Bitcoin Hits All-Time High as US Lawmakers Push Pro-Crypto Legislation

bitcoin Surges to New Heights Amid Legislative Push in the U.S.

bitcoin Reaches New All-Time High

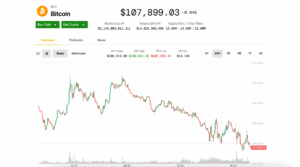

bitcoin has experienced a remarkable surge, reaching an unprecedented value of over $123,000 on Monday. This increase comes as U.S. lawmakers gear up for a week dedicated to advancing legislation that supports the cryptocurrency sector. Just a week prior, bitcoin was trading around $108,000, marking a significant rise in its market presence.

Legislative Developments in Congress

The excitement surrounding bitcoin coincides with the U.S. House of Representatives preparing to discuss various cryptocurrency-related bills during what has been termed “crypto week.” Lawmakers are under considerable pressure from influential figures, including President Donald Trump, and a robust crypto lobbying effort to expedite the passage of these regulations.

Among the proposed legislation is a bill that the Senate approved last month, aimed at regulating stablecoins, a specific type of cryptocurrency. Additionally, the House is set to consider broader legislation that will establish a comprehensive framework for the cryptocurrency market.

Trump’s Shift in Stance on Cryptocurrency

Former President Trump, who previously expressed skepticism about cryptocurrencies, has now committed to making the United States the leading hub for crypto during his anticipated second term. His family has actively engaged in various aspects of the industry, including mining operations, substantial bitcoin investments, and the introduction of a new stablecoin, along with a Trump-themed meme coin.

The Crypto Industry’s Growing Influence

The cryptocurrency sector has rapidly gained traction in Washington, particularly after feeling marginalized by the current administration. The industry has invested heavily in political campaigns and lobbying efforts, aiming to secure favorable regulations.

bitcoin‘s Resilience and Market Dynamics

Since experiencing a dip below $75,000 in April, bitcoin has shown a strong recovery. The popularity of spot bitcoin ETFs, which launched last year, has contributed to this resurgence. Several publicly traded companies have adopted strategies focused on acquiring bitcoin through debt and stock sales.

Originally created as a response to the 2008 financial crisis, bitcoin has navigated a tumultuous journey toward mainstream acceptance. Advocates often liken it to “digital gold,” asserting that it serves as a safeguard against governmental and central bank mismanagement. The total supply of bitcoin is capped at 21 million coins, adding to its scarcity.

Institutional Demand and Market Fundamentals

Adam Back, CEO of Blockstream, remarked, “The current price of bitcoin reflects the underlying demand that has been building up. This surge is driven by institutional interest aligning with bitcoin’s fundamental characteristics and its limited supply fulfilling its intended purpose.”