Flare Launches FAssets Program to Boost BTC, DOGE, XRP DeFi Growth

Flare Network Launches FAssets Incentive Program to Boost Institutional DeFi on XRP

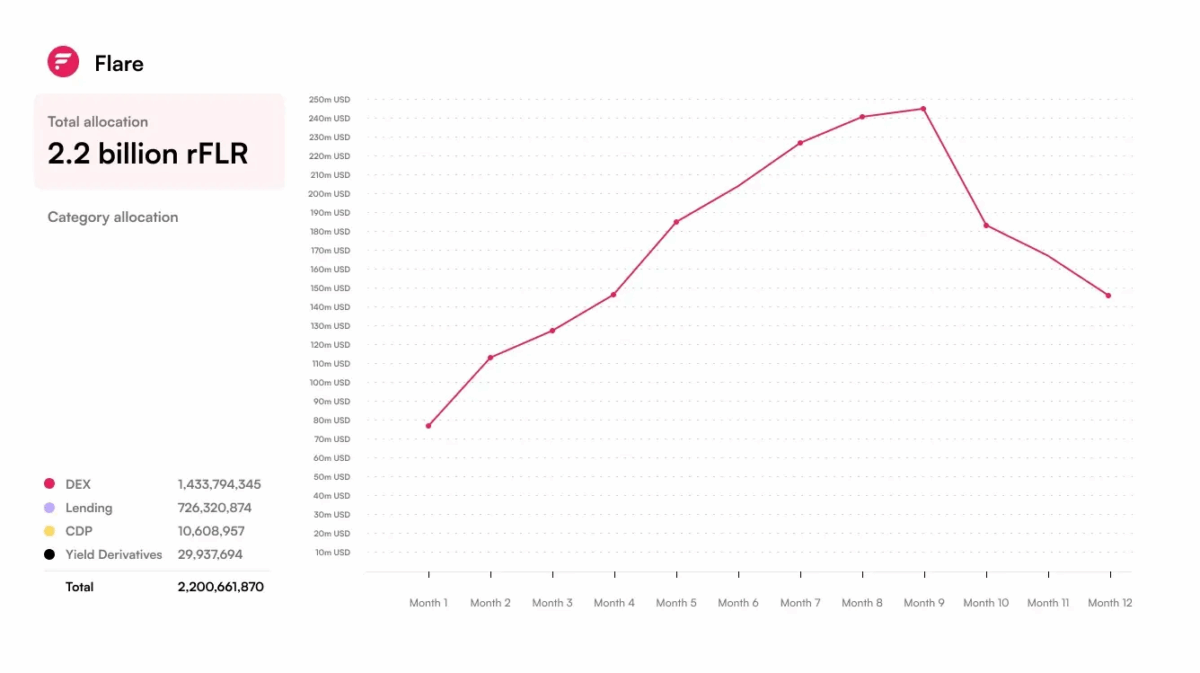

Flare Network has unveiled its FAssets Incentive Program, designed to enhance decentralized finance (DeFi) activities on the XRP ledger. This initiative builds on the previous rFLR incentives and aims to reward participants while expanding the Flare ecosystem. The program will distribute a total of 2,200,661,869 FLR tokens to contributors from July 2025 to July 2026.

Overview of the FAssets Incentive Program

The FAssets Incentive Program is a strategic move to promote the adoption of FAssets and facilitate institutional-grade DeFi on Flare. The launch is supported by significant commitments from Uphold and ViVoPower, totaling $100 million, indicating a strong market interest in Flare’s offerings.

Historical Context and Growth

This initiative follows the groundwork laid by FIP.09 in 2024, which established a 510 million FLR emissions schedule aimed at bolstering essential DeFi infrastructure, including decentralized exchanges (DEXs), stablecoin pathways, and lending protocols. The impact of these efforts is reflected in Flare’s Total Value Locked (TVL), which has surged from $9.95 million to an impressive $150 million, showcasing the rising demand for yield and composable assets.

Key Focus Areas of the FAssets Incentive Program

The FAssets Incentive Program targets four primary areas to maximize its impact:

-

Decentralized Exchanges (DEXs): The program will incentivize liquidity for essential token pairs, including USDT0, FXRP, and other FAssets.

-

Lending Protocols: It aims to support platforms that facilitate borrowing and lending of both Flare-native and cross-chain assets.

-

Collateral Debt Positions (CDPs): The initiative will promote overcollateralized stablecoin and credit systems that utilize FAssets.

-

Yield Derivatives: The program encourages the creation of protocols focused on yield trading, fixed income, and risk management strategies.

Rewards will be dynamically allocated across these categories to enhance FAsset utilization, TVL growth, and liquidity health.

Distribution Mechanism and Oversight

The distribution of incentives will utilize the rNAT contract, ensuring compatibility with existing infrastructure through rFLR tokens. Rewards will be allocated in 30-day cycles, with a 48-hour period for decentralized applications (dApps) to distribute the rewards after each cycle. An existing committee will oversee the program, ensuring transparency and accountability in the allocation process.

It’s important to note that the 2.2 billion FLR allocation is the maximum available for this program, and actual distributions will depend on participant engagement. Any unallocated FLR will be reserved for future community initiatives, allowing for flexible ecosystem growth.

Strategic Alignment and Future Goals

This initiative aligns with Flare’s broader vision of rewarding active participation within its ecosystem. Following the success of FlareDrops (FIP.01), the network aims to create simplified and transparent yield mechanisms for FLR holders, particularly those who convert their tokens into wFLR to support network activities. A key focus will be ensuring that wFLR is properly recognized in on-chain TVL metrics across analytics platforms, enhancing the visibility of ecosystem participation and providing deeper insights into Flare’s economic activities.

As Flare transitions from building infrastructure to activating its ecosystem, the launch of the FAssets Incentive Program marks a significant milestone. With liquidity flowing, new protocols emerging, and innovative solutions on the horizon, the Flare ecosystem is set to attract a new wave of builders, users, and institutional participants.

This article provides a comprehensive overview of Flare Network’s latest initiative, highlighting its objectives, mechanisms, and potential impact on the DeFi landscape.