Mastering MTAV: Technical Pivots & Risk Controls for Stock Traders

Technical Analysis of Global X metaverse Index ETF (MTAV): Key Levels and Strategies

Overview of MTAV Performance

The Global X metaverse Index ETF, known as MTAV, has garnered attention for its focus on the rapidly evolving metaverse sector. Investors are keen to understand its price dynamics and potential future movements.

Identifying Support and Resistance Levels

Key Support Levels

In the analysis of MTAV, several critical support levels have emerged. These are price points where buying interest has historically been strong enough to prevent further declines. Observing these levels can provide insights into potential entry points for investors looking to capitalize on price rebounds.

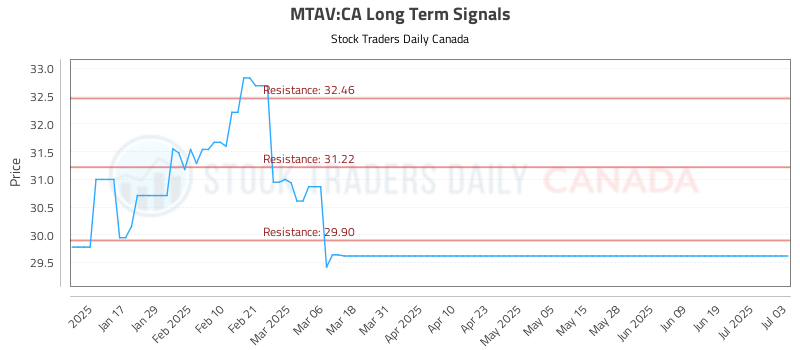

Significant Resistance Levels

Conversely, resistance levels represent price points where selling pressure has previously halted upward movements. Identifying these levels is crucial for traders, as they indicate where the stock may struggle to rise further. Monitoring these areas can help in making informed decisions about taking profits or adjusting positions.

Stop Loss Strategies for MTAV

Implementing Stop Loss Orders

For those trading MTAV, establishing stop loss orders is a prudent strategy to mitigate risk. By setting these orders at strategic points, investors can protect themselves from significant losses in case the market moves unfavorably. It’s essential to determine stop loss levels based on individual risk tolerance and market conditions.

Adjusting Stop Loss Levels

As MTAV’s price fluctuates, it may be beneficial to adjust stop loss levels accordingly. This approach allows traders to lock in profits while still providing a safety net against unexpected downturns. Regularly reviewing and modifying these levels can enhance overall trading effectiveness.

Conclusion: Navigating the MTAV Landscape

In summary, understanding the technical aspects of the Global X metaverse Index ETF is vital for investors aiming to navigate this innovative sector. By closely monitoring support and resistance levels, along with implementing effective stop loss strategies, traders can position themselves to make informed decisions in the evolving metaverse market.