Gold Prices Surge: XAU/USD Targets $3,400 Amid Market Optimism

Gold Prices Surge to 29-Month High Amid Trade Tensions

Gold’s Recent Performance

Gold prices (XAU/USD) have surged to a new 29-month peak, reaching approximately $3,370 per ounce on Monday. This marks the fourth consecutive day of gains for the precious metal, largely fueled by escalating global trade tensions following the United States’ imposition of a 30% tariff on imports from both the European Union and Mexico over the weekend.

- Gold’s Recent Performance

- Impact of Trade Tariffs on Gold Demand

- Market Reactions and Future Outlook

- Analyst Insights on Gold’s Volatility

- Focus on U.S. Inflation Data

- Rate Cut Expectations and Market Sensitivity

- Technical Analysis of Gold Prices

- Geopolitical Risks and Long-Term Outlook

- Long-Term Prospects for Gold

- Conclusion: A Critical Juncture for Gold

Impact of Trade Tariffs on Gold Demand

In times of increased global economic and geopolitical uncertainty, demand for safe-haven assets like gold typically rises. The recent tariff announcement by U.S. President Donald Trump came after a 90-day pause in reciprocal tariffs with the EU and Mexico, during which no new trade agreements were established.

Market Reactions and Future Outlook

Despite the initial shock to the markets, European Commission President Ursula von der Leyen has indicated that discussions with the U.S. are still ongoing. She has postponed any countermeasures until an August 1 deadline but warned that the EU is ready to implement proportional retaliatory actions if necessary. This partial de-escalation has somewhat stabilized the markets, allowing the U.S. dollar to recover slightly, which in turn led to a minor pullback in gold prices from their session highs.

Analyst Insights on Gold’s Volatility

Rania Gule, a senior market analyst at XS.com for the MENA region, noted that gold is currently navigating a highly sensitive price range, influenced by a complex interplay of geopolitical tensions and economic concerns. Gule emphasized that the recent fluctuations in gold prices may be just the beginning of greater volatility as the release of U.S. inflation data approaches. The market is particularly responsive to any developments related to the U.S., China, and Europe, especially given the interconnected nature of trade and military issues.

Focus on U.S. Inflation Data

Market participants are closely watching the upcoming release of the U.S. Consumer Price Index (CPI). Inflation figures are crucial in shaping the Federal Reserve’s monetary policy, which directly affects market sentiment towards safe-haven versus risk-on assets. A higher-than-expected inflation reading could dampen expectations for a rate cut by the Fed in September, potentially strengthening the U.S. dollar and putting downward pressure on gold. Conversely, weaker inflation data could bolster the case for earlier rate cuts, providing significant support for gold prices.

Rate Cut Expectations and Market Sensitivity

Analysts are currently anticipating a total of 50 basis points in rate cuts by the end of the year, with a 60% probability of the first cut occurring in September. Gule pointed out that any unexpected inflation data could dramatically alter these expectations, making gold’s short-term outlook highly dependent on upcoming economic indicators.

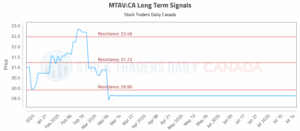

Technical Analysis of Gold Prices

From a technical standpoint, gold is encountering significant resistance around the 23.6% Fibonacci retracement level, near $3,377. Analysts have identified this as a crucial barrier on the way to the next major resistance level at $3,499. If gold fails to break through this level, it could lead to a swift correction towards support zones at $3,300 and potentially $3,250. However, a successful breakout, possibly driven by disappointing economic data or renewed political tensions, could set the stage for a rally towards $3,500.

Geopolitical Risks and Long-Term Outlook

Beyond economic indicators, ongoing geopolitical risks remain a concern. Recent developments, such as North Korea’s pledge of support for Russia’s military actions in Ukraine and Trump’s announcement of plans to send Patriot missiles to Kyiv, indicate that geopolitical tensions could resurface quickly. Additionally, unconfirmed reports about Federal Reserve Chair Jerome Powell’s potential resignation add another layer of uncertainty, prompting investors to adopt a cautious approach.

Long-Term Prospects for Gold

Despite short-term fluctuations, the long-term outlook for gold appears positive, bolstered by global liquidity trends and central bank behaviors. The increase in gold purchases by central banks over the past two years suggests a gradual loss of confidence in the current monetary system and a strategic shift towards assets viewed as preserving long-term value. This trend, coupled with potential U.S. dollar weakness should anticipated rate cuts occur, positions gold favorably in the medium to long term.

Conclusion: A Critical Juncture for Gold

In summary, gold finds itself at a pivotal moment. While the medium-term trend remains upward, the short-term direction will largely hinge on this week’s U.S. inflation figures and any unforeseen geopolitical developments. Therefore, it is advisable to approach gold investments with tactical caution, relying on robust technical signals supported by confirmed macroeconomic news before making new investment decisions.