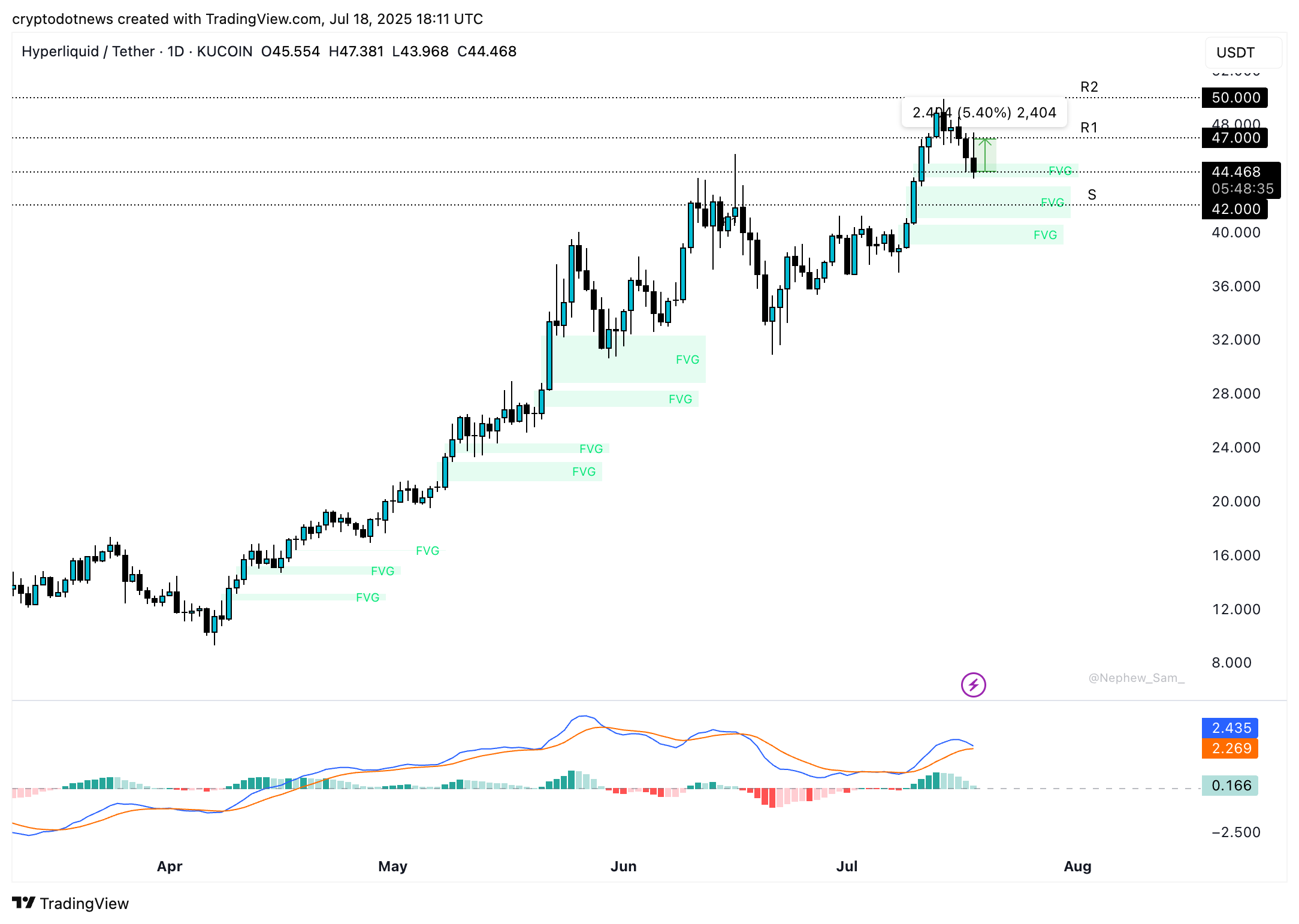

Hyperliquid is currently approaching its key resistance levels at $47 and $50. The token is expected to find support at around $42, and momentum indicators suggest it could rally approximately 6% to test the first resistance level in the coming week.

Official Trump is trading at $10.20, just 12% away from its resistance level at $11.45, which has proven to be a challenging barrier in recent weeks. A daily close above this level could see TRUMP target $12.25. Should the market experience a pullback, liquidity may be collected at the support level of $9.27.

Expert Insights on Market Dynamics

Werner Brönnimann, an Investment Manager at AMINA Bank, shared insights on the current market landscape:

“Bitcoin’s recent surge past $123,000 and its market cap exceeding $4 trillion signify a fundamental shift in market dynamics, largely driven by institutional investments rather than retail speculation seen in previous cycles. This growing institutional interest explains why Bitcoin continues to attract the majority of crypto inflows.

Despite Bitcoin’s impressive performance, we are not officially in an ‘altcoin Season’ yet, as the altcoin Season Index remains at 43 out of 100, indicating we are still in a Bitcoin-dominated phase. Similarly, the AMINA Crypto Asset Select Index (AMINAX) is currently 29% below its all-time high of 12,545.87 from November 10, 2021.”

Conclusion

As the cryptocurrency market evolves, the potential for altcoins to gain traction is becoming increasingly evident. With key tokens like Pi Network, Hyperliquid, and Official Trump on the radar, traders should remain vigilant as the market dynamics shift.

Disclaimer: This article is for informational purposes only and does not constitute investment advice.