Record High of $112K Approaches: What It Means for Investors Today

Bitcoin Surges, Approaching May Record Amid Broader Crypto Rally

Bitcoin Breaks Out of Trading Range

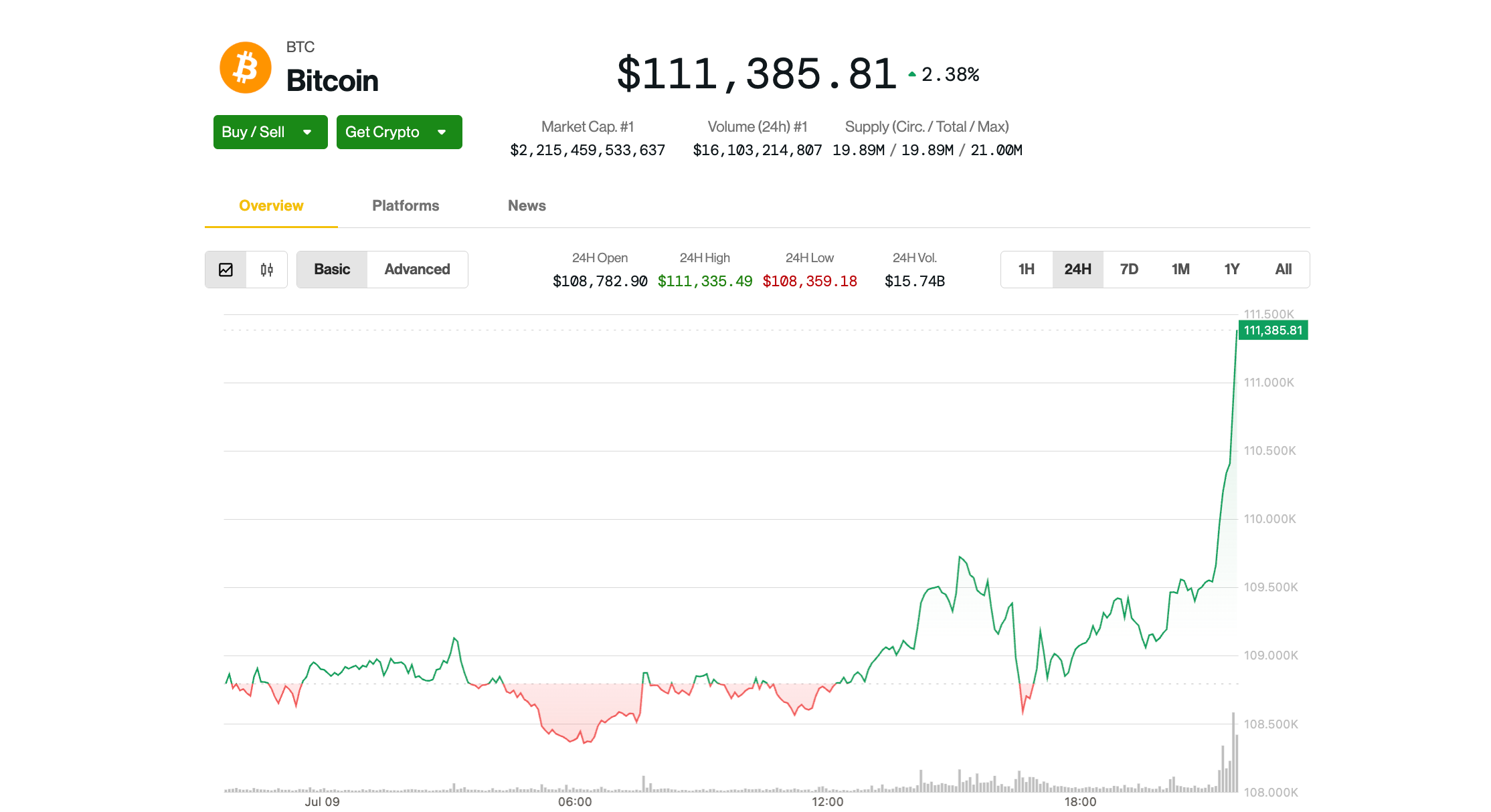

In a notable shift during U.S. trading hours on Wednesday, Bitcoin broke free from its recent narrow trading range, setting its sights on surpassing its previous peak of $112,000 established in May. The leading cryptocurrency briefly reached a new all-time high on several exchanges, including Binance, Coinbase, and Bitstamp, before pulling back to around $111,000. However, data from aggregators like CoinDesk, CoinGecko, and CoinMarketCap indicated that Bitcoin remained just shy of its May 22 record.

Ethereum Also Sees Significant Gains

This upward movement in Bitcoin coincided with a broader rally in the cryptocurrency market, as Ethereum’s ether experienced a 6% increase, reaching $2,760, marking its highest value in a month. At the time of reporting, Bitcoin was up 2.4%, trading at $111,400.

Liquidation of Short Positions

During this rapid price increase, approximately $425 million in leveraged short positions were liquidated across various crypto derivatives, according to data from CoinGlass. The $110,000 mark has proven to be a critical resistance level for Bitcoin in recent weeks, with many investors taking profits and short sellers entering the market whenever the price approached this threshold.

Crypto-Related Stocks on the Rise

In the realm of crypto-related equities, shares of MicroStrategy (MSTR) rose by 4.4%, nearing $414, just a few dollars away from its highest point in 2025, although still below its record of $543 set late last year. Coinbase (COIN) also saw a 5% increase, while Bitcoin mining companies like Marathon Digital Holdings (MARA) and Riot Platforms (RIOT) gained approximately 6%.

Market Sentiment and Future Outlook

Despite the recent volatility, market analysts suggest that the current quiet phase could be indicative of a bullish trend. Charlie Morris, Chief Investment Officer at ByteTree, noted in a report that Bitcoin’s decreasing volatility often precedes significant upward movements. He emphasized that the current market conditions appear favorable for a potential surge.

Technical Analysis of Ether

Joel Kruger, a market strategist at LMAX Group, highlighted the strength of ether as it remains above crucial technical support levels. He pointed out the increasing interest from institutional investors who are betting on ether’s future significance in settlement infrastructure and asset tokenization. This sentiment was echoed by analysts from digital asset manager Bitwise, who identified ETH as one of the most promising tokens in the burgeoning tokenization market.

Conclusion

As the cryptocurrency market continues to evolve, both Bitcoin and Ethereum are showing signs of strength, with analysts optimistic about future price movements. The current market dynamics suggest that investors should remain vigilant, as the potential for significant gains appears to be on the horizon.