Ethereum Surges Toward $3,000 as ETF Demand and Regulations Align

ethereum Poised for $3,000 Breakthrough Amid Rising ETF Interest

Overview of ethereum‘s Market Position

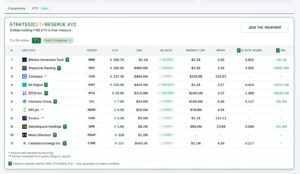

ethereum is on the verge of testing the significant $3,000 price point, buoyed by a surge in interest surrounding exchange-traded funds (ETFs) and a more favorable regulatory landscape. This growing enthusiasm among investors signals a potential shift in market dynamics.

- Overview of ethereum‘s Market Position

- Key Factors Driving ethereum‘s Momentum

- Increased Institutional Interest

- Evolving Regulatory Framework

- Positive On-Chain Metrics

- Retail Investment Trends

- Potential Challenges Ahead

- Strategic Insights for Investors

- Conclusion: A Critical Moment for ethereum

- About the Author

Key Factors Driving ethereum‘s Momentum

Increased Institutional Interest

Recent weeks have seen a notable uptick in institutional investment in ethereum, particularly through spot ETF activities in the United States. This influx of capital reflects a burgeoning appetite among institutional investors for ethereum, reminiscent of the early days of Bitcoin ETF adoption.

Evolving Regulatory Framework

Simultaneously, a clearer regulatory framework is emerging in key markets, which is helping to alleviate investor concerns. Authorities are beginning to establish more defined guidelines for crypto assets, including ETFs, which is fostering a more secure environment for institutional participation.

Positive On-Chain Metrics

On-chain data further supports this optimistic outlook. Trading volumes across various exchanges have risen, and liquidity indicators suggest that resistance levels may be weakening as ethereum approaches multi-month highs. Analysts are closely monitoring the $3,000 mark, as a successful breakout could attract additional speculative interest.

Retail Investment Trends

Retail investors are also becoming more active, with recent data indicating an increase in new ethereum deposits across multiple platforms. This trend suggests that both seasoned investors and newcomers are positioning themselves for potential gains.

Potential Challenges Ahead

Despite the positive momentum, the journey to $3,000 may not be without hurdles. A significant rejection at this price point could trigger profit-taking and market consolidation. Investors should remain vigilant for sustained support levels, as any pullback to around $2,800 could test market confidence and temporarily stall upward momentum.

Strategic Insights for Investors

From a strategic perspective, ethereum‘s increasing involvement in ETFs and supportive regulatory signals are likely to exert upward pressure on its price. Early market participants may find themselves well-positioned to benefit from both momentum and underlying strength.

Conclusion: A Critical Moment for ethereum

In summary, ethereum is gearing up for a significant move toward the $3,000 threshold, driven by a combination of capital inflows, regulatory clarity, and technical readiness. Financial professionals should consider this an opportune moment to evaluate ethereum exposure and leverage its evolving market narrative.

About the Author

Sophia Cruz

Financial Writer – Asian & European Desks

Sophia Cruz is a seasoned writer and reporter specializing in financial markets, economics, technology, and trading. With over five years of experience, she has been a vital part of the FX Leaders team since 2017, delivering valuable insights for traders of all experience levels.