Bitcoin Treasury Firms at Risk of ‘Death Spiral’ by 2025: Key Insights

Breed Venture Firm Warns BTC Treasury Companies of Potential Collapse

Concerns Over bitcoin Balance Sheets

Venture capital firm Breed has issued a stark warning to businesses holding bitcoin as part of their financial strategy. In a recent analysis, they suggest that many companies with bitcoin on their balance sheets may not withstand future market downturns unless they maintain a trading price significantly above their net asset value (NAV).

The Chain Reaction of Falling bitcoin Prices

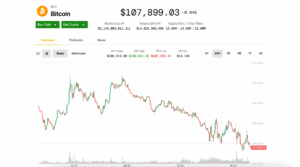

Breed’s concerns stem from a straightforward chain reaction. Currently, bitcoin is priced at just over $107,000. If it experiences a significant decline, the premium of a firm’s market-to-NAV (MNAV) diminishes. This situation leads investors to perceive limited potential for growth in shares tied to a depreciating asset, resulting in a rapid decline in new investments, whether through equity or convertible debt.

The Importance of Capital for Sustainability

For these businesses, capital acts as a lifeline. Many have taken on debt or raised funds specifically to acquire more bitcoin, banking on the assumption that the cryptocurrency would appreciate faster than their borrowing costs. If this capital runs dry as loans come due, lenders may enforce margin calls, prompting forced asset sales.

The Risk of a “Death Spiral”

Each forced sale can further depress bitcoin prices, creating a ripple effect that impacts other companies engaged in similar practices. Breed characterizes this scenario as a “death spiral.” Presently, many firms rely on equity funding, which provides a buffer against margin calls. However, Breed cautions that if low-cost debt becomes appealing, companies may increase their leverage, making the sector more vulnerable. A sudden price drop could trigger widespread liquidations across multiple firms.

Identifying Potential Survivors

According to Breed, only a select few companies are likely to navigate these turbulent waters successfully. The firms that endure will be those that can maintain or increase bitcoin value per share, even in stagnant markets, communicate effectively with stakeholders, and avoid excessive leverage. Strong governance and a financial cushion will be more critical than the total amount of bitcoin held.

The Broader Impact of bitcoin Treasury Strategies

The stakes are considerable. Since MicroStrategy pioneered the corporate treasury strategy in 2020, over 250 organizations—including ETFs, publicly traded miners, pension funds, and even sovereign nations—have adopted similar approaches, as reported by BitcoinTreasuries.net. If the anticipated market correction occurs in 2025, the key metric will not be how many Bitcoins a company has previously acquired, but rather how many it can retain in the aftermath.

Conclusion

As the landscape of bitcoin treasury management evolves, Breed’s insights serve as a crucial reminder of the inherent risks involved. Companies must prioritize sustainable practices and sound financial strategies to weather potential market storms.