Ethereum, XRP, and Solana Spark Crypto Market Rally: Is Altcoin Season Here?

altcoin Season Emerges as Bitcoin Dominance Declines

Cryptocurrency Market Shows Bullish Trends

The cryptocurrency landscape has recently displayed a positive trajectory, particularly among prominent altcoins such as Ethereum, XRP, and Solana. Over the past week, these altcoins have experienced significant gains, while Bitcoin has remained relatively stable.

Bitcoin’s Market Share Dips

Bitcoin’s market dominance has seen a notable decrease of 6.9%, dropping from a peak of 66%. This shift indicates a potential movement of investor capital towards altcoins, hinting at the onset of an altcoin season. Analysts suggest that this trend could be a precursor to a broader rally in the altcoin market.

Signs of an altcoin Rally

The recent performance of altcoins has sparked discussions about the possibility of an altcoin season. Major players like Ethereum, Solana, and XRP have recorded impressive gains, with Bitcoin experiencing a slight decline of 2%. The decrease in Bitcoin’s dominance to 59% suggests a shift in investor sentiment, as funds are redirected towards altcoins.

Historical Context and Future Implications

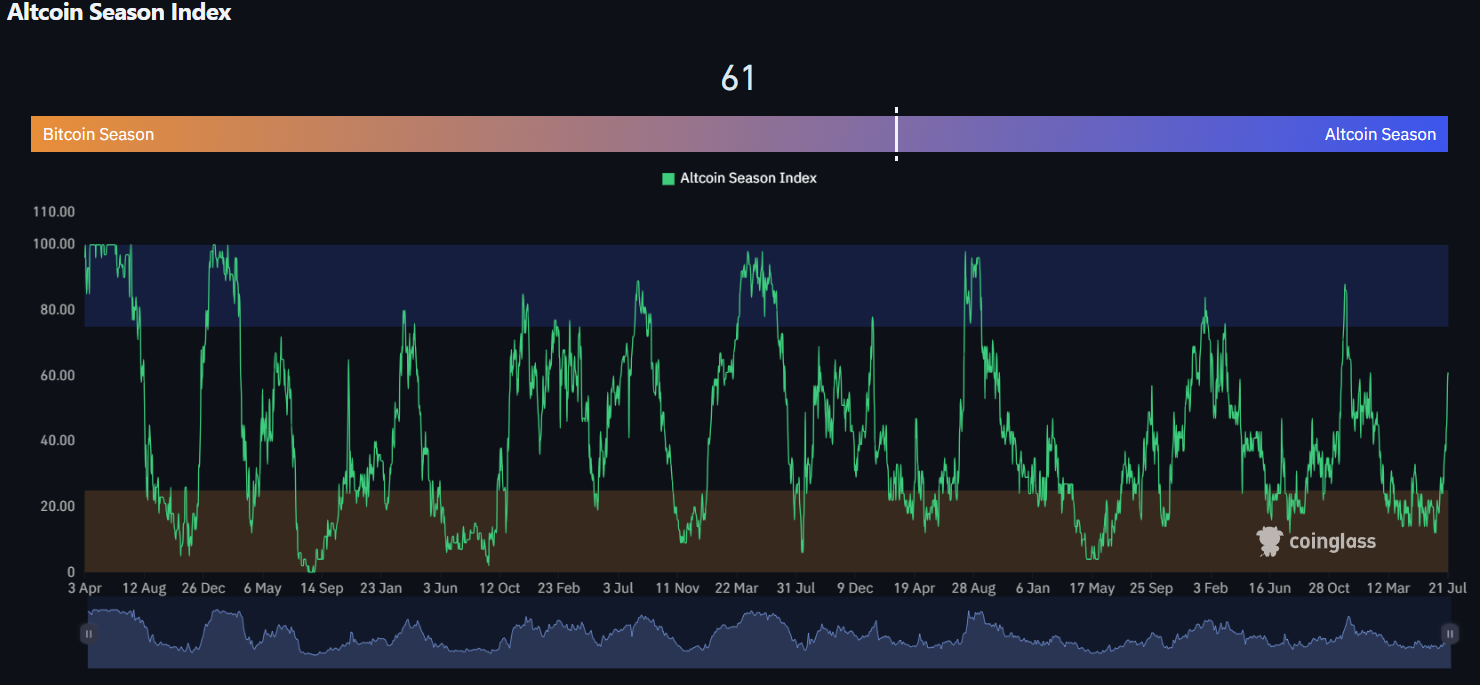

According to analysts from Bitfinex, historical patterns indicate that a sustained drop in Bitcoin’s dominance, particularly without a significant correction in Bitcoin’s price, often marks the beginning of altcoin-led phases within larger bull markets. The altcoin season index has also shown positive movement, surpassing the 50 mark for the first time since December.

Record Inflows into Ethereum ETFs

The surge in altcoin prices coincides with unprecedented inflows into US spot Ethereum exchange-traded funds (ETFs), which reached $2.18 billion last week, significantly surpassing the previous record of $908 million. Additionally, Ethereum’s futures Open Interest has surged from approximately $40 billion to over $57 billion, reflecting growing optimism among futures traders.

Regulatory Developments and Market Sentiment

The recent influx of capital and growth in Open Interest can be attributed to favorable regulatory developments, including President Trump’s signing of the GENIUS Act. This legislation is expected to benefit Layer-1 networks that support stablecoins, according to analysts at QCP.

Corporate Adoption of Altcoins

Moreover, the increasing allocation of altcoins within the corporate treasuries of public companies has further bolstered the momentum in this sector. Analysts have noted that firms are increasingly looking to Ethereum and other Layer-1 solutions like Solana, XRP, and ADA as potential alternatives to Bitcoin.

Potential for Continued Growth

If the current trends in altcoin performance persist, especially with the anticipated approval of staking within Ethereum ETFs by the Securities and Exchange Commission (SEC), the market may already be witnessing the beginnings of an altcoin season.

Disclaimer: This article is for informational purposes only. Previous performance does not guarantee future results.