Bitcoin Price Soars: Is BTC Heading Toward $110K Milestone?

bitcoin Surges Towards $110,000 Amid Positive Market Sentiment

bitcoin‘s Recent Price Movement

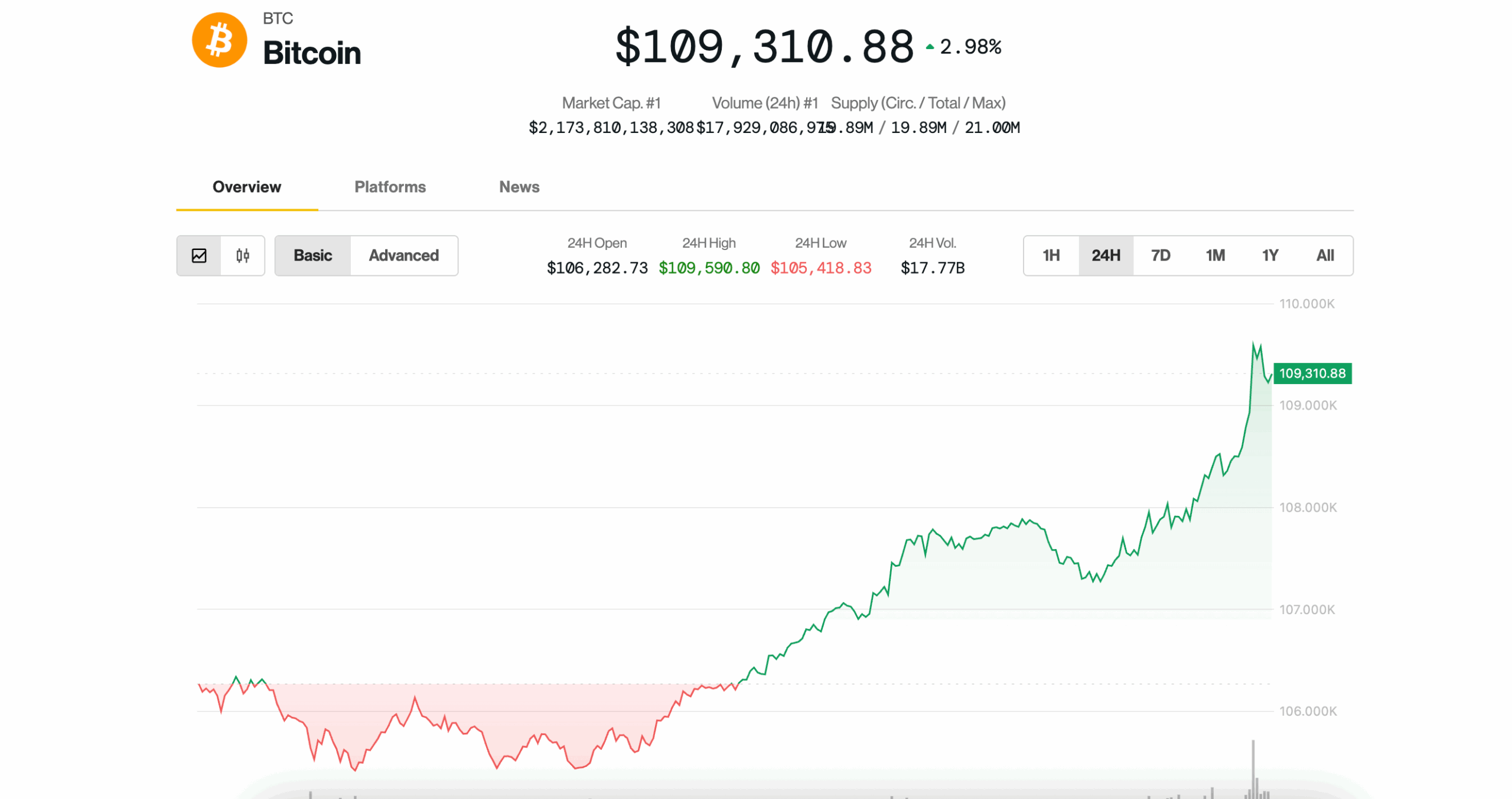

On Wednesday, bitcoin experienced a significant rebound, climbing towards the $110,000 mark. This surge comes after a brief dip below $106,000 the previous day, showcasing the cryptocurrency’s resilience. Currently, bitcoin is trading at approximately $109,500, marking a 3.5% increase in the last 24 hours, its highest level since June 11.

Market Influences and Economic Developments

The upward momentum in bitcoin‘s price can be attributed to various market factors, including a recent trade agreement announced by Donald Trump with Vietnam. This deal has positively impacted risk assets across the financial spectrum, with the Nasdaq index rising by 0.8% at midday.

Under the terms of the agreement, the U.S. will implement a 20% tariff on imports from Vietnam, alongside a 40% tariff on goods transshipped through the country. Conversely, U.S. exports will enter the Vietnamese market tariff-free, which is expected to enhance trade relations.

Crypto Market Sentiment Boosted by New ETF Launch

A notable development in the cryptocurrency sector is the introduction of the REX-Osprey Solana + Staking ETF (SSK), marking the first crypto staking product available in the United States. This launch has generated considerable interest, with trading volume reaching $20 million, a strong performance for a new product. Bloomberg analyst Eric Balchunas highlighted that this volume places SSK in the top 1% of new launches, especially when compared to the $1 million volume of the SOLZ futures-based ETF on its debut.

Anticipated Volatility in July

Looking ahead, July is poised to be a month of potential volatility for bitcoin, influenced by the policies of the Trump administration, according to Vetle Lunde, head of research at K33. Trump is expected to sign a controversial budget expansion bill, informally referred to as the “Big Beautiful Bill,” which could increase the U.S. deficit by $3.3 trillion. Lunde suggests that this could be bullish for scarce assets like bitcoin.

Additionally, the July 9 deadline for tariff negotiations may lead to more aggressive trade strategies from the Trump administration. Another critical date is July 22, when a long-awaited executive order on cryptocurrency is expected to be addressed, potentially impacting the U.S. Strategic bitcoin Reserve.

Lunde notes that while July may bring volatility linked to Trump’s policies, the current crypto market remains relatively stable without excessive speculation. He emphasizes that the contained leverage in the crypto space suggests a favorable environment for maintaining spot exposure and exercising patience as the market navigates this historically quieter period.