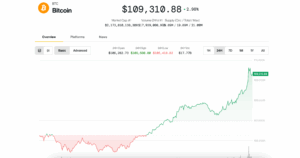

Bitcoin Rally: 3 Key Factors That Could Push Prices Above $110K

bitcoin‘s Path to $110,000: Analyzing Market Dynamics and Economic Influences

bitcoin‘s Recent Price Stability

bitcoin (BTC) has experienced minimal price movement over the past week, remaining within a narrow range for six consecutive days, with fluctuations staying below 3%. This period of low volatility has led traders to speculate about a potential breakout, especially in light of a weakening US dollar amid ongoing fiscal challenges in the country.

The Role of the US Dollar in bitcoin‘s Future

While the US dollar’s performance is under scrutiny, several other factors must align for bitcoin to reach the $110,000 mark. Historical trends indicate that bitcoin‘s price movements do not always inversely correlate with the strength of the US dollar. For instance, from August 2024 to April 2025, bitcoin demonstrated resilience even as the US Dollar Index (DXY) rose from 100 to 110, only to weaken when the dollar retraced to 104. This suggests that attributing bitcoin‘s potential growth solely to a declining dollar may not be entirely justified.

Economic Context and Market Sentiment

The US economy plays a significant role on the global stage, contributing 26% of the world’s output. Notably, 46% of revenues for companies in the Nasdaq 100 come from international markets. A weaker DXY can enhance the value of foreign earnings when converted back to US dollars, benefiting these firms.

Will Inflation and Market Dynamics Propel bitcoin?

Investors often view bitcoin as a risk-on asset rather than a completely independent financial alternative. With the Nasdaq 100 reaching new heights on June 30, there is a growing sense of investor confidence, prompting some to shift their investments from fixed income to riskier assets, including bitcoin.

Inflationary Pressures and Their Impact on bitcoin

Another factor that could drive bitcoin‘s price above $110,000 is the resurgence of inflationary pressures. The US Personal Consumption Expenditures Price Index (PCE) remained below 2.3% from March to May, following a period of inflation exceeding the Federal Reserve’s target. The 10% import tariffs introduced in April are gradually being reflected in consumer prices as supply chains adapt. Experts suggest that June marks the beginning of a widespread price increase as sellers adjust to higher costs.

bitcoin has long been touted as a hedge against inflation, particularly during the 2021 bull market. Often referred to as digital gold, bitcoin‘s impressive 114% gain in 2024 indicates that significant price increases can occur even in a low-inflation environment.

Potential Catalysts for bitcoin‘s Growth

While not directly linked to bitcoin, the possible inclusion of Strategy (MSTR) in the S&P 500 index is seen by some as a potential catalyst for price growth. Analysts believe that if this occurs, a wave of passive investment capital could flow into bitcoin.

In conclusion, bitcoin‘s journey toward surpassing $110,000 may be influenced by a combination of factors: an increased appetite for risk following record equity highs, renewed inflation concerns, and the potential inclusion of Strategy in the S&P 500. These elements could converge to create a favorable environment for bitcoin‘s price momentum.

This article is intended for informational purposes only and should not be construed as legal or investment advice. The opinions expressed herein are solely those of the author and do not necessarily reflect the views of Cointelegraph.