Bitcoin Hits All-Time High: Will Altcoin Season Rally Follow?

Bitcoin Holds Steady Above $105K Amid altcoin Weakness

Bitcoin’s Resilience and altcoin Struggles

Bitcoin (BTC) has shown remarkable stability this week, remaining firmly above the crucial support level of $105,000. In recent trading, BTC was priced around $105,700, experiencing a minor consolidation after reaching a peak of $107,800. However, this strength in Bitcoin’s price contrasts sharply with the broader altcoin market, where signs of exhaustion and profit-taking are becoming increasingly apparent. Many major altcoins are experiencing declines, indicating that traders are exercising caution as these assets approach significant resistance levels. This divergence between Bitcoin’s stability and the struggles of altcoins presents a complex yet opportunity-rich landscape for traders.

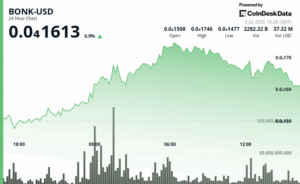

When analyzing specific trading pairs, the performance gap becomes even more pronounced. While Bitcoin remains robust, Ethereum (ETH) has dropped to approximately $2,419, reflecting a decline of over 3.6% in the past 24 hours. Other large-cap altcoins are facing even steeper losses: Solana (SOL) has decreased by more than 7% to $146.12, Cardano (ADA) has fallen by 7.2% to $0.5408, and XRP has seen a 5.3% drop to $2.17. Gregory Mall, Chief Investment Officer at Lionsoul Global, notes that this trend is not entirely surprising. Historically, Bitcoin dominance—which has surged to over 54% from a low of 38% in late 2022—tends to peak before capital begins to flow into altcoins. Previous cycles, such as those in 2017 and 2021, have shown that significant altcoin rallies often lag behind Bitcoin’s new all-time highs by two to six months, suggesting a potential rotation may be on the horizon, despite immediate risks.

Positive Macro Conditions Amid Short-Term Profit-Taking

Despite the recent pullback in altcoins, the broader macroeconomic environment remains favorable for risk assets. Augustine Fan, Head of Insights at SignalPlus, recently highlighted that mainstream sentiment has improved significantly, driven in part by corporate treasury strategies that echo MicroStrategy’s approach and growing enthusiasm around stablecoins. Additionally, institutional adoption continues to serve as a strong tailwind. Kevin Tam pointed out that over the past year, demand for Bitcoin ETFs has outpaced newly mined supply by a factor of three. He also noted substantial institutional accumulation in Canada, where Schedule 1 banks now hold over $137 million in Bitcoin ETFs, and the Trans-Canada Capital pension fund has invested $55 million in spot Bitcoin ETFs.

Jeffrey Ding, Chief Analyst at HashKey Group, emphasized that advancements in U.S.-China trade relations and softer inflation data are contributing to a more stable global economic outlook, which is advantageous for digital assets. However, this optimism is tempered by current market dynamics, as many tokens are testing local resistance levels, prompting traders to lock in profits. For example, the ETH/BTC trading pair has declined by 1.3% to 0.02303, indicating that even Ethereum is losing ground against Bitcoin in the short term. This suggests that while the long-term institutional and macro outlook remains bullish, short-term volatility and profit-taking may characterize the market in the coming days.

Is an altcoin Rotation on the Horizon?

For traders, the pressing question is whether the current dip in altcoins represents a buying opportunity or a cautionary signal. Historical trends indicate that a capital rotation from Bitcoin to altcoins is a common feature of a maturing bull market. As investors who initially entered through Bitcoin ETFs become more comfortable, they often seek to diversify their portfolios. Data from DeFiLlama shows that the total value locked (TVL) in DeFi protocols has rebounded significantly, surpassing $117 billion, marking a 31% increase from its lows in April. This resurgence in DeFi activity suggests that on-chain risk appetite is returning. Gregory Mall points out that innovation in Layer 1 ecosystems like Solana and Avalanche, along with a broader institutional interest in diversified crypto indexes, could catalyze the next upward movement for altcoins. Thus, the current consolidation and pullback may be seen as the market gearing up for the next phase of the cycle, where altcoins could finally begin to close the performance gap with Bitcoin.