Donald Trump’s New Crypto Venture: What You Need to Know Now

Trump’s GENIUS Act: A Game-Changer for Global Finance and Stablecoins

Introduction to the GENIUS Act

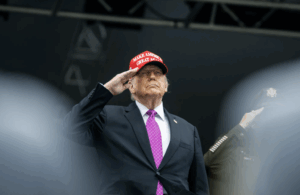

In the midst of recent controversies surrounding Epstein and other issues, Donald Trump has initiated a significant transformation in the global financial landscape. While the announcement of this new legislation may not have garnered extensive media attention, it holds substantial implications for the future of monetary systems.

- Introduction to the GENIUS Act

- The GENIUS Act Unveiled

- Implications for the Crypto Industry

- A Shift in Perspective on Cryptocurrencies

- Regulatory Changes and Industry Support

- Financial Gains from the Crypto Sector

- The Stability of Stablecoins

- The Rise of Stablecoin Transactions

- The Changing Landscape of US Government Debt

- The Future of US Treasury Demand

- The Challenges Ahead

- The Winners and Losers in the Crypto Sphere

- Conclusion: A New Era for Cryptocurrencies

The GENIUS Act Unveiled

The newly introduced “Guiding and Establishing National Innovation for US Stablecoins Act,” or GENIUS Act, has been met with mixed reactions. Trump humorously noted that the acronym was inspired by him, showcasing a rare moment of lightheartedness amidst serious discussions.

Implications for the Crypto Industry

This legislation is being hailed as a potential turning point for the cryptocurrency sector, aiming to enhance its credibility while also addressing Trump’s personal interests in the industry. The bill’s passage is expected to have profound effects on both the global financial system and the US economy.

A Shift in Perspective on Cryptocurrencies

Not long ago, Trump was vocal in his criticism of Bitcoin and other cryptocurrencies, labeling them as fraudulent. However, as the recent election approached, he adopted a more lenient stance on crypto regulations, signaling a shift in his administration’s approach to the industry.

Regulatory Changes and Industry Support

The new regulatory framework is anticipated to replace stricter regulators with those who adopt a more favorable view of cryptocurrencies. This change comes after significant financial scandals, including the downfall of FTX and its founder, Sam Bankman-Fried.

Financial Gains from the Crypto Sector

Following the election, Trump and his family ventured into the cryptocurrency market, launching their own meme coins and reportedly raising billions. This move has raised eyebrows regarding potential conflicts of interest, yet it could also redefine the dynamics of global finance.

The Stability of Stablecoins

Despite their name, stablecoins have faced challenges in maintaining their value. The collapse of UST, a stablecoin with inadequate backing, serves as a cautionary tale for investors. Nevertheless, stablecoins have proven to be useful for facilitating quick and cost-effective transactions.

The Rise of Stablecoin Transactions

Stablecoins, typically pegged to the US dollar, have seen a surge in transactions, surpassing $33 trillion in the past year. This growth is beginning to influence the market for US government debt, with stablecoins emerging as significant players in the Treasury market.

The Changing Landscape of US Government Debt

As stablecoins gain traction, they have become major buyers of US Treasuries, surpassing traditional sovereign holders. This shift occurs amidst growing concerns about the US dollar’s status as the global reserve currency, as confidence in the US economy wanes.

The Future of US Treasury Demand

US Treasury Secretary Scott Bessent is optimistic that stablecoins can help sustain demand for US government debt, especially as foreign entities withdraw from dollar-denominated assets. The hope is that stablecoins will mitigate rising borrowing costs.

The Challenges Ahead

While the potential for stablecoins to stabilize demand for US debt exists, experts caution that merely shifting domestic investments may not provide a long-term solution. The broader implications of stablecoin adoption could also strengthen the US dollar, complicating Trump’s trade policies.

The Winners and Losers in the Crypto Sphere

Despite the optimism surrounding blockchain technology, questions remain about the transparency and reliability of major stablecoins like Tether. Any instability in these assets could undermine the credibility of the entire cryptocurrency sector.

Conclusion: A New Era for Cryptocurrencies

The recent surge in interest in cryptocurrencies, particularly since Trump’s return to power, has been remarkable. While some investors have profited significantly, others have faced substantial losses, highlighting the volatile nature of the crypto market. As the landscape evolves, the implications of the GENIUS Act will be closely monitored by industry stakeholders and policymakers alike.