How Blockchain and Monetary Innovation Can Resolve Our Debt Crisis

Understanding the U.S. Debt Crisis: A Closer Look at Federal Debt and Its Implications

The Current State of Federal Debt

The federal government currently holds an astounding $38 trillion in outstanding debt securities. While this figure may seem alarming, it is essential to dissect what this really means for the economy. The sheer size of this debt does not inherently signal a crisis; rather, it can serve as a mechanism that compels the government to prioritize its spending. However, if Congress reacts to this situation by hastily increasing taxes to manage the debt, it could lead to significant economic repercussions.

- The Current State of Federal Debt

- The Role of Treasury Bonds in Financial Markets

- The Private Sector’s Capacity for Innovation

- The Impact of Government Debt on Financial Innovation

- The Need for a Diverse Securities Market

- The Future of Financial Securities in a blockchain Era

- The Consequences of a Shift Away from Treasury Bonds

- Conclusion: Embracing Financial Innovation

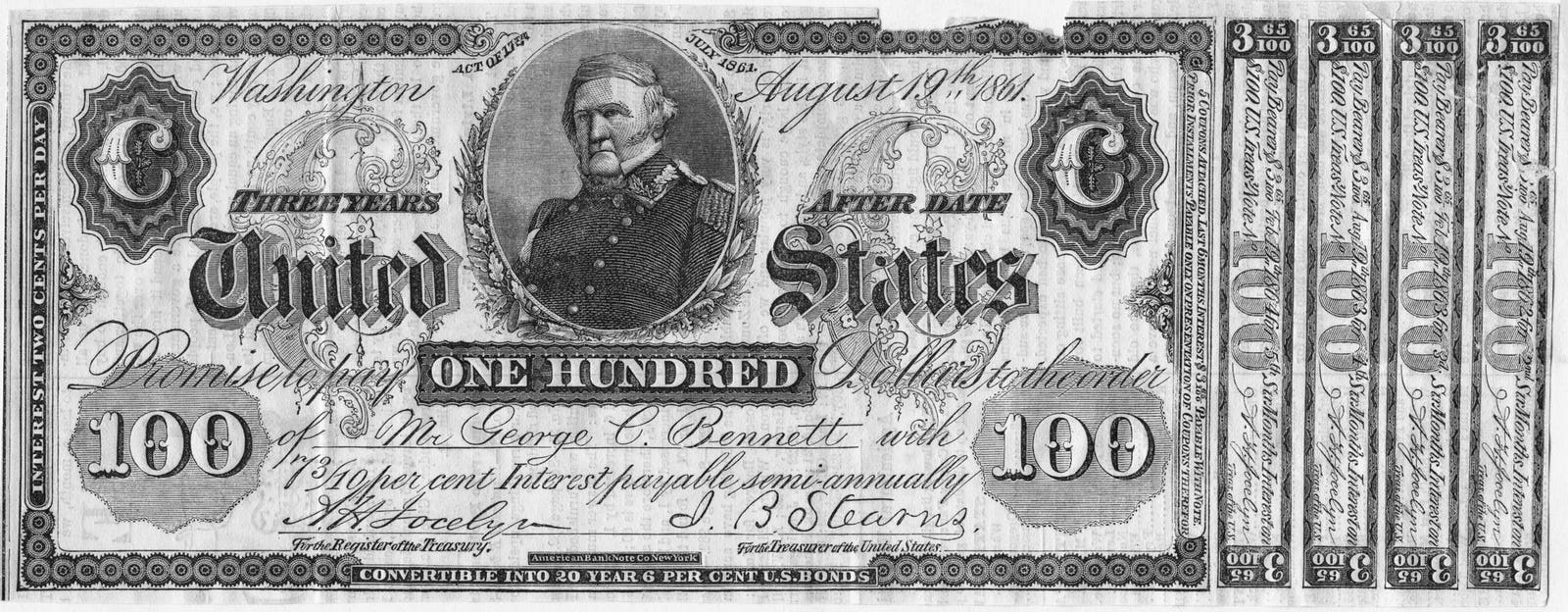

The Role of Treasury Bonds in Financial Markets

Federal treasury bonds are often regarded as the gold standard of security in financial markets, serving as a benchmark for assessing risk. These bonds are considered “riskless,” and they influence interest rates and premiums across various private securities. Their existence provides a foundational reference point for pricing other assets, allowing investors to gauge the risk associated with different investments.

The Private Sector’s Capacity for Innovation

Given the advancements made during the industrial and technological revolutions, one might question whether the private sector truly requires government-issued bonds to establish a reliable pricing mechanism for financial securities. The notion that the absence of government bonds would leave the private sector unable to price assets effectively is, quite frankly, absurd. The private sector has consistently demonstrated its ability to innovate and create a diverse array of financial products. The current dominance of government bonds in the market stifles this potential.

The Impact of Government Debt on Financial Innovation

Historically, the presence of substantial government debt has hindered the development of a robust private securities market. The government has often mandated that banks hold a significant portion of their reserves in government bonds, effectively monopolizing the market for riskless securities. This has led to a situation where banks are compelled to accept these bonds, which, despite being less desirable, become akin to cash due to their widespread acceptance.

The Need for a Diverse Securities Market

The extensive federal debt has crowded out the opportunity for a fully diversified securities market, particularly one that includes genuinely riskless assets. This lack of diversity is a significant drawback of the current financial landscape. The private sector has the potential to create a variety of financial instruments that could serve as alternatives to government bonds, but the government’s persistent presence in the market has stifled this innovation.

The Future of Financial Securities in a blockchain Era

In the context of emerging technologies like blockchain, the argument for government-issued bonds as the sole source of riskless securities becomes increasingly untenable. As blockchain technology evolves, it is likely to give rise to new forms of financial assets that could fulfill the role currently occupied by government bonds. This shift could lead to a more efficient financial market, benefiting both the economy and global prosperity.

The Consequences of a Shift Away from Treasury Bonds

If demand for treasury bonds diminishes in favor of blockchain-based securities, the implications for the government could be significant. However, the emergence of alternative riskless securities would likely mitigate any adverse effects from a potential default on government debt. The future of finance appears poised for transformation, and the government must adapt to these changes rather than impede them.

Conclusion: Embracing Financial Innovation

As we explore the evolving landscape of financial securities, it is crucial for the government to reconsider its role in the market. The large federal debt has historically limited the private sector’s ability to innovate and diversify financial products. By allowing the market to flourish without excessive government intervention, we can unlock the full potential of financial innovation, ultimately benefiting the economy as a whole.