Are Bitcoin Whales Selling Off? Insights on BTC Market Movements

Major bitcoin Wallet Transfer Sparks Speculation: Are Whales Selling?

In a recent analysis from bitcoin Magazine Pro, lead analyst Matt Crosby highlights a concerning trend: the unexpected transfer of over 80,000 BTC from some of the oldest wallets on the bitcoin network. With indicators like Coin Days Destroyed and Whale Shadows signaling potential alarm, many are left wondering: are bitcoin whales offloading their assets?

However, the reality is more complex than the initial data might imply.

A Significant Transfer — But Not a Market Panic

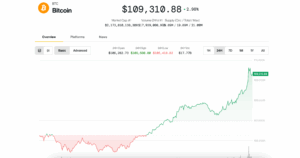

On July 4, a staggering 80,000 BTC, valued at nearly $10 billion, was moved on-chain from a wallet that had been inactive for more than 14 years. This unprecedented transaction raised red flags across various on-chain analytics platforms, causing key metrics such as Supply-Adjusted Coin Days Destroyed to surge.

Yet, a deeper investigation reveals a different narrative.

Crosby suggests that this substantial transfer likely originated from a single wallet, with Galaxy Digital, a recognized institutional OTC trading desk, as the probable recipient. This indicates that the coins are being gradually sold off rather than dumped onto the open market, which would have a more immediate and disruptive effect.

Understanding the Metrics

The initial spike in Supply-Adjusted Coin Days Destroyed (SACDD) above 1.0 has historically been associated with market peaks. However, when Crosby recalibrates the data to exclude this singular transaction, the SACDD reading falls to 0.77, significantly below levels that typically signal market tops.

This adjustment underscores an important lesson for analysts: anomalies can skew signals, and raw data must be contextualized for accurate interpretation.

Whale Activity Remains Low

Crucially, overall whale activity appears to be relatively quiet. While some metrics indicate an increase in total BTC movement, the number of active whales has not seen a significant rise. Historical trends suggest that market peaks are usually accompanied by a surge in whale transactions, not merely large transfers from one entity.

Crosby employs a 28-day smoothed average of whale transaction activity to filter out noise, revealing no sustained increase, which reinforces the idea that this event is an isolated incident rather than a broader trend.

Institutional Demand Countering Supply

On the other hand, institutional interest in bitcoin remains strong. Since the July 4 transfer, the following developments have occurred:

- ETF net inflows have surpassed 34,000 BTC.

- Strategy has acquired over 10,000 BTC.

- Short-term holder supply has increased by nearly 200,000 BTC.

These statistics indicate that both new and existing buyers are effectively absorbing any excess supply, presenting a bullish outlook that mitigates concerns about a potential sell-off.

Conclusion: One Whale Transaction Does Not Indicate a Market Downturn

While the initial data may have raised alarms, Matt Crosby’s thorough analysis offers a more nuanced perspective. A single, high-profile transaction—especially one conducted through OTC channels—should not be misconstrued as indicative of widespread market behavior.

Indeed, while a long-term holder may be cashing out after 14 years, this does not signify underlying market weakness. Instead, the ongoing accumulation by institutions and the growing demand from short-term holders suggest a robust and evolving market.

For bitcoin investors, this serves as a crucial reminder: context is essential, and not all whale movements should be interpreted as a cause for concern.