Ether RSI Buy Signal Predicts $7K-$10K Price Surge for ETH

Ether Price Surges to Six-Month High Amid Record ETF Inflows and Increased Network Activity

Ether’s Remarkable Price Rally

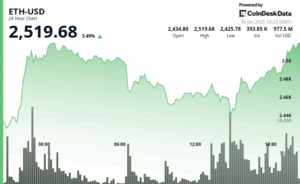

Ether (ETH) has experienced a significant price surge, reaching approximately $3,500—its highest point since early January. This upward momentum is largely attributed to heightened network engagement and substantial inflows into spot ethereum exchange-traded funds (ETFs).

Unprecedented ETF Inflows Propel ETH Prices

In the past 24 hours, Ether’s value has increased by over 10%, marking a 25% rise over the past week, with a peak of $3,481 recorded on Binance. The surge is fueled by strong institutional interest, highlighted by a record $727 million in ETF inflows on Wednesday alone.

Crypto analyst Blazey Crypto emphasized the significance of this movement, stating that the influx of over $726 million into ETH ETFs, with a substantial portion from BlackRock, indicates serious institutional investment rather than mere retail speculation.

Mikybull Crypto noted that these inflows represent the largest since the launch of spot ethereum ETFs on July 23, 2024. Over the last five days, these ETFs have attracted more than $1.76 billion, now holding around 4% of the total ETH supply.

Rising Network Activity and Total Value Locked (TVL)

The surge in Ether’s price is mirrored by a notable increase in on-chain activity. ethereum‘s active address count has risen by 9.4% over the past month, reaching 1.49 million, with a 2% increase in the last 24 hours. Daily active addresses have also seen a 6.7% uptick, totaling 463,880.

Additionally, ethereum‘s weekly network fees have surged by 139%, reaching $14 million, with daily fees up over 475% since early July, now standing at $3.11 million. This rise in fees indicates growing demand for ETH and highlights the necessity for layer-2 solutions and decentralized applications (DApps). Consequently, ethereum‘s total value locked (TVL) has soared to a three-year high of $78.2 billion, up from $57.2 billion just three weeks ago.

Technical Indicators Suggest Potential for Further Gains

A recent analysis of Ether’s three-week chart reveals that the relative strength index (RSI) signaled a “buy” opportunity back in April when it hit 40. Historically, this level has preceded significant price rallies for ETH.

Previous instances of the RSI reaching this threshold have led to remarkable price increases, with gains of 1,360% in 2021 and 350% in the 2023-2024 period. Analyst Mikybull Crypto highlighted the importance of this signal, suggesting that Ether could potentially reach between $7,000 and $10,000 as the RSI approaches its upper limits.

Other market analysts share a bullish outlook, suggesting that ETH could exceed $10,000 this year, driven by technical chart patterns, a bullish breakout in the ETH/BTC pair, and increasing institutional demand through ETFs and treasury companies.

This article serves as an informative overview and does not constitute investment advice. Readers are encouraged to conduct their own research before making any financial decisions.