BTC Digital Invests $1M in Ethereum, Dubbed ‘New Digital Gold’

BTC Digital Shifts Focus to ethereum, Investing $1 Million in Strategic Move

BTC Digital’s New Investment Strategy

BTC Digital, a Bitcoin mining company listed on NASDAQ under the ticker BTCT, has made a significant strategic decision by allocating $1 million of its treasury to ethereum (ETH). This shift marks a departure from its traditional Bitcoin-centric approach, as CEO Siguang Peng describes ethereum as the emerging “digital gold.” He highlights ethereum‘s pivotal role in facilitating on-chain USD settlements and value transfers.

Plans for Future Expansion in ethereum

The firm intends to gradually increase its ethereum holdings, aiming to capitalize on the burgeoning sectors of decentralized finance (DeFi), stablecoin creation, and asset tokenization. Peng noted that this initial investment in ETH is part of a forward-thinking strategy to adapt to ethereum‘s expanding functionalities and the changing regulatory landscape in the United States.

Transitioning Business Model

BTC Digital is undergoing a transformation from its previous focus on large-scale Bitcoin mining operations, including a notable 20-megawatt project in Georgia. The company is shifting its identity from a conventional “hash-rate provider” to a participant in the evolving landscape of on-chain financial infrastructure.

Industry Trends and Comparisons

This strategic pivot aligns with a broader trend in the industry, as seen with Bit Digital (NASDAQ: BTBT), which recently transitioned its entire Bitcoin treasury to ethereum to adopt a staking-focused model. Following this announcement, BTBT experienced a 30% surge in its stock price, although it later faced a nearly 20% correction.

Market Reaction and Institutional Interest

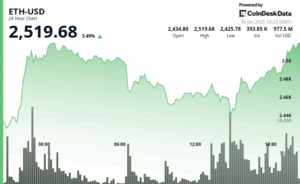

BTC Digital’s announcement regarding its ethereum investment led to a 13% increase in its stock by the end of Friday’s trading session. Current data indicates that public ethereum treasuries, including those managed by decentralized autonomous organizations (DAOs), Layer-2 networks, and publicly traded companies, collectively hold over 1.34 million ETH.

This trend underscores a growing institutional interest in ethereum as a foundational element for Web3, DeFi, and tokenized assets, further solidifying ETH’s reputation as a valuable treasury asset for innovative crypto enterprises.