Celestia Co-Founder Proposes Ending Staking as TIA Token Plummets 93%

Celestia’s Co-Founder Proposes Revolutionary Consensus Shift from Proof of Stake

A Bold Proposal for Change

Leaders in the Celestia ecosystem are advocating for a significant transformation of the modular blockchain. Recently, John Alder, a co-founder of the network, suggested abandoning the existing Proof of Stake (PoS) consensus model in favor of an innovative approach termed Proof of Governance.

- A Bold Proposal for Change

- Addressing Inflation Concerns

- The Need for Change

- Understanding Proof of Governance

- Prioritizing Revenue Generation

- Criticism of Current Staking Model

- Concerns Over Venture Capital Influence

- The Case for a Fairer System

- Simplifying Network Operations

- Broader Implications for Blockchain Economics

- Projected Changes Under Proof of Governance

- Balancing Security and Innovation

- Community Response and Future Discussions

Addressing Inflation Concerns

This proposed change aims to drastically reduce the issuance of Celestia’s TIA token by a factor of 20, while preserving the blockchain’s security framework and eliminating the complexities associated with liquid staking tokens. Alder shared these insights in a post on the Celestia governance forum.

The Need for Change

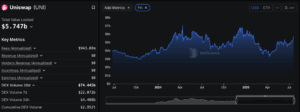

This proposal comes at a critical time, as demand for Celestia’s data availability services has not met initial expectations. The value of the TIA token has plummeted by 93% from its peak, prompting early investors to withdraw their investments.

Understanding Proof of Governance

Under the Proof of Governance model, token holders would have the ability to directly elect the operators managing the blockchain without the need to lock up their tokens for staking rewards. Advocates of this model argue that it streamlines the process, enhances cost efficiency, and maintains the same level of security as the PoS system.

Prioritizing Revenue Generation

Alder believes that implementing this new consensus mechanism will enable Celestia to focus more effectively on generating revenue from its data availability services, ultimately benefiting TIA token holders.

Criticism of Current Staking Model

Celestia has faced criticism regarding its PoS model, with detractors claiming that the inflation of the TIA token due to high staking rewards is detrimental to the network’s health. Currently, the network distributes TIA tokens equivalent to nearly 8% of the total circulating supply annually, amounting to approximately $127 million in rewards at current market prices.

Concerns Over Venture Capital Influence

Critics have also pointed out that allowing venture capital firms, such as Polychain Capital, to stake their vested tokens enables them to sell rewards while their primary investments remain locked. Alder contends that staking may be an unnecessary hurdle in selecting network operators.

The Case for a Fairer System

He argues that the existing staking system penalizes those who choose not to stake their tokens, diminishing their share of the network over time. By eliminating staking, Alder posits that it creates a more equitable environment for all participants.

Simplifying Network Operations

With the removal of staking and its associated rewards, the network would only need to compensate the operators responsible for maintaining its infrastructure. The need for slashing—penalizing operators for misconduct—would also be unnecessary, as the potential for token holders to vote out underperforming operators would suffice to ensure proper transaction processing.

Broader Implications for Blockchain Economics

Celestia is not alone in grappling with the challenges posed by excessive token distribution to stakers. Earlier this year, Ethereum Foundation researcher Justin Drake suggested capping staking rewards to address perceived flaws in its tokenomics. Celestia has also approved a proposal to reduce its staking rewards from 8% to 5%, although this adjustment has yet to be implemented.

Projected Changes Under Proof of Governance

If Alder’s Proof of Governance model is adopted, the annual issuance of new tokens could drop significantly to just 0.25%, reducing the total rewards from $127 million to approximately $4 million. This new framework will require substantial restructuring, as Proof of Governance will operate offchain due to the limitations of the Celestia blockchain in supporting governance voting.

Balancing Security and Innovation

While some purists may resist the idea of offchain governance lacking onchain codification, Alder argues that this approach can be just as secure as traditional onchain systems. He emphasizes that Celestia already has offchain governance mechanisms in place.

Community Response and Future Discussions

So far, the feedback regarding the Proof of Governance proposal has been largely positive, and discussions surrounding the idea are ongoing.

Tim Craig is a correspondent for DL News, covering DeFi from Edinburgh. For tips, reach out at [email protected].