MoonPay Unveils Solana Staking: Boost Your Liquid Yield Today!

MoonPay Launches Liquid Staking Program for Solana Holders

New Liquid Staking Initiative Offers Competitive Yields

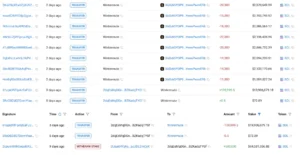

MoonPay, a fintech innovator focused on cryptocurrency transactions and Web3 solutions, has unveiled a new liquid staking program tailored for Solana (SOL) investors. This initiative allows users to earn an impressive annual yield of 8.49% on their SOL holdings through liquid staking.

Users can begin staking with as little as $1 in Solana, receiving a liquid staking token known as mpSOL in return. The rewards from this program are distributed approximately every two days, and participants have the flexibility to unstake their assets at any time, as there is no lockup period involved.

This feature became available on July 23, but it is not accessible to residents of New York or the European Economic Area (EEA).

Entering a Competitive Landscape

MoonPay’s mpSOL offering joins a crowded market, where Solana-native liquid staking platforms like Marinade and Jito already provide similar liquid tokens with competitive yields and liquidity options.

Ivan Soto-Wright, the CEO and co-founder of MoonPay, emphasized the company’s mission to simplify access to crypto rewards. He stated that the new product is designed to replicate the convenience of a traditional savings account while harnessing the earning potential of blockchain technology.

Rising Interest in Solana Staking

Established in 2019, MoonPay initially served as a user-friendly fiat-to-crypto gateway, facilitating the buying, selling, and swapping of cryptocurrencies. Over time, the company has expanded its offerings to include various Web3 services, such as NFTs and stablecoins, and now on-chain yield opportunities.

The launch of this new feature coincides with a notable increase in interest surrounding staking on the Solana network. In April 2025, Solana briefly outpaced ethereum in total value staked, amassing over $53.9 billion compared to ethereum‘s $53.7 billion, as reported by Solana Compass and BeaconScan. Currently, Solana staking yields hover around 8.3%, while ethereum offers approximately 3.2%.

Growing Institutional Interest in Solana

In recent developments, Nasdaq-listed DeFi Development Corp announced the acquisition of 141,383 SOL tokens, raising its total holdings to 999,999 SOL. Additionally, the first Solana staking ETF launched on July 2, achieving over $100 million in trading volume within its first twelve sessions, indicating robust demand from registered investment advisors (RIAs), according to CEO Greg King.

On another note, Upexi recently purchased 83,000 SOL tokens for $16.7 million, increasing its total Solana holdings to 1.9 million SOL. Furthermore, Robinhood has announced plans to introduce staking for both ETH and SOL for its U.S. customers.

This surge in staking activity and institutional interest highlights the growing significance of Solana in the cryptocurrency landscape, positioning it as a key player in the evolving DeFi ecosystem.