Bitcoin Mining Profitability Soars 20% in May, Jefferies Reports

bitcoin Mining Profitability Surges Amid Price Rally

Significant Increase in Mining Profitability

In May, the profitability of bitcoin mining experienced an impressive rise of 18.2%. This surge was largely attributed to a notable 20% increase in bitcoin‘s market price, coupled with a slight 3.5% uptick in the overall network hashrate, according to a recent analysis by investment bank Jefferies.

Market Dynamics and Investor Behavior

Analysts Jonathan Petersen and Jan Aygul highlighted that the recent surge in bitcoin prices mirrors a similar trend in gold, as investors increasingly turn to assets that can protect against inflation. This shift comes in response to growing concerns over escalating fiscal deficits in the United States and other nations.

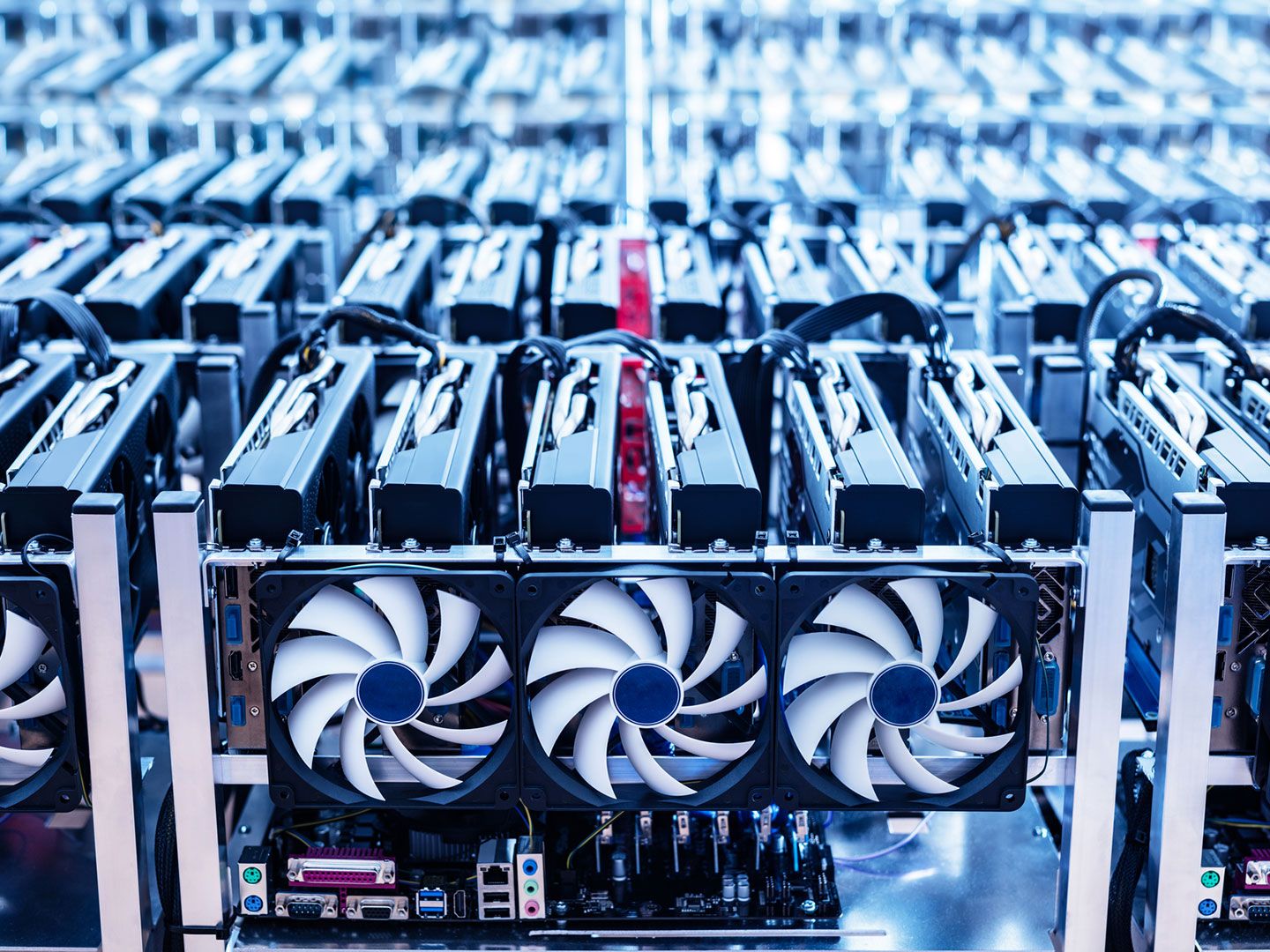

Understanding Hashrate and Its Implications

Hashrate, which represents the total computational power dedicated to mining and processing transactions on a proof-of-work blockchain, serves as an indicator of industry competition and mining difficulty. A higher hashrate typically suggests increased competition among miners.

Mining Output and Market Share

In May, U.S.-listed mining firms collectively produced 3,754 bitcoins, a rise from the 3,278 mined in April. Notably, North American miners accounted for 26.3% of the total network hashrate last month, up from 24.1% the previous month.

Leading Mining Companies

Among the mining companies, MARA Holdings (MARA) led the pack by extracting 950 bitcoins, marking a substantial 35% increase from the previous month. CleanSpark (CLSK) followed closely, mining 694 bitcoins during the same period.

Hashrate Rankings

MARA maintained the highest installed hashrate at 58.3 exahashes per second (EH/s), while CleanSpark secured the second position with a hashrate of 45.6 EH/s, as reported by Jefferies.

Stock Market Insights

In light of these developments, Jefferies has adjusted its price target for MARA, lowering it to $16 from a previous target of $18, while maintaining a hold rating on the stock.

Related Insights

For further reading, check out: bitcoin Miners Just Had One of Their Best Quarters on Record, JPMorgan Says.