Ethereum ETFs Celebrate First Birthday: A Year of Growth and Innovation

ethereum ETFs Celebrate First Anniversary with Significant Growth

A Year of Progress for ethereum ETFs

July 23 marks the one-year anniversary of the SEC’s approval of ethereum exchange-traded funds (ETFs), which have now amassed $15.7 billion in assets under management. Initially, these funds faced a slow start, but recent developments, including the passage of the GENIUS Act, have accelerated their growth.

Comparing ethereum and Bitcoin ETF Launches

Nic Roberts-Huntley, the CEO and cofounder of Blueprint Finance, shared insights with Sherwood News, noting that ethereum ETFs have experienced a more gradual introduction compared to the rapid success of Bitcoin ETFs that launched in January 2024. This difference reflects the intricate nature of ethereum‘s value rather than any inherent weaknesses.

In their debut week, ethereum ETFs experienced significant outflows, totaling hundreds of millions of dollars. In stark contrast, Bitcoin ETFs attracted over $1 billion in inflows shortly after their launch, according to data from Farside Investors.

Institutional Adoption Trends

Roberts-Huntley explained that the trend of institutional adoption makes sense; firms typically start their digital asset journey with Bitcoin before exploring ethereum as they become more familiar with the underlying infrastructure.

In the week leading up to their anniversary, ethereum ETFs saw unprecedented inflows, with $726.6 million on July 16, followed by $600 million on July 17, culminating in a record total of $2.12 billion for the week—almost double the previous high of $1.2 billion.

Future Growth Potential

Juan Leon, a senior investment strategist at Bitwise, indicated that ethereum stands to gain significantly from clearer regulations surrounding stablecoins and the increasing trend of tokenization. The stablecoin market currently boasts a total market cap of $262 billion, with ethereum-based stablecoins representing a substantial $130 billion of that figure, according to DefiLlama.

Leon expressed optimism about institutional interest in ethereum, predicting that demand could lead to net inflows of $10 billion in the latter half of 2025.

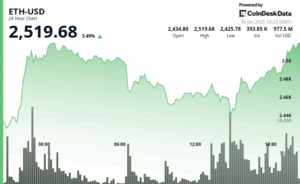

ethereum‘s Market Position

As the second-largest cryptocurrency, ethereum has recently seen a surge, with its market cap reaching $450 billion and a 22% increase over the past week.

David LaValle, Grayscale’s global head of ETFs, noted that as ethereum ETFs mark their first year, key performance indicators such as client engagement, trading volumes, and fund flows are on the rise. This suggests that investors are beginning to look beyond Bitcoin when considering cryptocurrency allocations.

Leading ethereum ETFs

The most prominent ethereum ETF is the iShares ethereum Trust ETF, which currently holds $9.6 billion in assets. Following BlackRock, the top five funds include:

- Grayscale ethereum Trust ETF: $3.4 billion in assets

- Fidelity ethereum Fund: $1.3 billion in assets

- Grayscale ethereum Mini Trust ETF: $1.3 billion in assets

- Bitwise ethereum ETF: $496 million in assets

Looking to the Future

One potential catalyst for further growth in ethereum ETFs is the SEC’s decision on allowing staking within these funds. Staking involves locking up cryptocurrency to earn rewards for securing the blockchain.

Currently, staking is not permitted in U.S. spot ethereum ETFs, which means investors may miss out on potential revenue. However, this could change soon, as Nasdaq, on behalf of BlackRock, has filed an amended application with the SEC to incorporate staking into the iShares ethereum Trust.

Jason Linehan, VP of strategy at SharpLink Gaming, which has become the largest corporate holder of ethereum with 360,800 tokens, emphasized that ethereum ETFs still have room for improvement to fully realize ethereum‘s investment potential.

Linehan expressed hope that regulators will soon approve staked ETH ETFs, allowing more investors to benefit from ethereum‘s native staking yields. This would also enhance the security and economic viability of the ethereum platform, making it more appealing for stablecoin and tokenized real-world asset issuers.

Roberts-Huntley echoed this sentiment, stating that ETFs enabled for staking would unlock ethereum‘s true potential, positioning current offerings as just the beginning. He added that once institutions can access both price appreciation and network rewards through a regulated framework, it will transform the institutional dialogue surrounding productive digital assets.