Bitcoin Traders Eye $100,000 Accumulation Range: What You Need to Know

bitcoin Shows Signs of Long-Term Confidence Amidst Market Pressure

Key Insights on bitcoin‘s Current Market Dynamics

- bitcoin‘s monthly outflow/inflow ratio has decreased to 0.9, indicating a resurgence of long-term confidence and accumulation among investors.

- Despite facing significant short-selling pressure on Binance derivatives, bitcoin has maintained a stable price range between $100,000 and $110,000.

- A notable transfer of over 19,400 BTC into institutional wallets suggests strategic positioning by long-term holders.

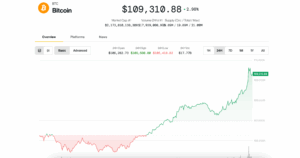

Since surpassing the $100,000 mark on May 8, bitcoin (BTC) has consistently closed above this psychological threshold. Although it dipped to $98,300 on June 22, the cryptocurrency remains close to its recent highs, exceeding $111,800.

Market Resilience and Accumulation Trends

While a decline to $100,000 represents only a 9% correction, some analysts believe that the price range between $100,000 and $110,000 could establish a new support level before bitcoin embarks on another upward trajectory in the latter half of 2025.

Data from CryptoQuant reveals a significant shift in market sentiment, with on-chain metrics indicating a strong outflow dominance over inflows. The current monthly outflow/inflow ratio of 0.9 has not been seen since the conclusion of the bear market in 2022, historically signaling robust demand.

This ratio, which gauges the balance of coins moving in and out of exchanges, serves as a sentiment indicator. A reading below one typically suggests that investors are withdrawing assets from exchanges, reflecting accumulation behavior. Conversely, values above 1.05 often correlate with increased selling pressure and local market peaks.

Interestingly, this recent drop mirrors levels observed in December 2022, which marked bitcoin‘s macro bottom around $15,500. This inflection point preceded a sustained rally, reinforcing the idea that a low ratio can often foreshadow a price reversal.

The current trend of outflows, coupled with increased participation from long-term holders, suggests that a structural bottom may be forming. If historical patterns hold true, bitcoin could be nearing a pivotal demand-driven shift, potentially signaling the onset of its next bullish phase.

bitcoin‘s Ability to Withstand Short-Selling Pressure

Despite ongoing aggressive selling pressure on Binance derivatives over the past 45 days, bitcoin has remained resilient within the $100,000 to $110,000 range. Cumulative Volume Delta (CVD) data indicates a negative trend, reflecting consistent short-selling activity. However, the price’s inability to drop further suggests that this selling pressure is being absorbed, indicating accumulation.

This structural strength may be further supported by on-chain activities highlighting institutional movements. Analyst Maartunn noted that over 19,400 BTC, valued at approximately $2.11 billion, was transferred from dormant wallets to institutional-grade addresses. These coins had remained untouched for three to seven years, emphasizing the significance of this transfer.

Such transactions are typically strategic rather than impulsive, indicating that large entities may be positioning themselves as prices stabilize amid visible short-term pressures.

The combination of persistent selling, muted price reactions, and substantial accumulation reinforces the notion that bitcoin is establishing a bottom near the $100,000 mark. While short-term volatility may continue, the underlying demand, likely from institutional investors, could make a significant drop below this level increasingly improbable.

Conclusion

This article does not constitute investment advice or recommendations. All investment and trading activities carry risks, and readers are encouraged to conduct their own research before making any financial decisions.